In 2024, No New Construction, But a Big Year for Atlantic Yards/Pacific Park

Larger plans for railyard & Site 5 surface, as does Related's role. Liberty win WNBA. New Koch investment boo$ts BSE Global, planning Brooklyn media (+ more) venture. Will arena company pay for plaza?

In working on my annual year-end round-up (stay tuned) of Atlantic Yards/Pacific Park news, a paradox of sorts becomes clear.

Yes, the project seems stalled, with a foreclosure process for six tower sites over the Metropolitan Transportation Authority’s Vanderbilt Yard delayed more than a year. But a lot is happening, or at least has become known.

A “permitted developer,” a joint venture involving the developer Related Companies (best known for Hudson Yards), is expected to surface, but has not yet been given formal blessing by Empire State Development (ESD), the state authority that oversees/shepherds the project.

That may be because the joint venture (JV) is also negotiating an extension of the May 2025 deadline to deliver the remaining 876 (of the 2,250 required) affordable housing units.

It also may be because that JV is renegotiating the scale of the project, aiming to add valuable new square footage, thus development of the railyard sites—which involves a costly platform over the working railyard—more viable, and profitable.

Supersizing already proposed

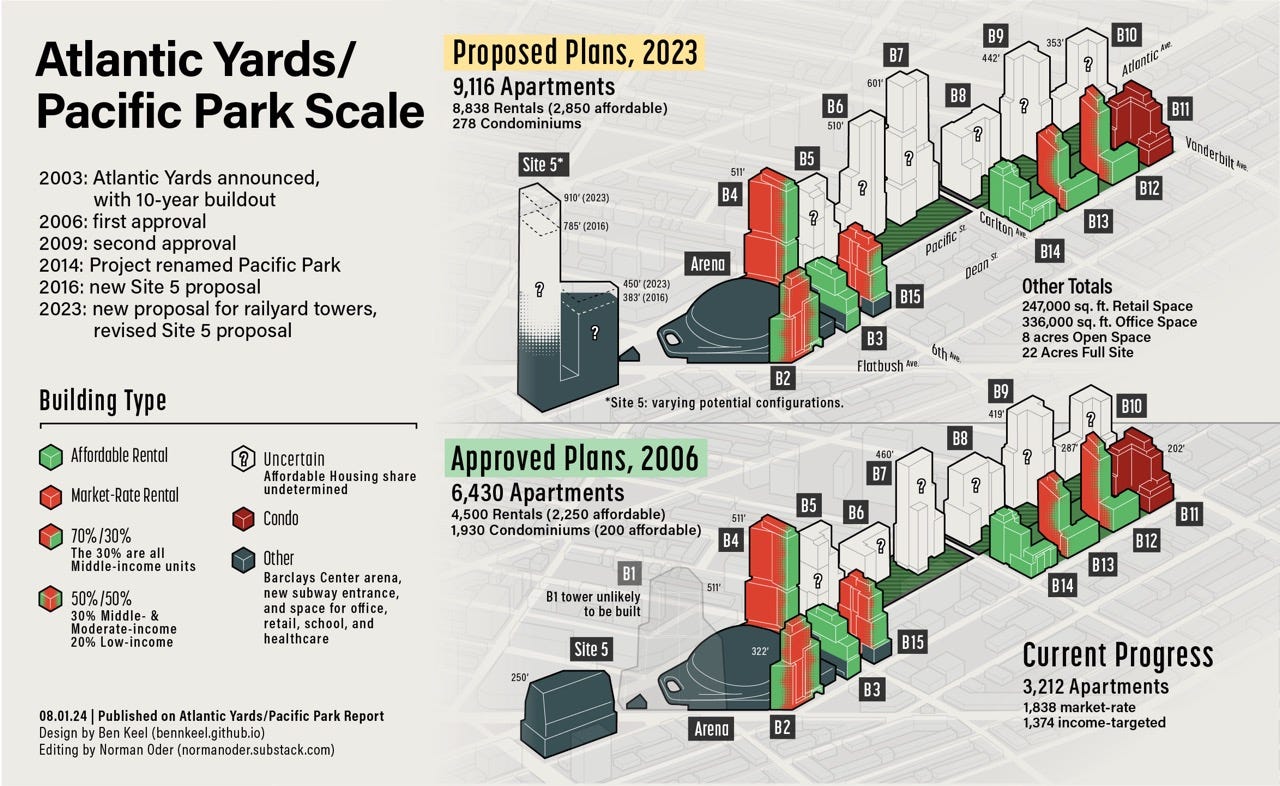

After all, this year significant evidence about the potential contours of the future project—adding 2,600-plus apartments—also surfaced, thanks to documents unearthed by Freedom of Information Law (FOIL) requests.

As I reported in August, current master developer Greenland USA in January 2023 proposed to add 1 million square feet, worth perhaps $200-$300 million, at the six railyard sites, B5-B10.

While that gained some encouragement from ESD, it never proceeded, and those sites fell into foreclosure, causing Greenland a significant loss.

