Why Does the EB-5 Manager Control the Investment? It's the (Dubious) Contract

"Sophisticated" (?) immigrant investors focused on visas loaned $500,000 each, seemingly agreeing to unfavorable terms. Now their "checkered past" middleman looks to have an Atlantic Yards stake.

Since late 2023, an unusual situation has loomed: the failure of Atlantic Yards/Pacific Park developer Greenland USA to repay nearly $286 million1 (of $349 million) in loans from immigrant investors, lent under the federal EB-5 investor visa program, has led to a foreclosure.

That left the U.S. Immigration Fund (USIF), a grandiosely named private company (or “regional center”) that organized and managed the EB-5 investment, steering the ship, thanks to dubious contract terms that disadvantage the actual investors.

I take a deeper look at that dubious contract—which discloses a huge array of risks and may not have been shared fully with investors—below.

That document contract leaves the manager, a company headed by USIF founder Nicholas Mastroianni II—who even allies acknowledge has a “checkered past”—as a key player in the future of Atlantic Yards, forming an expected new joint venture involving Related Companies that would develop most of the remaining project.

The document acknowledges that there’s no guarantee that the loan would be repaid or that proceeds from a foreclosure of loan collateral would be enough to pay investors back. What it doesn’t describe is how the process would work.

(Foreclosure auctions have been regularly announced, and postponed. There’s no evidence the one announced for yesterday proceeded.)

Deceptive practices?

In a sworn affidavit in a 2019 state lawsuit, investor Guiling Go asserted that investors were not provided with the copious risk disclosures and never received the Private Placement Memorandum (PPM) containing such disclosures. (It was acquired by Guo’s counsel and filed separately.)

Nor did USIF inform the plaintiff that the developer was out of compliance with the construction plan and that construction was very behind schedule, according to Guo.

The investor claimed, “In concert with their Chinese marketing/migration agents, Defendants provided only signature pages of Subscription Agreement and Operating Agreement,” not the full documents.

Asked about the charges in 2019, USIF attorney Richard Haddad stated, "While I will have no comment on the specific allegations by Guiling Guo, I can say the following: I read the allegations. So did the Court. The motion for a TRO was DENIED. In ALL CAPITAL LETTERS. I think that says it all."

As I wrote, that was clearly a procedural victory for the defense, but that doesn't mean the charges were evaluated. Instead, the judge ordered arbitration, which is private, as required by the contract.

