Atlantic Yards in 2025: New Developers Enter, Propose (Much Larger) "Feasible Alternative"

Many unknowns remain: subsidies, timing, accountability. Though Nets struggle & Liberty stumble, BSE Global debuts new training center, street festival, and arena renovations.

There’s always a surprise with Atlantic Yards.

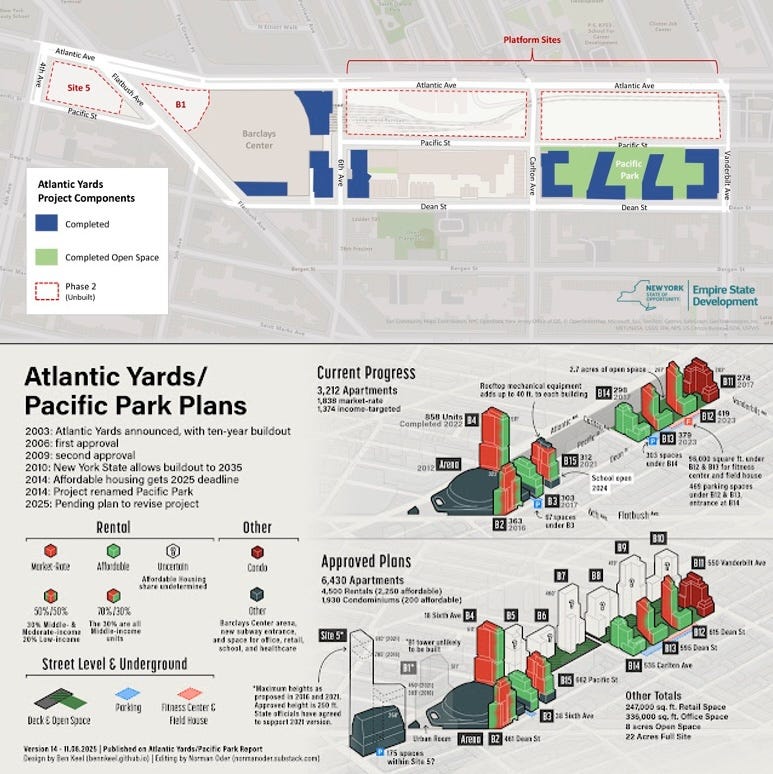

In my annual preview, I wondered whether 2025 meant “acceleration time.” It did, though the plan to supersize the project to make it more financially viable came from the joint venture Cirrus Workforce Housing and LCOR, not, as expected a year ago, Related Companies.

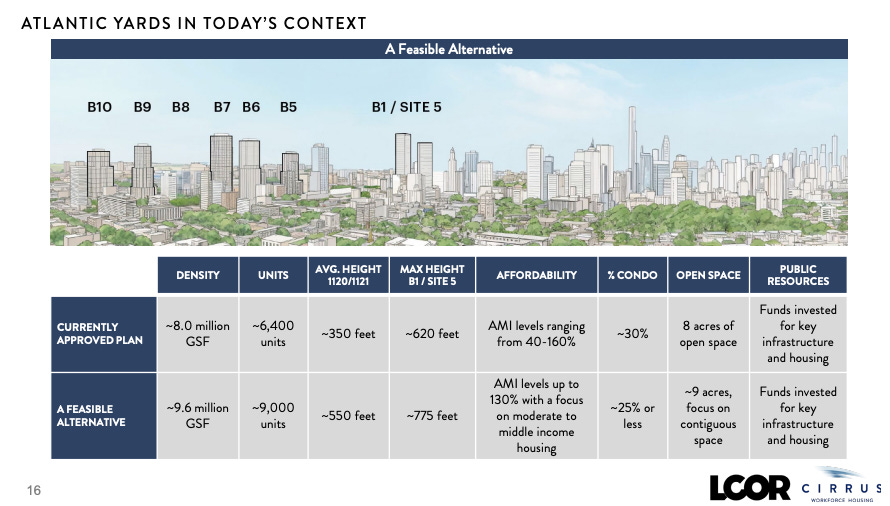

Beyond seeking 1.6 million more square feet while ditching one tower (but not its bulk), the new joint venture remained fuzzy on what public assistance it seeks to build the costly platform over the Metropolitan Transportation Authority’s Vanderbilt Yard.

It’s also fuzzy on its commitment to affordable housing, focusing on moderate- and middle-income units. (Maybe they’ll ask new Mayor Zohran Mamdani, a democratic socialist, for help?)

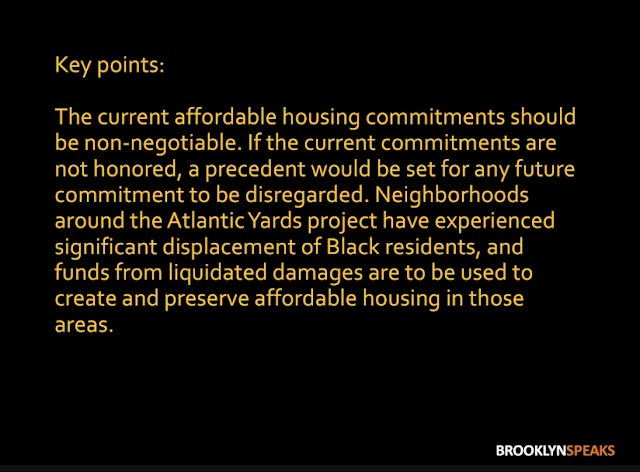

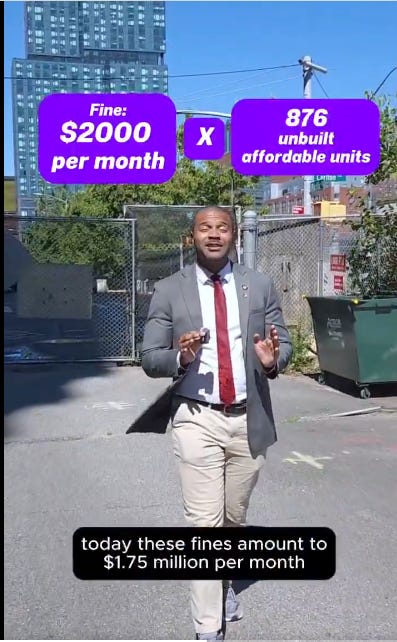

Before the new plan surfaced, we learned that Empire State Development (ESD), the state authority that oversees/shepherds the project, had suspended the seemingly ironclad penalties of $2,000/month for 876 unbuilt affordable units—for which previous master developer Greenland USA would’ve been liable—and then negotiated a limited $12 million payment from the new developers.

So, as ESD began seeking public input on the (edges of the) new plan, it was another sign that accountability remains elusive.

Before any deal is struck, I wrote in January, shouldn’t state legislators hold an oversight hearing, getting some answers about what went wrong and the potential path forward? That didn’t happen.

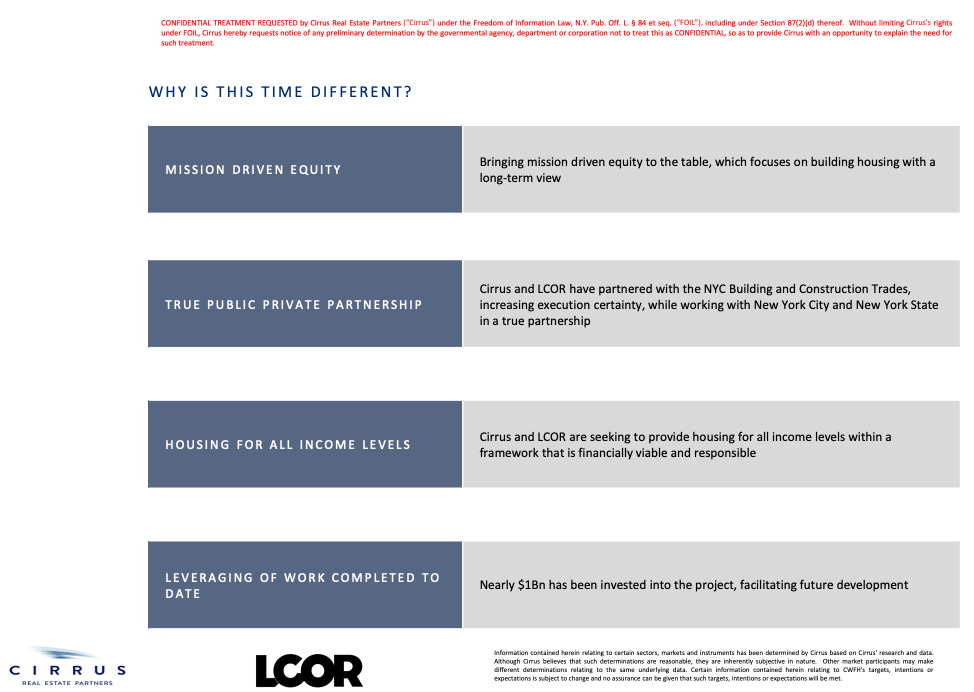

Is this time different? The developers say so.

