The EB-5 Marketing from 2014 Looks Even Worse Now

Back in 2014, the pitch for "golden visas" blatantly misled Chinese immigrant investors. What could go wrong?

Given the announced foreclosure sale—postponed until Feb. 12—of developer Greenland USA’s interest in six parcels over the Vanderbilt Yard (B5-B10) and a public meeting tomorrow regarding that sale, I’ll offer two related newsletters today.

The history of investor visa (aka EB-5) fundraising for Atlantic Yards has been blatantly sketchy. Should we be surprised that two loans from 2014 and 2015, totaling $349 million, have gone bad?

Back in 2010, I wrote a series, “Anatomy of a Shady Deal,” about the first round of EB-5 fundraising, which involved cheerleading from state official Peter Davidson, a representative of Empire State Development Corp. (ESDC, now ESD), the state authority that oversees/shepherds the project.

Would Atlantic Yards “be the largest job-creating project in New York City in the last 20 years,” as he claimed? No way. But Davidson dutifully supplied proclamations for migration recruitment firms, providing an official gloss on private fundraising.

That $228 million in low-cost financing, raised via a middleman known as the New York City Regional Center, was eventually paid back, albeit late. Evidence suggests that it may have funded infrastructure but primarily went to retire land loans.

So it didn’t really “create jobs,” which is the public policy rationale behind the Rube Goldberg-type EB-5 program. Immigrant investors accept little or no interest because they want green cards. (They do expect to be repaid in five to seven years.) Developers get below-market financing. The middlemen make bank. The public benefit? Dubious.

As Fortune’s Peter Elkind reported in 2014:

But because the EB-5 industry is virtually unregulated, it has become a magnet for amateurs, pipe-dreamers, and charlatans, who see it as an easy way to score funding for ventures that banks would never touch. They’ve been encouraged and enabled by an array of dodgy middlemen, eager to cash in on the gold rush.

Update, 2014

When original developer Forest City Ratner, with its incoming majority partner (and now master developer) Greenland USA, began in 2014 two new rounds of fundraising from immigrant investors, I dutifully pointed how sketchy it was.

See my January 2014 coverage of “Atlantic Yards II,” raising $249 million, and October 2014 coverage of “Atlantic Yards III,” raising $100 million.

Both involved a new middleman “regional center”—a loan packager authorized but under-scrutinized by the federal government—known as the U.S. Immigration Fund (USIF).

By October, the USIF and its founder, Nicholas Mastroianni II, were the subject of a tough article by Elkind in Fortune, The tangled past of the hottest money-raiser in America's visa-for-sale program, which cited his "long history of legal problems, failed ventures, and unpaid debts." More here.

What that missed was his company's continued dubious practices, visible then, and even more visible now. Should we surprised that the loans have gone bad, too?

Investor visas and “hoops”

As with so much of EB-5 fundraising, in which immigrant investors park $500,000 in a purportedly “job-creating” investment, the promotion had little to do with the actual project at hand.

Consider the marketing of “AY III” in conjunction with a visit to China by the Brooklyn Nets and a chance to meet retired NBA star Darryl Dawkins. The investment, of course, had nothing to do with basketball or the arena.

But New York State and City officials didn’t care, because Forest City and Greenland were getting cheap capital. (I did get the U.S. State Department to protest the misuse of a diplomat’s statement.)