What’s coming

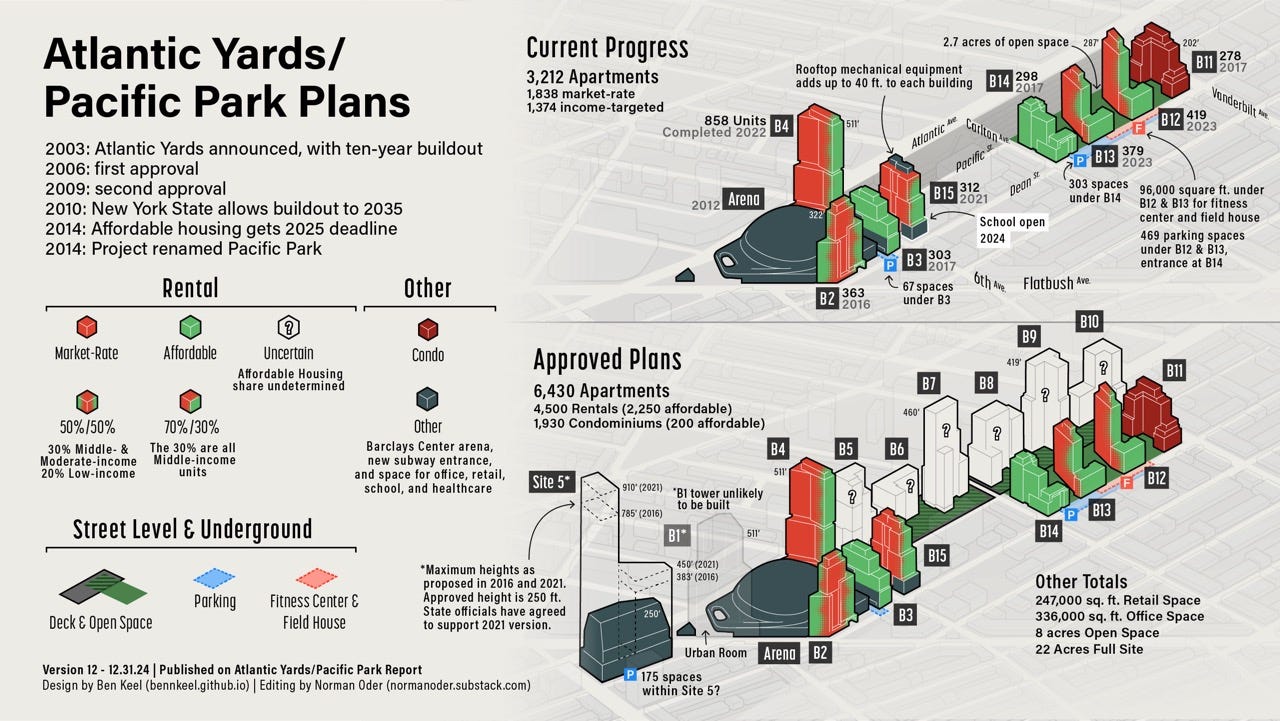

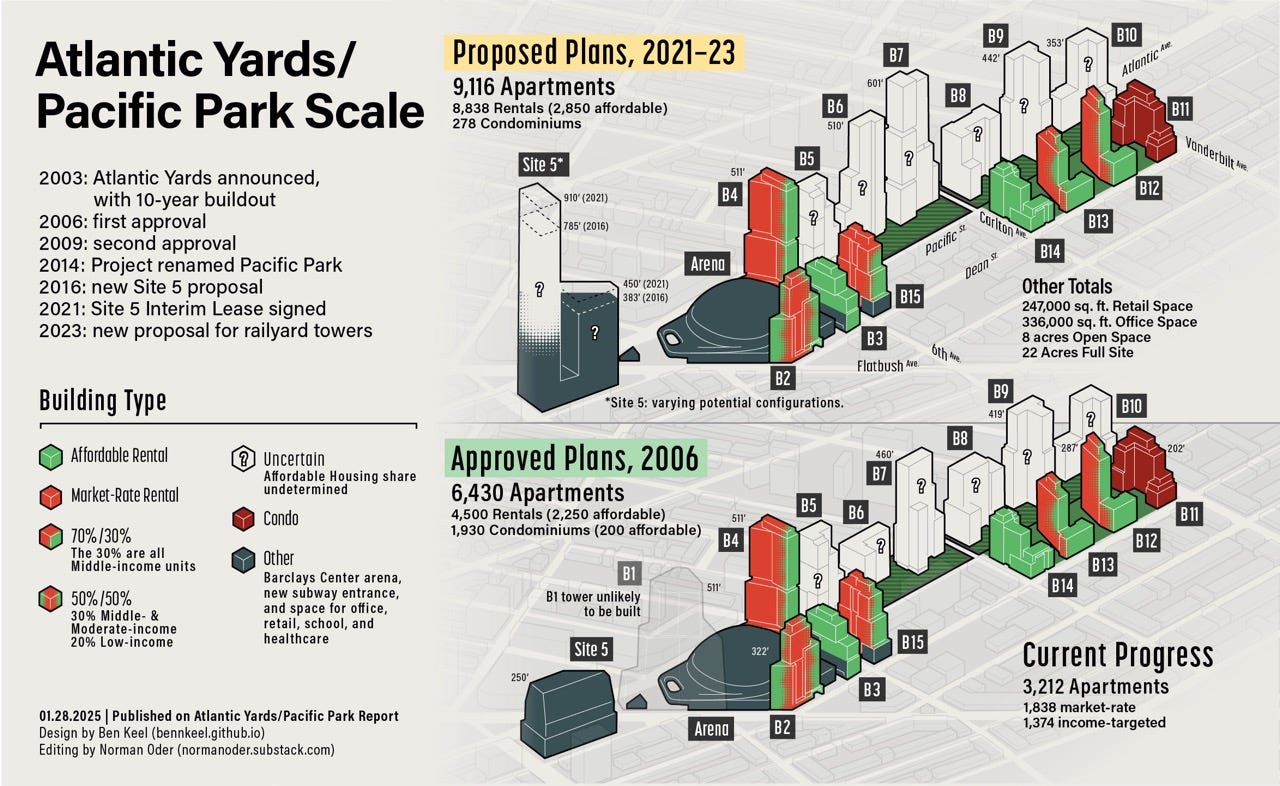

The foreclosure means Greenland should lose its collateral: rights to build six large towers (B5-B10) over the Metropolitan Transportation Authority’s Vanderbilt Yard.