Cirrus’s Joseph McDonnell cited “mission-driven equity,” not focused on the highest return, and a “true public-private partnership” involving the New York City Building and Construction Trades Council, whose pension funds support Cirrus projects and who will offer predictable costs via a project labor agreement.

Moreover, McDonnell contended, “the largest subsidy provider to this project is no doubt Greenland. They put $950 million into the ground, and they also built a railyard.” Still, he was cagey about public assistance they’re seeking.

Around the arena

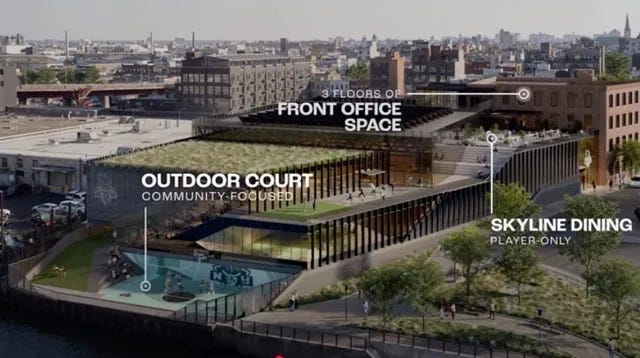

If BSE Global, which owns the Brooklyn Nets, New York Liberty, and the arena company, didn’t make as big news as in 2024, when the Koch family (!) invested, they did sell a slice of the Liberty at an astonishing $450 million valuation, with the funds fueling a planned practice facility in Greenpoint.

Meanwhile, their effort to expand a Brooklyn “ecosystem”of media and entertainment continued with a street festival, Planet Brooklyn, as well as opening the (temporary) Brooklyn Basketball Training Center in the shuttered Modell’s across Flatbush Avenue from the arena.

Below, I’ll summarize the news, month by month. Soon I’ll offer a 2026 preview.

January

In a bitterly cold January, wind whipped especially around Sixth Avenue, just east of the Barclays Center, as I reported. When more towers are built over the railyard, that problem might get worse, especially since the project’s wind analysis is now outdated.

The NBA Philadelphia 76ers’ attempt to move to a more profitable new downtown arena, dubbed 76Place, periodically invoked the Barclays Center.

It ended anticlimactically: after the 76ers won City Council approval for the site, setting up competition with the existing Wells Fargo Center, the team agreed with the Philadelphia Flyers and owner Comcast to go halfsies on a new arena at the current South Philadelphia sports complex.

After one year, Glide Brooklyn ice rink at Brooklyn Bridge Park becomes Roebling Rink, without BSE Global. OK, so not everything in the “ecosystem” has to work. Roebling Rink continued this winter, as well.

Did 461 Dean, the “World’s Tallest Modular Building,” save 20% on construction? No, it did not. Let’s follow up on FullStack Modular, the successor to the modular builder.

The Real Deal: Related pulls out of Atlantic Yards joint venture. Cirrus enters, but can’t qualify as a permitted developer. A host of labor unions endorse Cirrus, suggesting it has juice.

The Pintchik family, longtime investors, landlords, and neighborhood stewards, sells 26 buildings near the Barclays Center. The new owners, unsurprisingly, raise retail and residential rents.

Why does the EB-5 manager control the Atlantic Yards Investment? It’s the (dubious) contract, it seems. Funds steered by EB-5 middleman, not struggling developer Greenland, made the $11M annual Vanderbilt Yard air rights payment to MTA. That’s perplexing.

February

Mayoral candidate (and state legislator) Zohran Mamdani came to the Vanderbilt Yard to bolster his bold plan to “build 200,000 new, permanently affordable union-built, rent-stabilized homes over the next 10 years.” Still, he said nothing about the Atlantic Yards site behind him, perhaps underinformed.

The Social Justice Fund from Joe and Clara Tsai Foundation, whose founders own BSE Global, launches “Revitalize Brooklyn,” offering $50,000 grants to help nine Brooklyn businesses grow. Coffee, donuts, fashion—it’s a departure from their previous focus on non-gentrified Brooklyn.

As Atlantic Avenue Mixed-Use Plan Nears Vote, How Much Can Affordability Be Pushed? Well, not too far, expect where city officials use publicly-owned sites.

Brooklyn Community Board 8 proposed a new Mandatory Inclusionary Housing (MIH) Option 3.5, with more and deeper affordability, but that wasn’t possible.

The Brooklyn Way: new Brooklyn Nets merchandise from designer Kid Super includes boost from Borough President Antonio Reynoso, modeling a $995 leather jacket.

Buses line Atlantic Avenue (thanks to NYPD) for un-announced youth basketball event. Once towers start, construction would constrain the street and, after opening, residents and commercial tenants would object. It’s a very tight fit (one of my mantras).

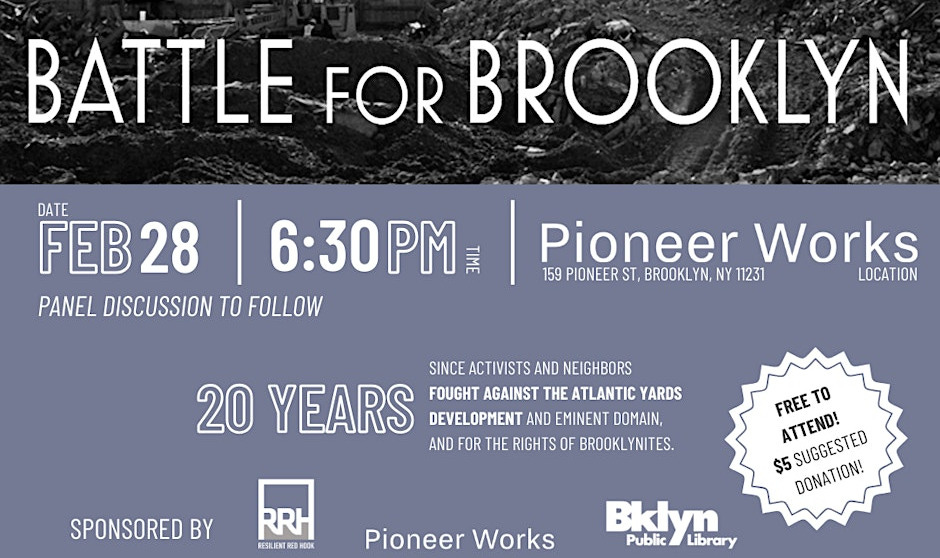

A new showing of Battle for Brooklyn, the 2011 documentary about the Atlantic Yards resistance, focusing on Daniel Goldstein, triggered discussion in Gothamist, with some expressing unguarded enthusiasm for the arena and others knowing it’s tainted.

Today, the context is different, since the film was released before the Barclays Center opened and eight towers (of 16) built.

Was the Atlantic Yards conflict merely between competing short-term interests? To one critic, Battle seems like “ancient history.” Still, it depicts the project’s enduring taint and leaves lessons about skepticism, as a new phase awaits.