Greenland also proposed—and gained ESD support for—a revamped project at Site 5, the parcel catercorner to the arena long occupied by the big-box stores P.C. Richard and the now-closed Modell’s.

While Site 5 was approved in 2006 (and 2009) as a 250-foot building with nearly 440,000 square feet, the developer in 2015-16 floated a plan to add most of the bulk from the unbuilt B1 (aka “Miss Brooklyn”), the flagship tower once slated to loom over the arena, across Flatbush Avenue, creating a giant two-tower project at Site 5.

In 2021, Greenland proposed an even larger plan for Site 5, with towers 910 feet and 450 feet, and more than 1.2 million square feet of bulk.

While ESD signed the Interim Lease for Site 5 in October 2021, committing support for such changes, which require public review and a formal approval by the gubernatorially controlled authority’s board, its executives never disclosed it, until I and advocate Gib Veconi, a member of the advisory Atlantic Yards Community Development Corporation, acquired it via FOIL.

While the project was once steered by original developer Forest City Ratner and later the JV Greenland Forest City Partners, Greenland USA for now is formally the developer.

What may surface is a hybrid set of obligations, in which Greenland still controls Site 5 and B1 (though it likely would bring in a partner), while the JV involving Related, Fortress Investment Group, and an affiliate of the U.S. Immigration Fund (USIF) control the railyard sites—and all must contribute affordable housing.

Note the curious role of the USIF, a “regional center” that recruited immigrant investors under the federal EB-5 program, offering below-market loans in exchange for green cards, given a purportedly job-creating investment.

Though Chinese investors put up $500,000 each of the unpaid $286 million, the USIF—the manager, run by a man with a checkered past and a track record of misleading marketing—essentially controls the investment. I’ve argued that Nicholas Mastroianni II may qualify as a “Prohibited Person.”