Those towers—located between Pacific Street and Atlantic Avenue, and between Sixth and Vanderbilt Avenues—require a costly platform before vertical construction can commence.

It could take three years to build each platform phase, first between Sixth and Carlton avenues, then between Carlton and Vanderbilt avenues.

(Note: the original loans were gained in association with original Atlantic Yards developer Forest City Ratner, once a 30% partner with Greenland, but Forest City has since left the project, and its successor has a “nominal” stake.)

Renegotiations first?

An announced foreclosure auction has been postponed multiple times; any new developer entering the project surely would want to renegotiate key obligations: the requirement to build 876 (of 2,250 total) below-market “affordable’ apartments by May 2025, as well as the 2035 “outside date”—25 years after a 2010 benchmark—to complete the full project.

Last year we learned that Hudson Yards developer Related was expected to enter the project, partnering in a joint venture with the private equity fund Fortress Investment Group and an affiliate of the USIF. The latter recruited the immigrant investors from China and formed investment companies known as AYB Funding 100 and AYB Funding 200.

Related surely would require that those deadlines be extended and likely would seek additional square footage to make its investment more profitable.

After all, in 2023, as I reported, Greenland itself sought to extend those deadlines while gaining 1 million square feet of additional square footage. It also promised an increase in affordable housing, though with the level of affordability unspecified.

That’s separate from a plan for Greenland, which still controls the Site 5 parcel across from the arena and the unbuilt flagship tower (B1) once slated to loom over the arena, to move that unbuilt bulk to create a giant, two-tower project.

USIF isn’t the lender

As I’ve written, both state officials and outside observers, such as members of the advisory Atlantic Yards Community Development Corporation (AY CDC), have referred to the USIF as the “lender” in the EB-5 transaction.

That tempting shorthand is inaccurate. The USIF controls the lending entity, thanks to advantageous contract language, but didn’t put up the money itself.

USIF says it “organizes and manages new commercial businesses into which sophisticated foreign individuals (‘foreign investors’) invest for the purpose of obtaining a U.S. visa under the EB-5 program.”

Whether they’re truly sophisticated remains at issue.

Masking reality

USIF’s projects page suggests both Atlantic Yards investments are successful, as they’ve been fully subscribed, construction is in progress, and the visa process has progressed.

However, there’s no mention that the investors haven’t been repaid and the loans are in foreclosure.

Why the name U.S. Immigration Fund? Regional center names, as I wrote in 2012, attempt to "convey to unwary investors the patina of officialdom," even though they're private companies. (Investors from China, the largest source of funds, are reassured by government involvement.)

Interestingly, Invest in the USA, the trade group for regional centers, in 2020 implicitly criticized the USIF, warning that using "U.S." in a name violates best practices. The USIF, however, is not a member.

A “prohibited person”?

Another issue: does Mastroianni II’s criminal record, including an arrest on felony drug charges, prohibit the joint venture from qualifying as a “permitted developer”? Felons are barred as "prohibited persons," but it’s unclear if he pleaded “no contest” to a reduced charge.

"We're still looking at it,” said ESD lawyer Matthew Acocella at a meeting last November. “But based on the information we've gotten and based on the structure of the [joint venture], we don't see any bar to proceeding with this joint venture as the permitted developer with Related [Companies] and USIF.”

As I’ve written, does that mean he’s not a felon or, if he is, it doesn’t count? Or that only the company that builds the project, not its partners, gets evaluated as a permitted developer? Or has Mastroianni's formal role changed?