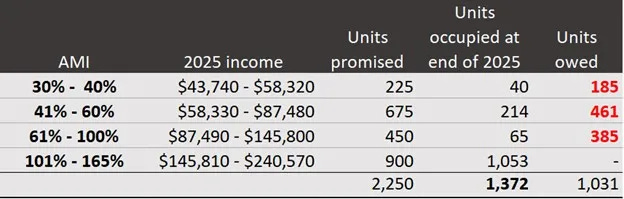

The screening prompted a request for a summary of the project’s promises, so I produced the chart below, which was adapted for the event. Many promises have fallen short; I’ve marked some key ones on the chart in orange. Others remain murky.

Yes, they built an arena for sports and events. (Biggest winners: two billionaires.) Promised social benefit and neighborhood connection have fallen far short.

Some eminent domain reminders from Battle for Brooklyn: bogus blight and dubious public use.

Regarding project promises, well, the Atlantic Yards Independent Compliance Monitor was never hired to ensure accountability for the much-hyped Community Benefits Agreement, with promises of jobs, contracting, and housing.

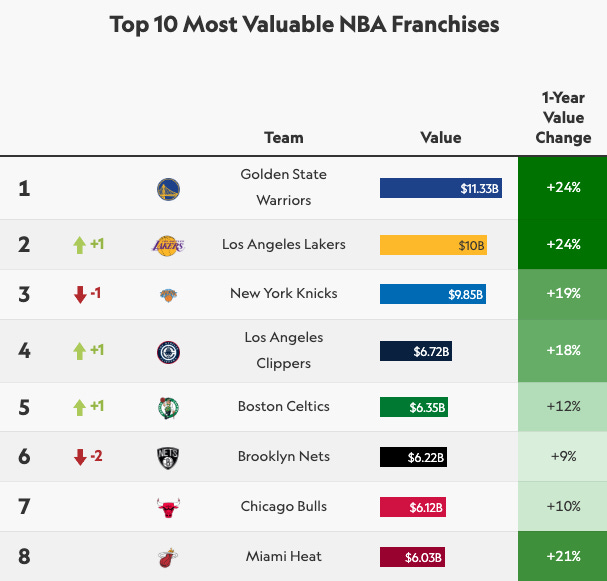

CNBC says the Brooklyn Nets (and arena company) are now worth $5.6 billion, sixth in NBA. An increase in media rights offers a rising tide for all.

A message from the Brooklyn Nets: “we put the city in authenticity.” Somehow, they’re promoting the “Brooklyn Blueprint,” encouraging fans to enter at the beginning of something. That’s because the Nets don’t have stars.

Brooklyn Marine Terminal development plan in Red Hook relies on big housing promises. Like Atlantic Yards, the project will bypass the city’s land use review, known as ULURP.

Will ESD impose the Atlantic Yards affordable housing penalties, Brooklyn Assemblymember Jo Anne Simon asks ESD CEO Hope Knight in a legislative hearing. Knight says they’d have to, but sounded less than convincing.

March

Does Atlantic Yards just need a transfer of rights? Or an inquiry? I think the latter.

Foregone property taxes on Barclays Center are now estimated at $123.6 million.

CEO of EB-5 middleman key to Atlantic Yards gave $50,000 to Gov. Hochul, who controls the project’s fate. U.S. Immigration Fund head(s) also gave $10,000 to NY State Democrats.

Barclays Center seeks guides (for $30!) to deliver a one-hour tour that “brings to life the history, culture, & behind-the-scenes magic of this iconic venue.” (Now tours are available.)

Comptroller Brad Lander is the only mayoral candidate to mention Atlantic Yards/Pacific Park, but he gets some things wrong. His priority, he says, is the promised affordable units.

To Prospect Heights group, key advocate Gib Veconi (also a leader of BrooklynSpeaks) describes Atlantic Yards as a “dire situation.”

Who really controls the six railyard sites? Maybe Fortress Investment Group is in the driver’s seat, I wrote, but it turned out to be more complicated.

As I wrote for City Limits, Brooklyn’s Stalled Atlantic Yards Plan Faces More Questions Than Answers, including whether the state would impose penalties.

BSE Global will spend $80 million on a new practice facility for the New York Liberty—who now practice at the Barclays Center—near Newtown Creek in Greenpoint, scheduled to open in 2027.

Pacific Park Conservancy said to hire new firms to oversee maintenance and landscaping. Questions persist about Conservancy’s opacity and board. The signage needs an update, months after it was promised. (That’s persisted.)

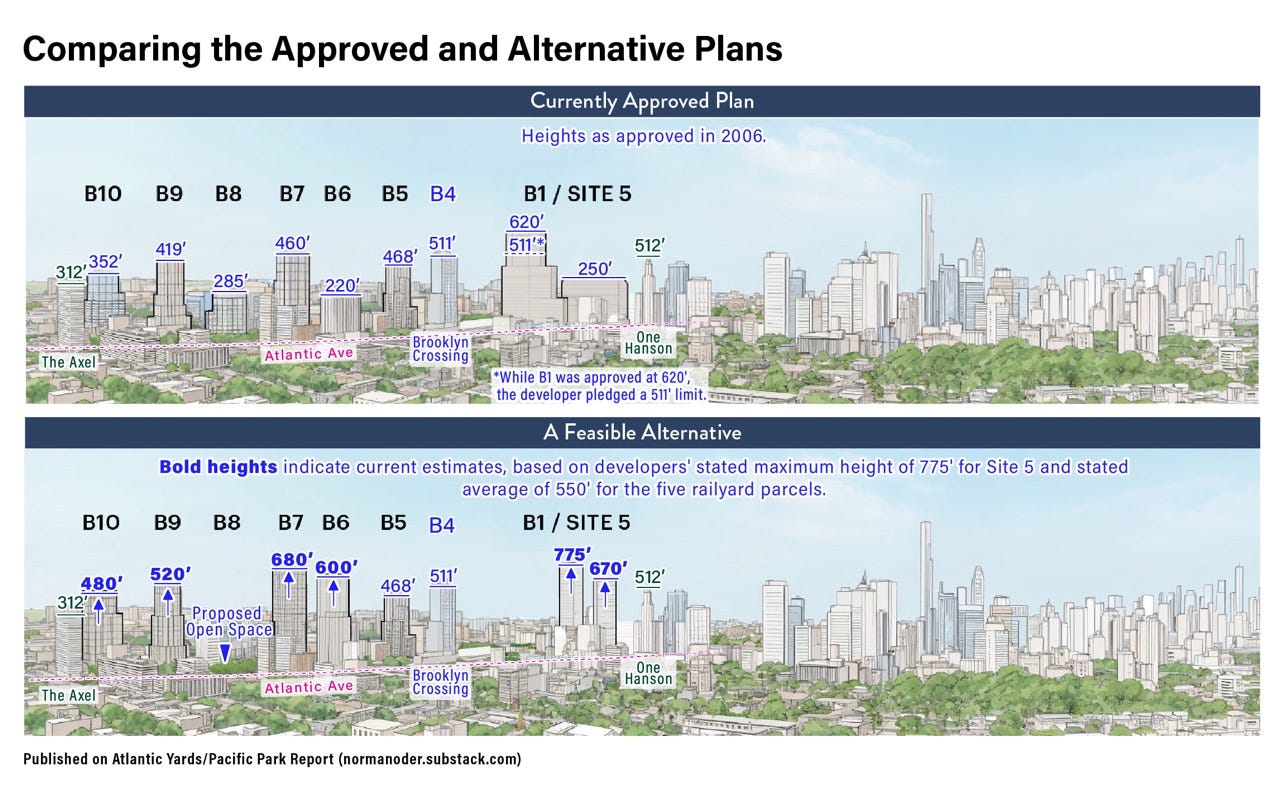

At an Atlantic Yards Community Development Corporation, Director Ron Shiffman suggests the unusually large plan for Site 5 is “an untenable proposal.” The only response he got concerns the affordability trade-off. But really, how big should it be?