The plan

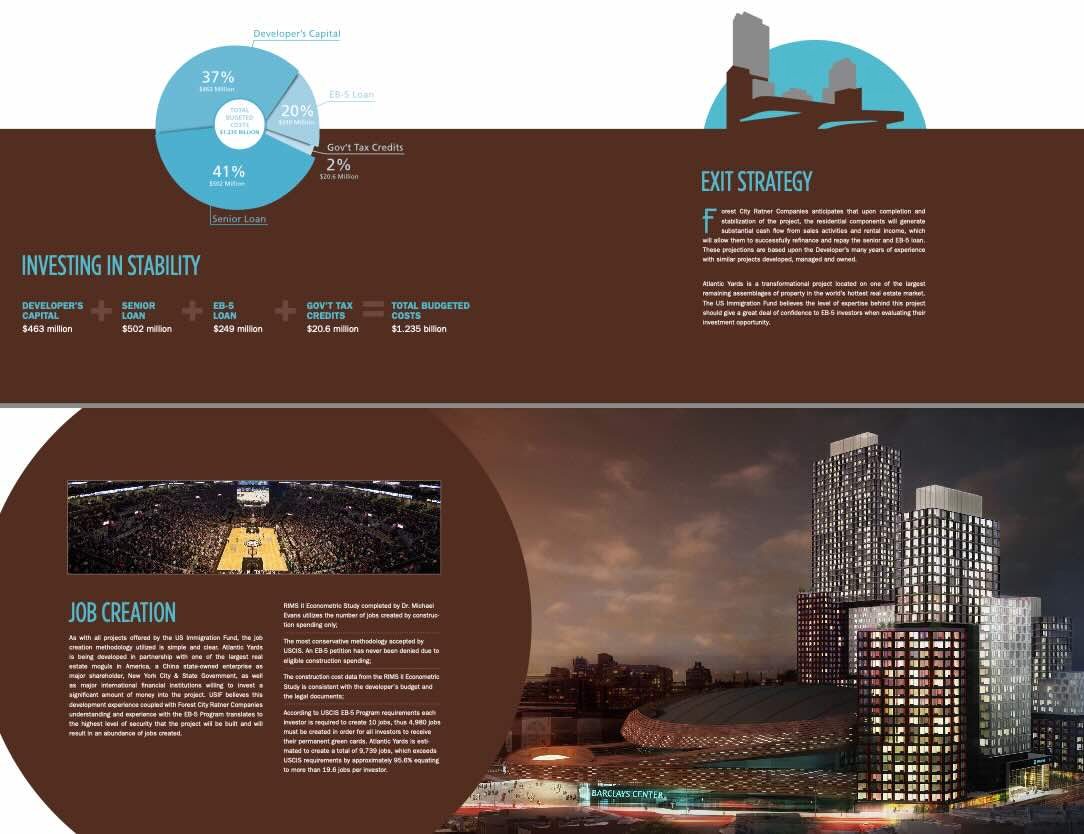

Check the excerpt below from the USIF’s “Atlantic Yards II” marketing brochure. It touts “Investing in Stability,” claiming that the $249 million in EB-5 capital would be combined with the developer’s capital, a senior loan, and tax credits.

That would create a $1.235 billion “project,” which thus would generate more than 9,700 jobs, at least according to EB-5 math, which allows credit for not just directly created jobs, but indirect and induced (created by worker spending) jobs.

Upon completion and stabilization of the “project,” the loans would be refinanced and repaid, according to the brochure.

However, as revealed in the associated video, below, the money was going to go to infrastructure, which was a precursor to tower construction rather than a revenue-generating project.

They must have thought the stirring music and visuals were enough to hook the investors.

The AY II video

The pitchmen—er, pitchpeople—were Forest City Ratner Chairman Bruce Ratner and his deputy MaryAnne Gilmartin. I’ll quote their statements, and then annotate them.

MAG: Brooklyn is no longer apologizing for not being Manhattan.

BR: Brooklyn has become a magic name all over the world. Everybody's talking about Brooklyn, whether it be art or media or building development or food. Brooklyn is amazing. It's the best development opportunities [sic] in the whole country right now.

OK, but that doesn’t have much to do with the EB-5 investment, except to try to convince investors that the overall atmosphere was positive.

The nuts and bolts of the project—the planned investment and the collateral—were not discussed, nor was the potential for new Downtown Brooklyn apartments to compete with the more complicated Atlantic Yards product.

Invoking Vogue

The screen offered a quote from a Vogue article headlined Bonjour, Brooklyn: Why New Yorkers Are Flocking to the Borough:

The city is in renaissance and “creative artists have been flocking to New York’s Left Bank for its destination restaurants, bustling farmer’s markets, Parisian-style parks and passionate dedication to l’art de vie.

However, the “models, writers, actors, and artists” highlighted in the fashion piece are habitués of Boerum Hill, Cobble Hill, Williamsburg (Bedford Ave.), DUMBO, Grand Army Plaza, and the Brooklyn Botanic Garden, all pretty much the antithesis of the megadevelopment at issue.

About Atlantic Yards

MAG: Atlantic Yards is probably among the most ambitious projects under way in New York City today. Anchored by the Barclays Center, it is 22 acres of large-scale mixed-use development, located above one of the most active transit centers here in New York City.

Today we're a year into celebrating the opening of Barclays Center, which has been welcomed by the community, the city, and the world at large. We're very excited by the fact that the arena has been so successful and we are now commencing the rollout of the residential portion of Atlantic Yards.

While the arena had provoked buzz and won awards, it had not been financially successful.

Its impressive gross revenue figures, goosed in part by the renovation of Madison Square Garden and the push to book major acts in the new arena, were counterbalanced by unusually high expenses.

“Public-private partnership”

MAG: Any project on the scale of Atlantic Yards requires the work of the public-private partnership. Our project is sponsored by the State of New York and heavily supported by the City of New York and local politicians.

It’s important to Chinese investors, who welcome government involvement, to argue that the state and the city support the project. Which they did, and do. But that doesn’t mean they’d bail it out. (We’ll see.)

Of course, as Ratner famously told Crain’s New York Business in November 2009, “Why should people get to see plans? This isn't a public project. We will follow the guidelines.”

In other words, it’s “public” only when convenient.