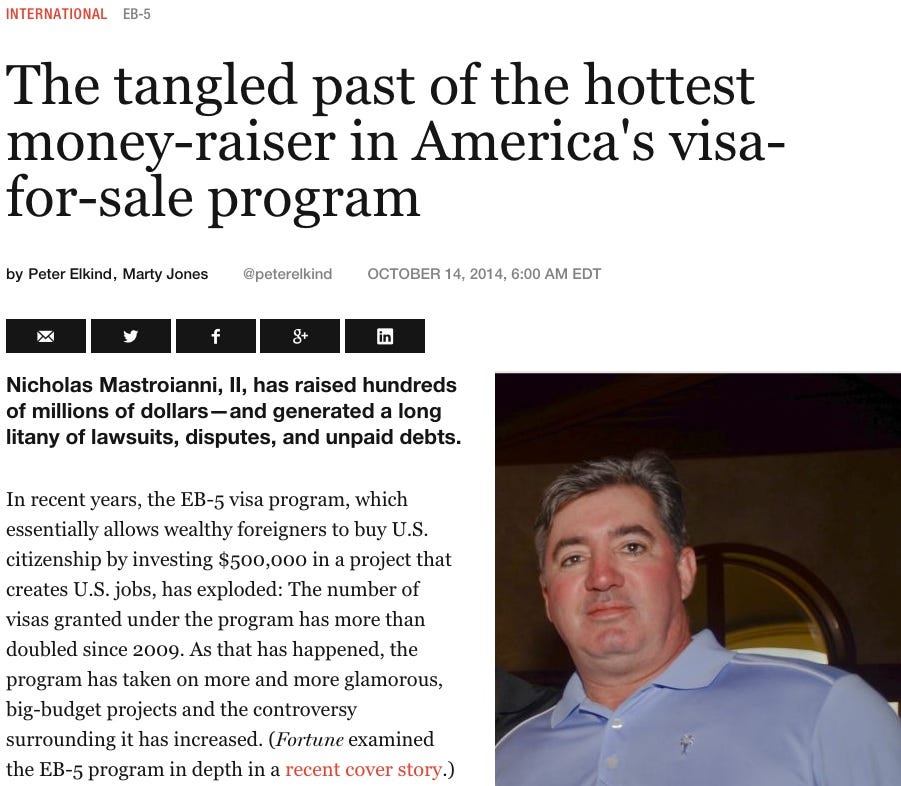

A Fortune article from October 2014, The tangled past of the hottest money-raiser in America's visa-for-sale program, by Peter Elkind and Marty Jones, provoked questions the next year in the Nassau Legislature about Mastroianni’s pending role in the Coliseum project.

"Why would this legislative body consider going into business with somebody who has an unscrupulous past like this?" one legislator asked incredulously. A Forest City representative said they were aware of his “checkered past” but had, as had other developers, fund-raised successfully with the USIF.

USIF safeguards?

On its website, USIF reassures investors that their investment is safe:

USIF prides itself on its track record of providing safe and secure investment opportunities for investors from start to finish. In addition to an expert team of internal, and external, counsel responsible for preparing and compiling offering documents and ancillary legal exhibits, USIF engages third-party compliance and conformity experts to review all documentation.

(Emphases added)

In its FAQ, USIF also states:

USIF’s EB-5 project selection includes “best in class” EB-5 project options that meet 100% of the government’s EB-5 program requirements. USIF also structures the EB-5 project for safety and security for the investor, and provides oversight of the project, developer and investment. USIF is backed by a strong network of immigration attorneys and developers.

The contract

To investors, however, the Private Placement Memorandum, at least the English version, offers a string of red flags.

It states, in all capital letters:

THE PURCHASE OF UNITS INVOLVES A HIGH DEGREE OF RISK AND IS SUITABLE ONLY FOR PERSONS OF SUBSTANTIAL MEANS WHO CAN BEAR THE RISK OF LOSS OF THEIR ENTIRE INVESTMENT AND WHO HAVE NO NEED FOR LIQUIDITY IN THEIR INVESTMENT.

That’s emphatic. The question is: did investors read it?

Yes, the list of risks is very long. Did investors take this seriously? Were they able to?

Conflicts of Interest

Several listed risks involve potential conflicts:

The Developer and its Affiliates will be Subject to Conflicts of Interest...(d) The Project, the Developer, and the Prospective Investors have not been represented by separate counsel… the proposed Loan Agreement may not necessarily be negotiated at arm’s length and may contain terms not in the interests of the Members.

The Operating Agreement has not been negotiated at Arm's-Length. The Manager and Regional Center have generally established the terms of the Operating Agreement, which were not negotiated on an arm's-length basis.

The Manager will control the Company, subject to certain rights granted to the Members. As a result, the Manager will have the power to approve transactions and agreements between the Company and the Manager, the USIF New York Regional Center and their affiliates. Such transactions and agreements may involve actual or potential conflicts of interest due to the financial relationships between the parties and the common ownership of the Manager and the USIF New York Regional Center.

The PPM summarized areas in which the interests of the Manager may conflict with those of the Company being invested in by the visa seekers, including:

Lack of Independent Representation. The Company has not been represented by independent counsel. [They work for the Manager.]

Control of the Company. [T]he Manager will be solely responsible for making all decisions of the Company pertaining to the lending of the Offering proceeds and the results therefrom.