April

A new tenant coming to 550 Vanderbilt: Prospect Heights Eastern Spa. Still, railyard-adjacent retail space remains at 550 Vanderbilt and at nearby 535 Carlton.

Barclays Center, giving up on Loge Boxes, announces new premium space, Gallagher Terrace, plus The Bridge, a new consumption/gathering space upstairs.

The Brooklyn Nets end a forgettable season that columnist Steve Lichtenstein called a “waste.”

The arena plaza is public, until they want it to be private.

Who’s the “Lender”/Creditor now? Who controls the EB-5 loan collateral? I don’t think I got this right—after all, nobody knew much about Cirrus)—but it probably got closer to the truth than anything a public agency shared..

The Triangle Building opposite Barclays Center no longer even hosts Rihanna billboards. No retail outlet in process. (Structural problems?) Prime property has languished for more than 13 years.

You can rent BSE Global’s One Hanson Place—the base of the Williamburgh Savings Bank tower—for events.

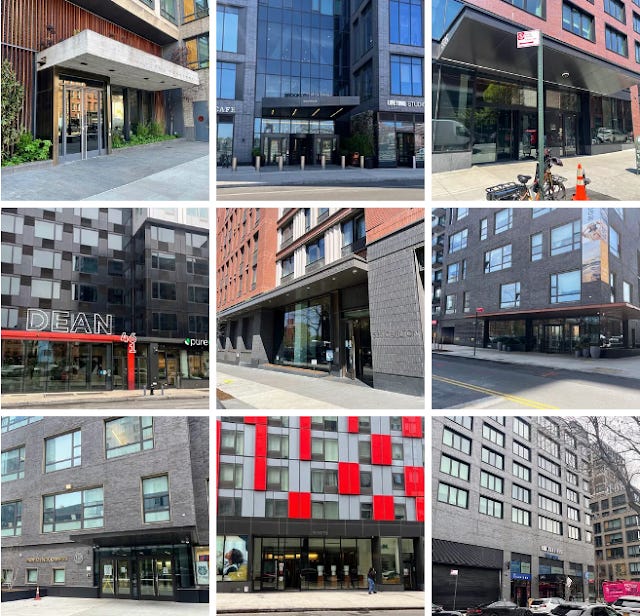

I assessed the entrances of the eight Atlantic Yards buildings (and the school). Bottom line: there’s no guiding sensibility. Some choices are thoughtful, others baffling or compromised. Placemaking remains inconsistent.

The next installment, sorry, will come in 2026.

EB-5 investment packager Nicholas Mastroianni II of the U.S. Immigration Fund gave Donald Trump’s inaugural committee $500,000.

So, newcomers embracing Prospect Heights (and 595 Dean) like McMahon’s Public House, which replaced dive bar O’Connor’s on Fifth Avenue.

