Does Atlantic Yards Just Need a Transfer of Rights? Or an Inquiry?

If the EB-5 "lender" didn't put up any money, what incentive does it have? Is New York State ignoring its leverage with penalties? Legislators should drill down.

I wrote last week about how Hope Knight, CEO of Empire State Development (ESD), seemingly told Assemblymember Jo Anne Simon that the state authority would enforce the $2,000/month penalties due when 876 more Atlantic Yards/Pacific Park affordable housing units (of 2,250 required) are not delivered by May 31, 2025.

Knight didn't sound convincing. After all, given past renegotiations, another is likely pending that would affect the project’s timeline and penalties.

So Simon's tweet--"I encourage the lender to present a qualified developer to ESD soon so the long-promised affordable housing can finally be built"--ignored that likelihood, and the complexity it brings.

As I write below, numerous questions remain, and the so-called "lender"--actually a middleman--has limited incentive to move forward, since it didn't put up the money.

Meanwhile, ESD may have more leverage than it allows, regarding both that "lender" and also developer Greenland USA, which might still be obligated to pay those penalties.

Bottom line: legislators should investigate, not merely encourage, and ensure that ESD uses its leverage.

The backstory

The deadline was set in 2014 when Greenland Forest City Partners, involving new entrant Greenland USA leading a joint venture with original developer Forest City Ratner, was optimistic about project completion.

The deadline was part of a settlement aimed to head off a potential lawsuit, on fair housing grounds, regarding the impact of delays in affordable housing. The settlement was prompted by the coalition BrooklynSpeaks, which Simon has supported and shaped.

Since then, Forest City has left the joint venture and Greenland has failed to pay back $286 million of $349 million in low-interest loans from immigrant investors under the EB-5 investor visa program, which trades green cards for purportedly job-creating investments.

Since November 2023, the loans have faced foreclosure, with Greenland's collateral--the rights to build the towers B5-B10, which require an expensive platform before vertical construction--controlled by the "lender" and expected to be transferred to a new joint venture.

Delays, delays

That hasn't happened yet. The "lender" is the U.S. Immigration Fund (USIF), a so-called regional center that recruits investors under the EB-5 program. It found Chinese investors to put up $500,000 each.

But calling the USIF, which put none of the money up, the "lender" is bad shorthand, though the firm, thanks to advantageous (and dubious) contract language, has control over the loan. Somehow Fortress Investment Group, a private equity fund, also has a stake.

However, they need a "permitted developer"--a development company or construction manager with at least ten years of experience in large projects. Last year, Hudson Yards developer Related Companies was expected to join the joint venture, but it pulled out. Another funding entity, Cirrus Real Estate, has reportedly entered.

Greenland separately retains the rights to build towers at the B1 and Site 5 parcels but has already gotten state support for a plan to move the bulk of the unbuilt B1 tower to Site 5, creating a giant, two-tower project.

Given Greenland’s diminished capacity, it likely would bring on a partner or sell those valuable development rights.

Simon's take

Simon since tweeted about the legislative exchange, noting delays have consequences. In fact, former Deputy Mayor Alicia Glen has argued that the penalties should be enforced.

However, Simon’s summary of the sequence omits some complications and possibilities. "I asked @EmpireStateDev about collecting liquidated damages if no developer is approved before 05/31/25. she wrote, along with a video clip of the exchange.

However, she didn't express skepticism toward Knight's response, as well as the state's previous reluctance to enforce deadlines.

A transfer is it?

Simon added, "I'm pleased @EmpireStateDev anticipates transferring the rights to the railyard when a viable developer is presented. I encourage the lender to present a qualified developer to ESD soon so the long-promised affordable housing can finally be built. We can’t afford more delays."

That skates over severak questions.

What happens to the penalties? Who would pay them? Does ESD have leverage over anyone? Or would they be waived or renegotiated?

Are the development rights viable or would ESD and the Metropolitan Transportation Authority, which controls those parcels, be asked for concessions regarding timing as well as additional buildable square footage (free land), as master developer Greenland USA--which has since lost those six railyard sites--sought in 2023?

How does such additional bulk affect the livability of the project and area? Should the formula simply be to build ever bigger, as long as it trickles down affordability?

Would additional affordable units be added to (seemingly) compensate for the delays, as proposed in 2023?

What level of affordability would be pursued?

Declining accountability

It's remarkable that a sole-source development project entrusted to a single developer, Forest City Ratner, has since devolved to even less transparent and accountable parties.

Forest City was at least part of a nationally traded firm, long known as Forest City Enterprises and later Forest City Realty Trust, that had to make quarterly reports to the Securities and Exchange Commission (SEC), and to answer (some) questions from investment analysts.

Greenland USA is an arm of the Shanghai-based Greenland Holdings Corp., which while traded on the Shanghai Stock Exchange, is far less accountable. Then add the language gap.

Now the USIF, an opaque private company with dubious ethics and facing no SEC oversight, controls the project’s future.