No Manager shall owe any fiduciary duties of any nature whatsoever to the Company; provided… such Manager shall be subject to the implied contractual covenant of good faith and fair dealing.

The Manager, Regional Center and their affiliates may receive a substantial economic benefit from participating in the Project and from the Company. [The manager will receive fees and keep unexpended portions of the Administrative Fee.]

The Manager and the USIF New York Regional Center will receive significant fees and other compensation from the Developer in connection with the Mezzanine Loan, including most of the interest payable under the Mezzanine Loan and various fees payable by the Developer… [T]he Manager would have an incentive to waive one or more of the conditions to the funding of the Mezzanine Loan because of the compensation payable to the Manager from such funding. Likewise, the Manager would have an incentive to extend the Mezzanine Loan because the compensation payable to the manager will cease when the Loan is repaid.

Other risks

Let me excerpt/distill some other risks:

The Project Has No Operating History… No assurances can be given that the Project will operate profitably.

Members Will Bear a Significant Financial Risk. Purchasers of Units will be providing a significant portion of the risk capital… at a time when the success of the Project remains uncertain.

The Manager’s Liability will be Limited. Pursuant to the Operating Agreement, the Manager, its agents, and their other affiliates will not be liable to the Company or any Members for any damages, losses, liabilities or expenses… unless one of those parties is guilty of fraud, deceit, gross negligence or willful misconduct.

The Project’s Success is Dependent upon the Successful Implementation of Project Business Plan by the Developer…. many of the factors necessary for success are beyond the control of the Developer.

Timing of Completion is Uncertain.

The Investment in the Project is Speculative…. [with] an inherent exposure to fluctuations in the real estate market.

The Lack of a Sinking Fund [which sets aside money over time to pay off debt] ]or the Requirement to Maintain Financial Ratios Increases the Risk that the Developer will be Unable to Repay the Principal and Interest.

While the Developer anticipates that it will be able to make appropriate payments on both the Senior Indebtedness and the Loan, any unforeseen difficulty… may cause the Developer to default on its payments on the Senior Indebtedness [which] may leave the Developer with significantly less funds than anticipated to repay the Loan

The manager’s in charge

A USIF affiliate is making decisions on the future of the project, though it didn’t put up the money. From the document:

The Manager shall have the authority and discretion to administer the Company's business. The Manager may from time to time seek the direction of the Members in making any decisions related to the Business, although it shall not be required to seek direction except where there is a material modification of the purpose of the Company... The Company shall follow the lending guidelines set forth in the Offering Memorandum in connection with the making of the Loan and seek direction and approval of the Manager with respect to any material modifications to the Loan Agreement.

Disputes go to arbitration

It’s difficult to air concerns in a legal process, as the contract requires private arbitration:

Any dispute, controversy or claim arising out of or in connection with, or relating to, this Agreement or any breach or alleged breach hereof, except allegations of violations of federal or state securities laws, shall, with the consent of the Manager (which must be given, if at all, in writing and within ten days of the date such matter matures), be submitted to and settled by arbitration in the State of New York.

That’s what happened with Guo.

Also see Google reviews like this one, translated from the Chinese: “Scam, usif refuses to repay the money due when it is due, deceives people in various ways before repaying the money…” Note that it’s unclear what project that refers to.

The Fortress mystery

How did Fortress get a piece of the project? It’s unclear, but the firm has periodically partnered with the USIF, seeking opportunities for potentially big payoffs.

Fortress invested at some point in the Nassau Coliseum EB-5 debt. Immigrant investors, who had loaned a total of $100 million toward Coliseum renovations via the USIF, were left unpaid when the pandemic shuttered the Coliseum and Mastroianni’s Nassau Live—again, a company controlled by the manager—took over the lease.

Nassau Live then sold that lease to Las Vegas Sands, pursuing a casino bid, for an astonishing $241 million. Mastroianni told Newsday that he and investors held "debt of approximately $120 million" on the site, which suggested—it’s unclear—that the immigrant investors had not been repaid.

Even after repayment, significant profit would remain. Is that what’s envisioned with Atlantic Yards?

Of the $249 million in the “Atlantic Yards II” EB-5 investment, $63,160,000 was repaid upon the sale of the lease to the B15 (662 Pacific St., now known as Plank Road) site, leaving a balance of $185,840,000. None of the $100 million in “Atlantic Yards III” was repaid. So the total remaining is nearly $286 million.