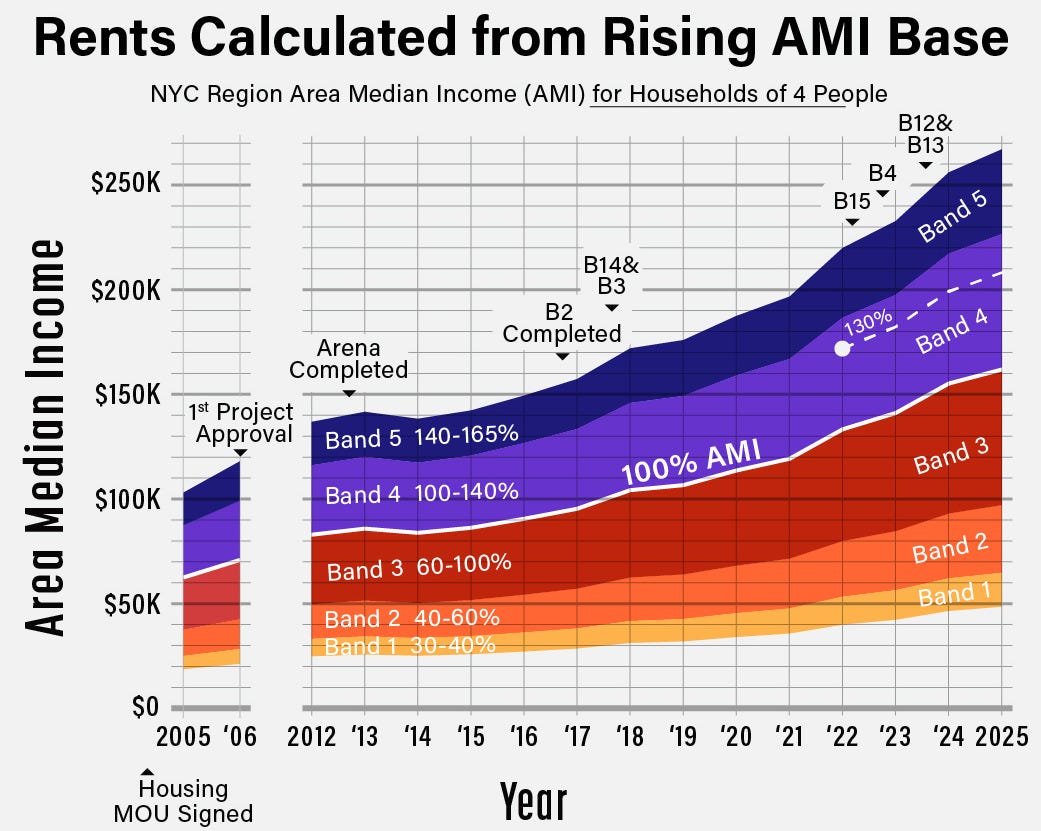

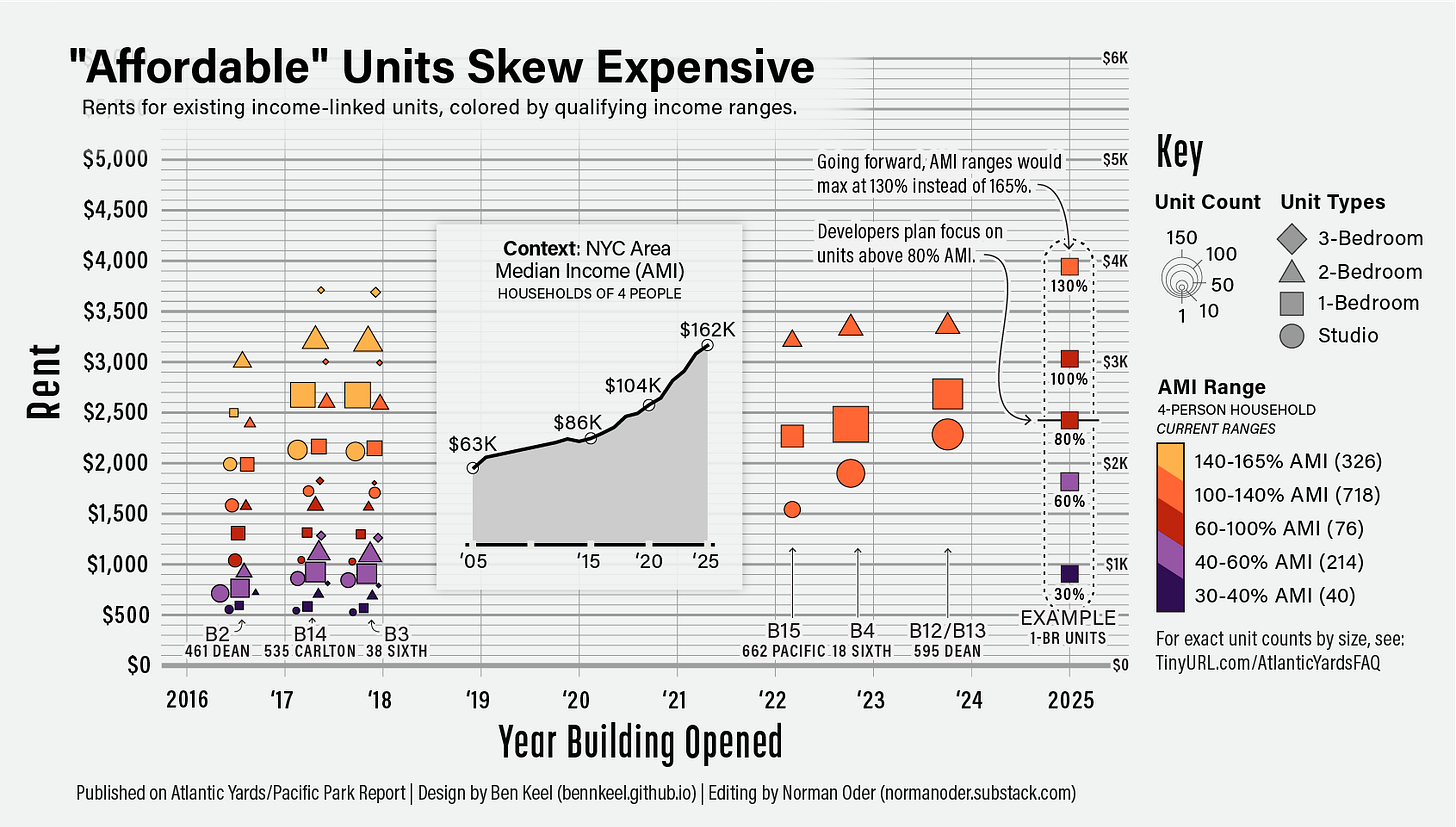

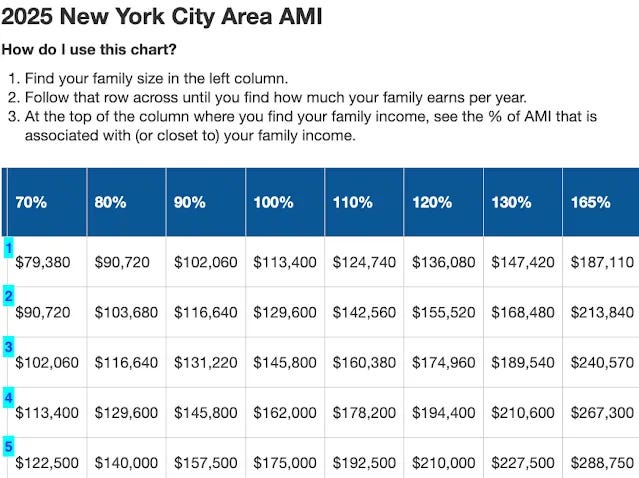

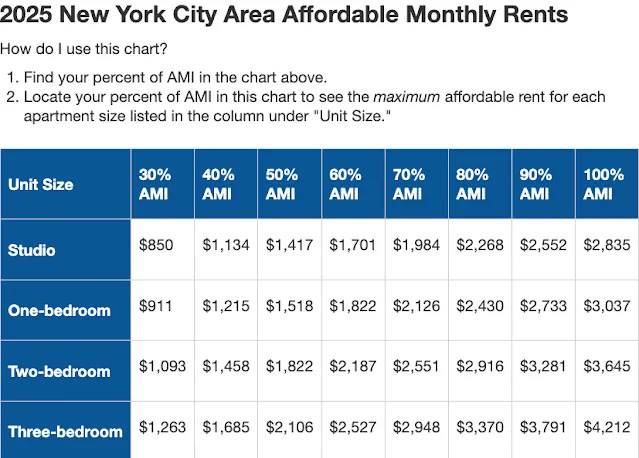

With 2025 Area Median Income (AMI) up 4.3%, more “low-income” households (at 80% of AMI) could earn six figures. So delayed “affordable housing” becomes ever more expensive.

“Affordable” rents rise, so a one-bedroom at 60% of AMI—the template for future below-market units in the Atlantic Avenue Mixed-Use Plan and perhaps Atlantic Yards—could now rent for $1,822. That baseline will continue to rise.

The Pacific Park Conservancy, thanks to “Clean” and “Safety” Ambassadors, makes partial improvements but work is still needed on entrance signage and the worn lawn.

May

Former Temple of Restoration on Dean Street between Sixth and Carlton avenues, in Redfin’s “hottest” Prospect Heights, set for alteration into eight apartments, likely condos.

The “flavor” of Fifth Avenue near the Barclays Center: not quite homey, but not fully franchised, either. Bars, omakase, plus, for a while, weed.

Announcing 395 Flatbush Avenue Extension, Brooklyn’s second-tallest tower (and across from the Brooklyn Paramount), Mayor Eric Adams declares, “I’m here to support my developers and not fight with my developers.”

In election season, mailers abound, but New York City’s diminished journalistic landscape means that mainly the mayoral race gets covered. Numerous candidates escape scrutiny. The unequal playing field is exacerbated by public funding, so, despite my qualms about getting government involved in journalism, I argue that some fraction of that spending should support journalism.

Audit from Greenland USA’s parent company says developer is “actively taking measures” to address risks from losing project collateral. That seems doubtful.

Emerging developer Cirrus seeks tax abatement, new funding, and (more) entitlements for railyard sites. They’re lobbying Empire State Development, local elected officials, and even Attorney General Letitia James.

Citing “competing” complaints from dog owners about limited hours and neighbors plagued by noise, Pacific Park Conservancy affirms policy for dog run near 595 Dean. No one is happy. It probably can’t be fixed without spending on sound protection.

Cirrus, Resorts World agree to build “up to 50,000” “workforce” units in five boroughs. There’s a lot of wiggle room.

Flashback: in May 2009 renegotiation, a Bloomberg aide promised that the MTA could get Vanderbilt Yard development rights back if nothing were built over the railyard. Not quite. It’s more complicated.

As the WNBA’s New York Liberty raise ownership stake at record $450 million valuation, a reminder: New York State could ask teams for more rent.

As affordable housing deadline nears, New York State punts on penalties, reviewing new development team. Cirrus joint venture now includes LCOR. As a commenter on my article, Unset, observes, trenchantly: “In sum, the “blight” of the railyards that supposedly needed to be remedied--the pretext for the whole fandango!--is still there.”

Flashback, 2014: What New York Times scoop on the new Atlantic Yards Plan missed. The article downplayed Greenland, omitted $2,000/month fines for 2025 deadline, and was misleading regarding affordable housing and accountability. Today, the absent skepticism seems glaring.

June

Is BrooklynSpeaks getting ready to sue over affordable housing, or renegotiate terms? Neither, it turns out, just protest the unpaid penalties.

Elected officials, including three from Congress, join Council Member Crystal Hudson in asking Gov. Hochul and Empire State Development to collect damages for absent Atlantic Yards affordable housing.

In Brooklyn Marine Terminal discussion, Atlantic Yards is the elephant in the room. After Borough President Antonio Reynoso points to broken promises from that project, city official says other projects met commitments. Not always.

New York Liberty update: Brooklyn Public Library cards (& gala); Ellie the Elephant’s ubiquity; team’s new investors include Jack Ma of Alibaba, who co-founded company with Joe Tsai of BSE Global.

Risk chart from the nonprofit ANHD shows four Community Districts near Atlantic Yards face high rent burdens, while few truly affordable units have been built.

Mamdani wins a surprisingly clear vote in the Democratic primary for Mayor over grim, tarnished, car-dependent Cuomo.

If affordable housing over railyards doesn’t work, are “politicians & activists” to blame? Columnist at The Real Deal criticizes unrealistic goals, but New York State backed developer Ratner’s unwise (and renegotiated) Atlantic Yards plans.

To meet city housing goals, do we simply build bigger? What about infrastructure (and the region)? That’s relevant to the future of Atlantic Yards. London, for example, has done much better, with a new train line.

So Type.Set.Brooklyn, BSE Global’s new “digital first global media brand,” is supposed to rely on “Brooklyn’s intrinsic values”? I have some doubts.

In 2025 Forbes Global 2000, Greenland Holdings, parent of Greenland USA, continues drop, to #931 from #891. In the Fortune Global 500, Greenland plunges to #480, from #291. In latest Moody’s analysis, Greenland retains near-bottom credit rating.