Big mistake

BR: Our company started developing 25 years ago and we have built probably 80% of the office space that's been built in Brooklyn has been us. And when we finish Atlantic Yards we will have probably built half of the high-rise residential that will been built in Brooklyn over the last 25 years.

That was a terrible miscalculation, already unwise when stated in 2013, as the Downtown Brooklyn skyline, as well as that in the North Brooklyn neighborhoods of Williamsburg and Greenpoint, had begun to spawn towers.

Atlantic Yards/Pacific Park today is a relatively small contributor to the skyline of “high-rise residential.”

Changing the subject

MAG: Atlantic Yards creates an abundance of construction jobs and, in the operation of the arena, we're very proud of our track record in creating jobs and we believe that that's a big driver in what makes this project so important and in fact so successful.

That’s a clever piece of misdirection. Arena operations had nothing to do with job-creation credit for these investors. The arena was already built.

More misdirection

The screen flashed with text stating, “Welcome to Atlantic Yards. 22 acres. 16 buildings. 7.8 million square feet.”

Whatever the statistics, that was not the much smaller subset of the project in which they were investing.

Moreover, hearing the arena’s public address announcer announce, “Ladies and Gentlemen, your Brooklyn Nets” was also irrelevant.

Invoking government

BR: Whatever I do has to have a social value. It has to either create employment, create homes or create economic development. And so I built a lot of office space to keep jobs in New York City. And now what we're doing is building a lot of residential units.

It has to be a partnership with the government, because a project this size requires a lot of government approvals, requires a lot of help from the government, getting it through all of the different environmental requirements, and so on. So it really is a public-private partnership.

That “and so on,” in retrospect, covers a lot of ground.

Sleight-of-hand

MAG: We're in the strongest core market in the country. We believe that the city was built and created for an immigrant population and EB-5 allows folks from all around the globe, in the great tradition of this city to come, and participate in one of the most exciting developments in our country.

That’s a remarkable sleight-of-hand, suggesting that immigrant investors—who are essentially buying their way into the country in exchange for a purportedly job-creating investment—are just like other immigrants to New York City.

However, they do not have to live in the city in which they invest, so that leaves a lot of slack.

As to whether they have since “participated” in Atlantic Yards, well, they’ve contributed low-cost capital that has not been returned. Now they face perhaps only partial repayment after the foreclosure sale.

What’s the money for?

MAG: Several years back we utilized EB-5 funds to execute other infrastructure improvements in and around the Barclays Center. And so, given the success of that first EB-5 raise, we are focused on a second raise that will allow us to continue the infrastructure development portion of the project.

What did “given the success” mean in this case? Perhaps it could be translated as, “We were able to raise cheap capital, so we’d like to do it again.”

Omitted: any mention of how this EB-5 raise might lead to new construction that could then be sold or refinanced, generating cash to repay the investors.

Forest City’s reputation

BR: One of the most important things about our company, if you were to ask people in New York, is: they get it done. We finish things. And that's very important for EB-5. We have a real track record and it's a very good track record. But we understand that is very important to all the people in EB-5 that we do what we say we're going to do.

Except this time they didn’t.

They had already announced a plan to sell 70% of Atlantic Yards going forward to Greenland USA, an arm of a Shanghai-based conglomerate, which had no track record in New York.

The “people in EB-5”--the investors—deserved candor rather than misdirection.

As to whether Forest City reps “do what we say we’re going to do,” well, that was already belied by the shifting history of Atlantic Yards/Pacific Park: original architect Frank Gehry had been dropped and the original plan for an arena ringed by four office towers had become three residential towers and a plaza.

Remember, as Ratner lieutenant Jim Stuckey once famously said, “Projects change, markets change.”

The “Atlantic Yards III” video

A second video, for the third round of fundraising—“Atlantic Yards III”—is below.

It most reprises the first video, though it excises a few statements—like celebrating the arena’s opening and commencing the residential rollout—and images, while adding some images and scenes.

Indeed, as shown in the screenshot below, the video contains images of the modular tower, B2 (aka 461 Dean); the new name Greenland Forest City Partners; and representatives of both Greenland and the EB-5 marketer U.S. Immigration Fund.

As I wrote in October 2014, despite the recent name change from Atlantic Yards to Pacific Park Brooklyn, they didn't want to confuse the potential investors from China--where “Atlantic Yards” remained a brand--so they still called it Atlantic Yards.

There were two other ironies. Though the video included some dramatic shots of the B2 modular tower, the project was stalled, the subject of a bitter legal dispute and later, clearly, a construction debacle.

Also, not only could the investors not put their money into the Barclays Center, Forest City would soon no longer have a role.

Its share of the arena company was up for sale, and Russian oligarch Mikhail Prokhorov, already the Brooklyn Nets owner, would by late 2015 own it all.