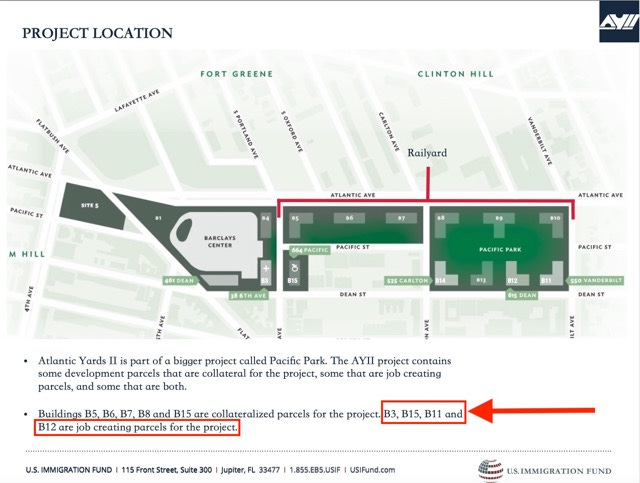

Remember how the USIF suggested to investors in “Atlantic Yards II” two towers that didn’t exist, B12 and B15, were “job-creating” parcels, as seen in the screenshot above?

Or how a Consent Letter signed with ESD prohibited any of the EB-5 money being used on any of the purported job-creating parcels?

Does the "lender" have incentives?

The USIF earns money from fees paid by investors. It also takes most of interest paid to investors as a fee. The interest rate remains advantageous to real-estate borrowers, since it's well below market. The investors mostly care about green cards--and getting their money back.

In other words, the USIF has already made a lot of money on the project. Yes, it likely would make more once a deal is done, but it didn't put up any money and thus--unlike a bank--is not itching to be repaid.

Does NY State have leverage?

Empire State Development, I suspect, has more leverage than it acknowledges, though that might require a willingness to go to court.

For example, why not enforce the affordable housing obligation against Greenland, given that ESD retains jurisdiction over that developer's plans for B1 and Site 5?

Also: why not enforce that against the "lender," at least if USIF and financial partners currently control the railyard parcels? After all, the latest payment to the MTA for railyard development rights suggests they do.

Moreover, ESD may have leverage over USIF, whose CEO, Nicholas Mastroianni II, has a record that includes an arrest for felony drug possession. He pleaded no contest. If he pled to a felony, rather than a misdemeanor, he'd qualify as a "prohibited person," and ESD shouldn't even be doing business with him.

"We're still looking at it,” ESD lawyer Matthew Acocella said at a meeting last November of the advisory Atlantic Yards Community Development Corporation (AY CDC). “But based on the information we've gotten and based on the structure of the [joint venture], we don't see any bar to proceeding with this joint venture as the permitted developer with Related [Companies] and USIF.”

Does that mean that Mastroianni is not a felon? Or if he is, it doesn’t count? Or that his formal role has changed, giving the joint venture an out? Legislators and the AY CDC should get some clarification.

A new plan, or an investigation?

"It's time for a new plan at #AtlanticYards @pacificparkbk," tweeted Gib Veconi, a key leader of BrooklynSpeaks. "Holding the current parties accountable for project commitments is the place to start."

That could include both Greenland and the “lender,” though, again, ESD has shown little vigor in pursuing accountability.

Not long after the foreclosure surfaced, Veconi and Michelle de la Uz of the Fifth Avenue Committee, in a New York Daily News op-ed, called for a new plan for the project.

I suggested it needed even more than that: a process that involves public scrutiny, including oversight hearings—which BrooklynSpeaks had earlier proposed, in a now-deleted Nov. 29, 2023 press release.

“ESD has made it clear collecting damages is not a priority for them — as they demonstrated when the May 2022 deadline for the Urban Room, a glass-enclosed atrium to be located in front of Barclays Center, was missed,” Simon said in that press release. “By signaling it won’t hold developers accountable, ESD has encouraged them to take larger risks than they otherwise would. This is the result.”

So she, as much as any legislator, knows to be skeptical today.

“The public deserves a full accounting of how things have gone so wrong at Atlantic Yards,” added de la Uz in the press release, calling for legislators and city/state officials “to investigate the failure of ESD’s 20-year stewardship of the Atlantic Yards project, and take such action as may be necessary to regain control of the site and its development rights, restart development under a new plan that has truly affordable housing, better manages supplier risk, and ensures transparent accountability.”

That new plan must also balance other things, as I wrote, since the formula shouldn’t simply be to build ever bigger, as long as it trickles down affordability.

The state needs to enforce the agreement as is and not allow for any changes. If the developer is unable to deliver than the contract should be abrogated and a new plan developed by the AYCDC in concert with relevant city and state housing and community development entities. They shoud undertake a robust community participation process to develop an innovative social housing plan to meet the housing needs of each income quartile of NYC residents. That plan should then be presented to the relevant community boards, the Brooklyn Borough President and upon approval an RFP should be issued for 3-5 development teams to undertake design, deveopment and construction of the housing. The state should (1) issue a bond to cover all infrastructure costs including but not limited to the platform and (2) write down the cost of housing for those income quartiles in need of subsidization. The cost of the bonds should be backed by rescinding a small portion of the daily rebate of the NYS stock transfer tax and use those funds as a guarantee of repayment