As we await a new mayor, remember columnist Errol Louis’s 2010 warning: the bill for the railyard platform might “get handed to the city or state a decade from now.” Or, perhaps, the cost will be finessed by giving away more bulk—free vertical land.

The Brooklyn Nets had five first-round draft picks. So 2025-26 likely will be another rebuilding year.

July

Revisiting BrooklynSpeaks’ 2022 Crossroads session: a huge irony. Participants at the charrette said the developer shouldn’t get more slack without delivering on commitments. But New York State had already agreed on an expanded Site 5 plan.

This would not only reward Greenland, but also benefit BSE Global, which owns the arena company and would get the plaza made permanent. (BSE Global, a clear financial winner in this project, should pay.)

Art, promotion, or both? The “Liberty Portraits” are a BSE Global power move. Stirring and bewildering, the Ticketmaster Plaza exhibit claims to be public-spirited but most serves the brand.

Goodbye, Get Your Guide: Brooklyn Nets, again claiming alignment on “values,” sign another jersey patch partner, medical billing company All In Won.

City & State ranks Joe and Clara Wu Tsai, owners of the Brooklyn Nets, New York Liberty, and the Barclays Center operating company, #43 in the Brooklyn Power 100. That’s too low. That ignores the Brooklyn “ecosystem” and recent power moves.

As new Trump Kings County Republican Club slams Atlantic Yards for “systemic failure,” remember: it’s bipartisan (and developer Trump worked the system, duh).

A few days after that, BrooklynSpeaks, the main vector for public advocacy regarding the project, launches a petition to urge Gov. Kathy Hochul to enforce the penalties, which have been suspended as ESD waits for a new plan.

Note that former Deputy Mayor Alicia Glen in 2023 told the Real Deal that the penalties should be upheld.

How could the “100% affordable” 38 Sixth Ave. tower have been approved without an on-site or nearby super? Unclear. The lack of a super has hampered maintenance at the building, residents say.

“Pacific Park”—the 2.7 acres of open space (of 8 acres, ultimately), currently limited to the southeast block of the project—has been under stress. The Main Lawn, between the two 595 Dean towers (B12-B13), has become remarkably worn in barely eight months.

While new maintenance ordered by the governing Pacific Park Conservancy has improved things, it’s not quite enough, as worn segments persist.

BSE Global CEO Sam Zussman says Barclays Center should offer a “Brooklyn DNA-based experience.” That buzzword it shows how they’re doubling down on the professed Brooklyn “ecosystem” of sports, experiences, media, and more.

As part of BSE Global’s plan for “generational fandom” for Brooklyn Nets and New York Liberty, school hoops clinics have distributed 32,000 t-shirts this past year, while a STEM curriculum has engaged 1,000+ students. It’s smart marketing.

For the proposed Brooklyn Marine Terminal development, 122 acres in Red Hook and the Columbia Street Waterfront area, Atlantic Yards seems a cautionary tale. So it was unusual to see a split among leaders of BrooklynSpeaks, the main coalition left to respond to Atlantic Yards, regarding the BMT plan.

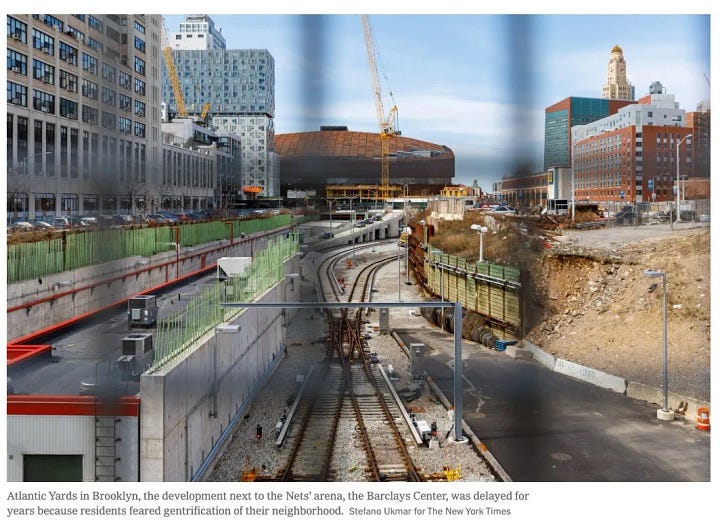

Is Atlantic Yards “next to” the arena? For the New York Times, it’s “Atlantic Yards down the memory hole.” Stale photo, too.

Cirrus-LCOR alliance, backed by construction unions and aiming for Atlantic Yards, is awarded rights by New York City to develop the former Flushing Airport site in Queens.

August

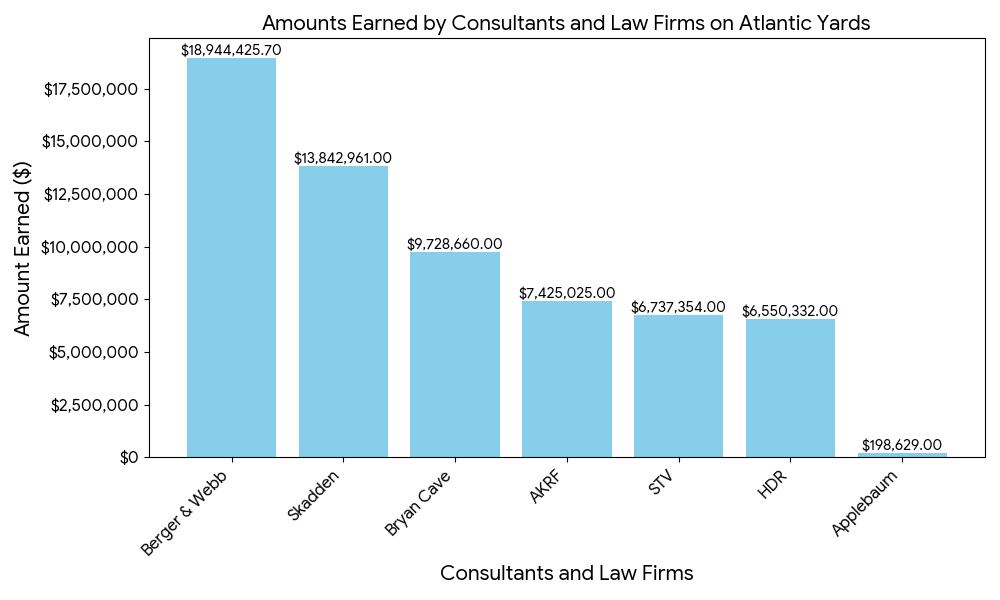

Who else made bank on Atlantic Yards/Pacific Park? The law firms and consultants have earned $63.4 million of the developers’ funds. Shouldn’t some of that money support a public response?

Why not a few bucks for the public? Could there be an independent voice?

Why valuable Site 5 (worth $250M-$400M+?), across from the arena, is key to restarting Atlantic Yards, and why New York State has far more leverage than it acknowledges.

When it comes to enforcement of Atlantic Yards penalties, why is Democratic Mayoral nominee Mamdani so cautious, especially compared to Republican Curtis Sliwa?

Does developer Greenland USA have a case for Unavoidable Delay, and thus could hold off the affordable housing penalties? Maybe, but ESD should have come clean sooner and seems wary of exercising power.

Does collecting damages for that missing housing make “it less likely the project gets built,” as real estate consultant tells Gothamist? It’s not so simple.

Flashback to 2014 Videos: “Pacific Park, Brooklyn’s Newest Neighborhood”? A “Neighborhood From Scratch”? As we await new plans, let’s recall a series of promotional videos produced in 2014.

“The New York we love is a place that largely happened by accident. But what if it happened on purpose?” one narrator states. Now, as the record shows, we can say: what if it didn’t?

Grub Street asks: “Is Vanderbilt Avenue Cursed?” Probably not, since certain turnover of restaurants is inevitable.

