Weekly Digest: Related Out, Cirrus In, but They Need Another Partner to Pursue Project

EB-5 loan packager Mastroianni keeps dealing. Also: Pintchik family sells 26 buildings near Barclays Center.

This digest offers a way to keep up with my Atlantic Yards/Pacific Park Report blog and my other coverage in this newsletter and elsewhere.

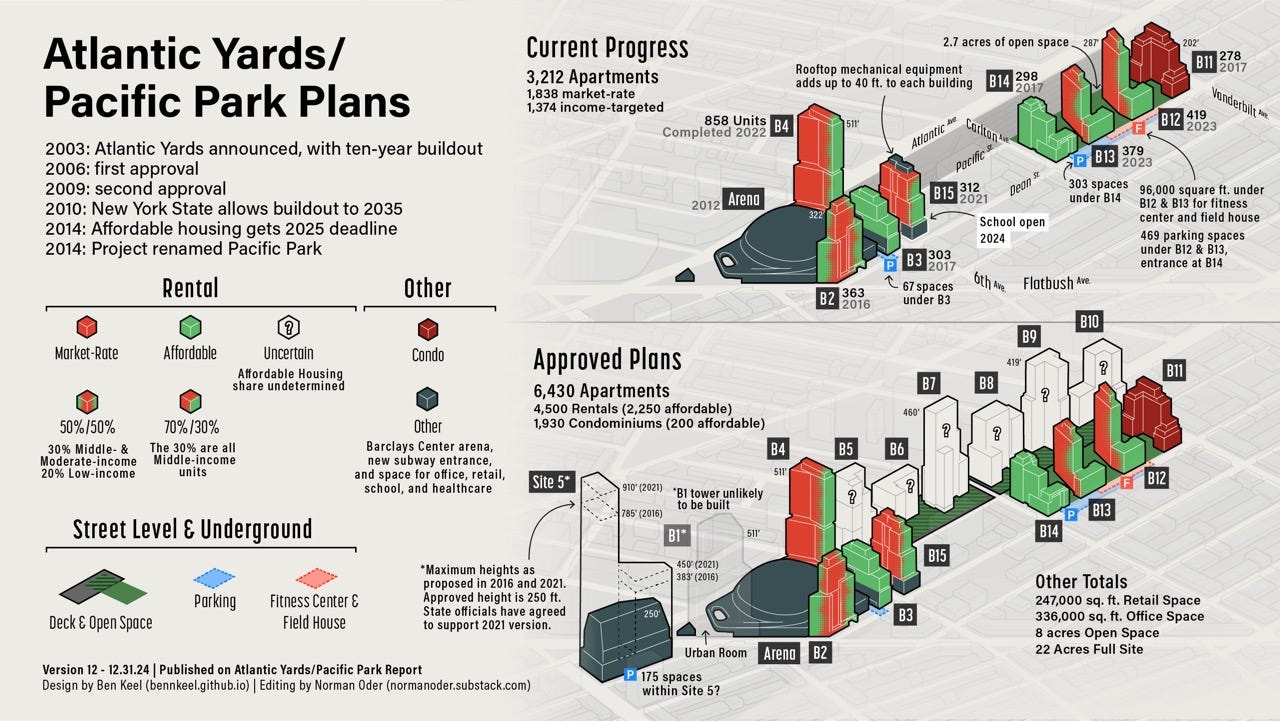

In my recent 2025 preview, I predicted that this was the year that Related Companies, developer of Hudson Yards, would move in, leading a joint venture to develop six towers (B5-B10) over the Metropolitan Transportation Authority’s Vanderbilt Yard, which need a costly platform before vertical construction.

Well, that didn’t happen.

Instead, we learned two days ago, thanks to The Real Deal, that Related had backed out, for reasons unexplained, and the key player in the project’s fate—the manager of the EB-5 lender that would control those six parcels, given foreclosure on a loan—had found a partial replacement.

However, as I wrote, Cirrus Real Estate Partners—a small firm focused on funding projects—couldn’t qualify as a “preferred developer,” under state requirements, but instead would have to find another developer or at least a construction manager with a decade’s worth of experience in such large-scale projects.

So stay tuned to see what Empire State Development (ESD), the state authority that oversees/shepherds the project, has to say, and how the project might be modified, with developers likely seeking additional square footage (free land!) and extended deadlines, while promising more affordable housing.

Who’s in charge?

Remarkably, the fate of most of the remaining Atlantic Yards/Pacific Park project has been steered since late 2023 by Nicholas Mastroianni II, founder of the U.S. Immigration Fund (USIF).

He’s probably the country’s most prolific packager of EB-5 loans, recruiting immigrant investors willing to invest $500,0001 (plus fees), foregoing interest, in a purported job-creating investment in exchange for green cards.

Mastroianni, who even supporters acknowledge has a “checkered past,” recruited Chinese investors to put up $349 million in loans (of which about $286 million remains unpaid), but created contract language that leaves the fund manager in charge.

The problem is that the documents the investors signed acknowledge a huge number of risks and potential conflicts of interest, and at least one investor—in charges not ventilated in court, given required arbitration—claimed that she was not delivered the document but signed only the signature pages.

Putting that aside, I’ve written at length about the USIF’s deceptive marketing of the EB-5 loans, as well as claims that the loan funds were spent on construction which ESD deemed ineligible.

A big change near Barclays

The Pintchik family, longtime investors, landlords, and neighborhood stewards, has sold 26 buildings near the Barclays Center, potentially transforming those retail and residential strips.

The parcels on Flatbush Avenue, mostly three and four stories, could support larger buildings of eight stories, while those on Bergen Street could support an additional story.

Plans from the new owners, the brothers Michael and Edward Ostad, remain unclear, but they have a higher cost basis than the Pintchiks and likely—and based on limited history with other projects—will push for rent increases.

From this newsletter

Jan. 28: Why Does the EB-5 Manager Control the Investment? It's the (Dubious) Contract.

"Sophisticated" (?) immigrant investors focused on visas loaned $500,000 each, seemingly agreeing to unfavorable terms. Now their "checkered past" middleman looks to have an Atlantic Yards stake.

From Atlantic Yards/Pacific Park Report

Jan. 29: Barclays Center releases February 2025 event calendar: 15 ticketed events over 14 days, plus two days of mystery private events.

Jan. 30: Mastroianni moves in: funds steered by EB-5 middleman, not struggling developer Greenland, made $11M annual Vanderbilt Yard air rights payment to MTA.

Jan 31: Pintchik family, longtime owners of properties near Barclays Center, sells 26 buildings, with retail at the base. New owners have the opportunity to build bigger.

Feb. 1: TRD: Related pulls out of Atlantic Yards joint venture. Cirrus enters, but can't yet qualify as permitted developer. Affordability and scale unclear.

The minimum is now $800,000.