In article on modular construction, New York Review of Architecture discloses that ill-fated 461 Dean (aka B2) was the subject of three audits after it faced delays and leaks.

State Sen. Jabari Brisport goes to bat, on video, to enforce Atlantic Yards affordable housing penalties.

September

New York Liberty ticket prices keep going up and loyalists, especially with once reasonably-priced courtside seats, feel the pain.

470 Vanderbilt office building, across Atlantic Avenue from Atlantic Yards site (and once contemplated for Atlantic Yards housing!), sold again, this time for a big loss.

New owners of former Pintchik properties near arena now pitching “The Retail at Flatbush and Bergen,” with a wobbly map, centered on the arena.

So, how was the Planet Brooklyn festival? Lots of fun reported, especially by promoter-associated media. More noise complaints and illegal vendors, too.

The defending WNBA champions Liberty exited the playoffs quickly—and fired Coach Sandy Brondello. Still, BSE Global got a nice bounce opening the new Brooklyn Basketball Training Center. Youth clinic cost: $520/8 hours or $1,000/16 hours.

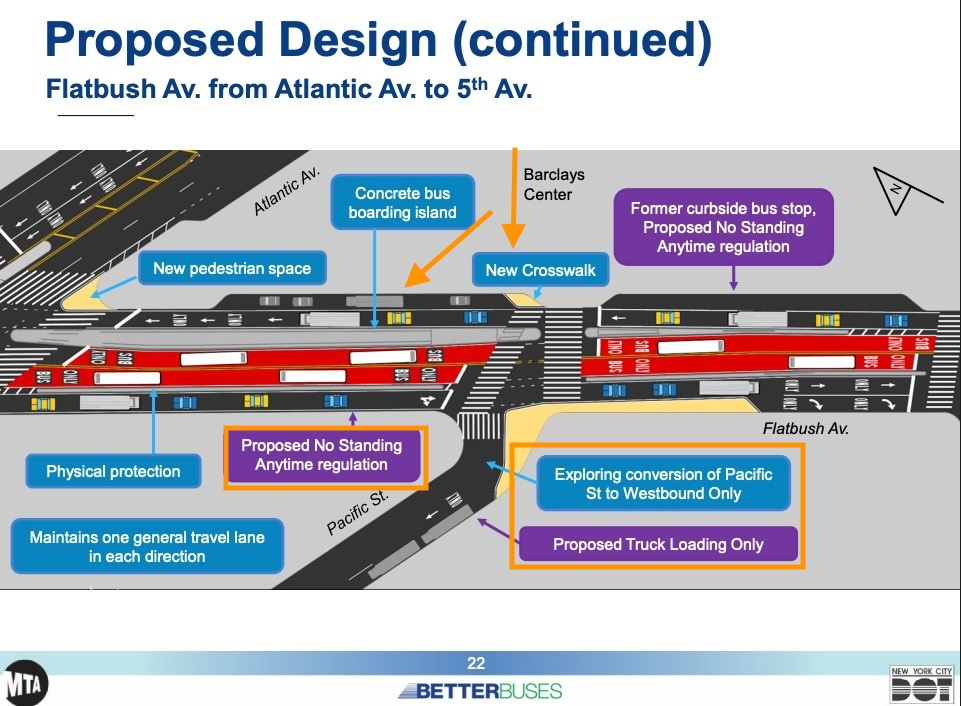

Bus priority plan on Flatbush Avenue would leave little slack near Barclays Center. With “No Standing” in pockets near arena, wouldn’t enforcement be needed to prevent congestion? Also, change in Pacific Street direction could challenge Site 5 construction. Stay tuned.

Lessons from twists in Brooklyn Marine Terminal and Coney Island development dramas. For Atlantic Yards, does this mean that new promises and safeguards get a “big thing” done in the name of “abundance,” the new buzzword among Democrats and YIMBYs?

If Hudson Yards got taxpayers to pay for the platform, what happens with Atlantic Yards? The Manhattan megaproject’s second half rose from the dead thanks to little-scrutinized political and financial maneuvers. Keep watch in Brooklyn.

October

An arena naming rights deal in Phoenix, plus the New York Liberty’s rise, again suggest the Barclays Center sponsorship deal is under value. It’s up in 2032.

The arena company again reports modest profits (putting aside paper loss), though with downtick from FY 2024. Capital contribution down from $51M to $15M.

Empire State Development has approved the new development team, led by Cirrus and LCOR, and negotiated a small, almost symbolic, $12 million payment of the affordable housing penalties.

This time, the developers say, is different. They have an argument. But they also face skepticism.

At Atlantic Yards Community Development Corporation meeting, criticism of damages for missing affordable housing, optimism about new permitted developer, big questions re scale, subsidies, affordability

Are larger market-rate apartments in Brooklyn Marine Terminal plan key to the 40% affordability promise? Below-market apartments are smaller.

Sportico: After 43% jump in 2024, value of Brooklyn Nets’ parent BSE Global grew “only” 9%, now NBA’s sixth most valuable. Owner Tsai key in NBA China ventures.

As the Brooklyn Nets struggle and “tank,” lots of backlash, including toward non-cheap tickets.

Forbes ranks Liberty’s Breanna Stewart and (lead) owner Wu Tsai among top ten America’s Most Powerful Women in Sports.

November

If “there really is no accountability,” as per former ESD executive, why not involve third-party experts regarding the project’s future.

To me, the housing ballot proposals seemed confounding. They still passed, and will empower the mayor’s office over the City Council.

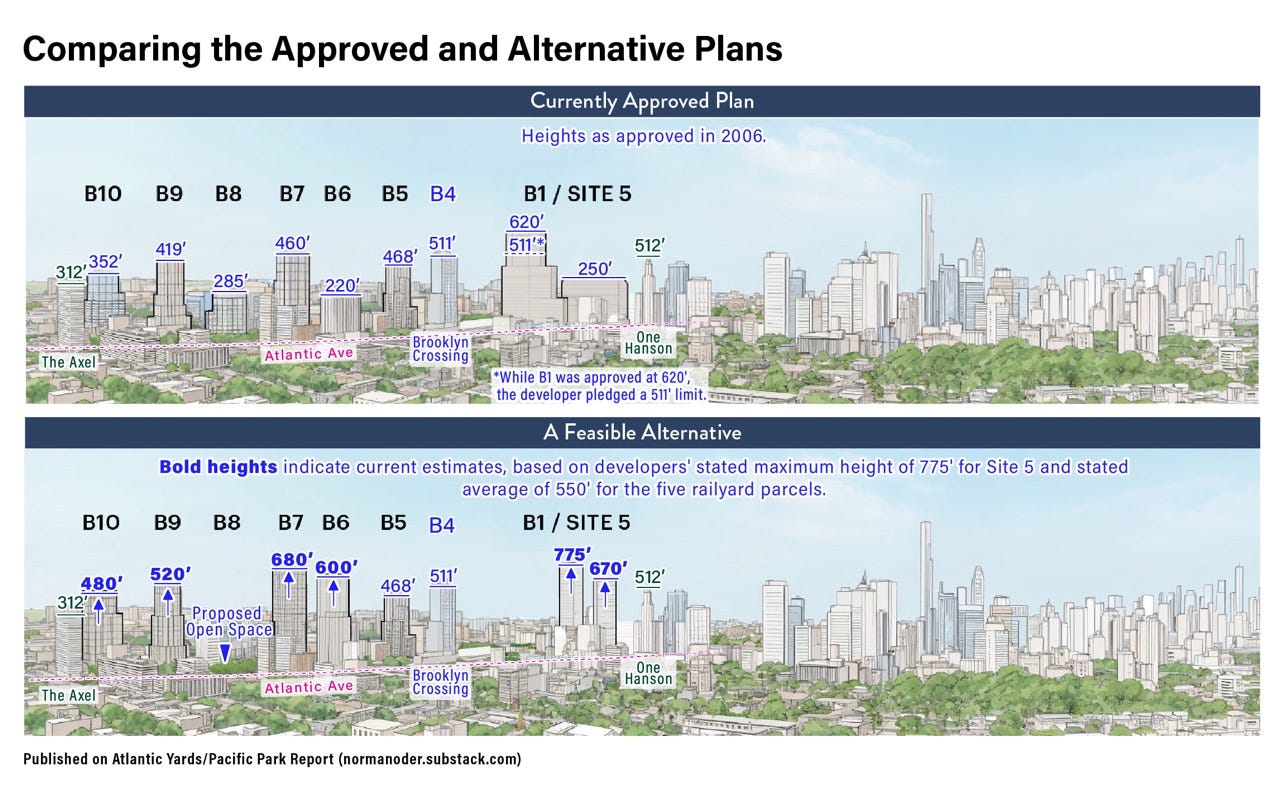

A briefing before the first public workshop, on height and density, ignores the plan for two towers across from arena and hints at new configuration over railyard. Yes, it was a hint.

The BrooklynSpeaks advice on the first workshop—and what’s missing.

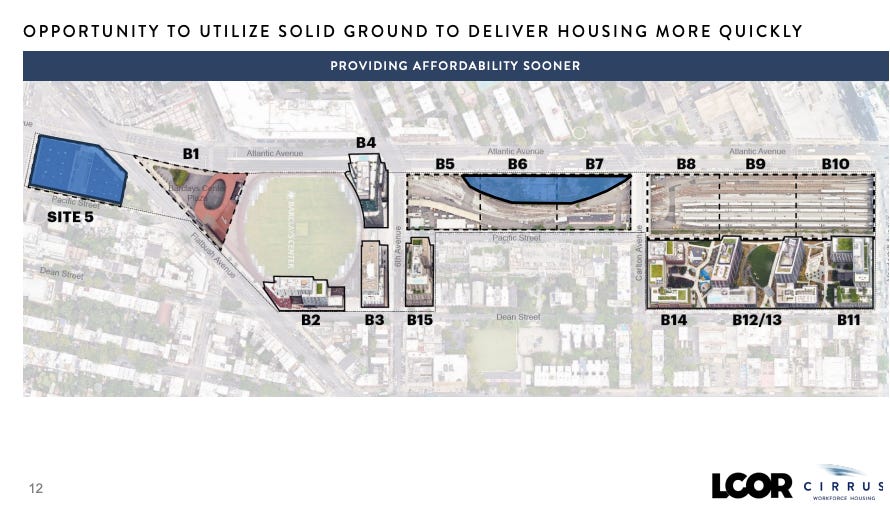

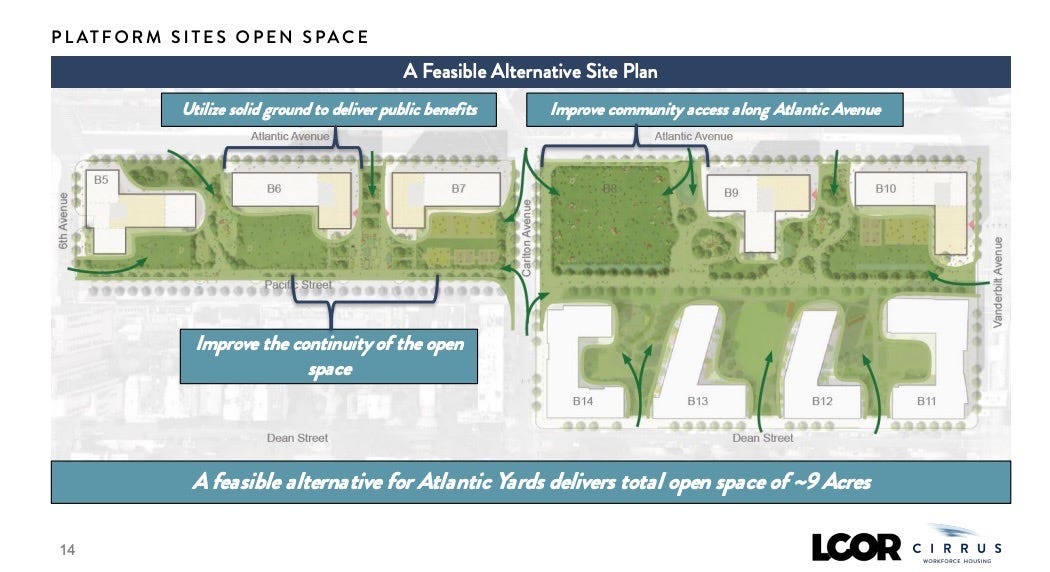

One Nov. 18, the new developers presented their vision to complete the project: a major increase in scale, adding 1.6 million square feet and some 2,570 apartments, while eliminating one parcel to add open space. Changes to building designs could mean a faster buildout.

This time, they say, is different, citing their ability to leverage previous spending by Greenland on infrastructure. But the “public-private partnership” involves yet unspecified help from city and state taxpayers.

The new developers apparently expect 1.6 million square feet in additional air rights for free. “Today’s context,” they say, justifies bigger buildings. But the 2005 appraisal and bid for MTA development rights, in a different context, envisioned less bulk. Will there be no additional payment?

Is more open space better? Maybe not, if population outpaces it. More acreage would come with a larger percentage increase in apartments.

Developers’ rhetoric suggests low-income units not a priority. The promised faster buildout would dampen increases in base rents, but skyrocketing Area Median Income (AMI) has taken its toll.

Who owns what in the project? What are the real variables? When I asked about ownership, I got the runaround. The variables they present are not so simple.

December

My pre-meeting questions: Was the “Feasible Alternative” depicted feasibly? (Not quite.) Do new developers seek just a 20% increase in bulk, & should they get it for free? Why no plans for lower-income units?

As developers propose much larger buildings, their renderings distort reality. Images downplay proposed changes while inflating what’s been approved. Yes, the images are preliminary, but the public is owed more candor.

At advisory board meeting, new focus on affordable housing. Negotiator of original ACORN housing deal points to unmet promises regarding the level of affordability and family-sized units. What are the costs to make it work?

Brooklyn Ascending everywhere? In complex Atlantic Yards ownership structure, at least ten LLCs have “Brooklyn Ascending” in their name. Looking at ownership transfers for Vanderbilt Yard parcels that now involve “Brooklyn Ascending” entities.

Workshop on public realm, retail, and community facilities crowdsources input, but some big gaps. Would “signature open space” be “transformative,” given boost in apartments? How long would it take? What about loading docks, parking issues, Site 5 retail (& LED lighting), and value of arena plaza?

Can public-private development projects be fixed? Well, maybe, according to a panel, but it requires better monitoring, new procedures (approve in phases?), and better execution. Plus, legislators and the public must step up.

What I noticed at the Barclays Center. “The Fighting Spirit of Brooklyn” (via Modelo), a Coney Island boardwalk homage (!), and the obscured Meditation Room. Plus unsurprisingly pricey concessions.

A few other notes

A new public school campus at the base of the B15 tower, 662 Pacific Street, has been operating without many complications.

Walgreens finally opened at Pacific Street near Flatbush Avenue.

A sewer and water main installation moved down Dean Street, starting between Sixth and Carlton avenues and then between Carlton and Vanderbilt avenues. Neighbors told me it was frustrating.

At recent public meetings, both state officials and the developers have used the name “Atlantic Yards” rather than “Pacific Park” or “Atlantic Yards/Pacific Park.” I still wouldn’t rule out a name change at some later point.

Close readers may have noticed that this newsletter, which began in December 2023 as Learning from Atlantic Yards/Pacific Park, was a few months ago renamed Atlantic Yards/Pacific Park Report (Substack).

The original name, unfortunately, was a mouthful, and I don’t think it took.

I still write my Atlantic Yards/Pacific Park blog, on Blogger, which appears more frequently and goes back to 2006! I aim to reserve longer, more in-depth articles for this Substack, as well as round-up digest posts. But more content will move to this platform.

Bottom line: subscribe here, and you’ll get everything, eventually. You also can follow me on Twitter and BlueSky. Your comments and suggestions are welcome.