Affordability questions

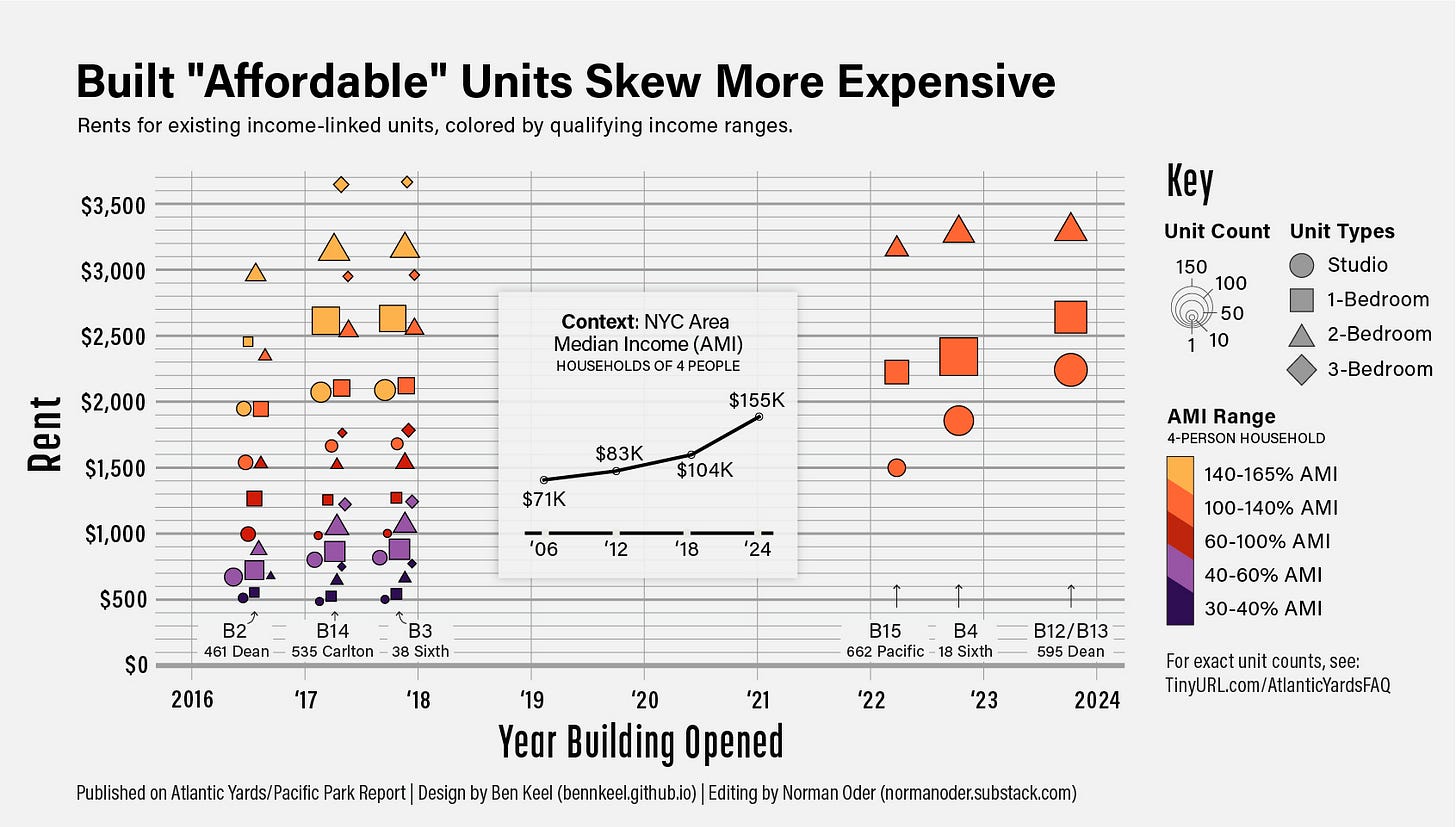

The contours of the affordability obligation—recent units have been below-market but not very affordable—also remain at issue.

Not only were the developers of the four most recent towers able to take advantage of the now-expired 421-a tax break, which allowed for 30% middle-income units, the base for calculating affordability, Area Median Income (AMI), keeps rising, making those units ever more costly, aimed mostly at households earning six figures.

That, of course, makes “affordable” a term of scorn. The new 485-x tax break requires somewhat more affordability, but not the deep affordability advocates seek, which could trigger requests for deeper subsidies and/or the justification that only building bigger could make such affordability viable.

Paying for (?) a permanent plaza

If the Site 5 changes are enacted, they would make the Barclays Center plaza, now known as Ticketmaster Plaza (its fourth sponsor) permanent, a huge boon to BSE Global, the holding company that operates the arena and owns the Brooklyn Nets and the WNBA’s New York Liberty.

After all, the plaza provides an indispensable place for arena crowds to gather, as well as significant canvas for promotion and advertising, far more than would be available than if BSE Global controlled the Urban Room, the atrium planned to be attached to the unbuilt flagship tower.

Thus, I’ve argued that BSE Global, owned mostly by Alibaba billionaire Joe Tsai, should pay for the plaza. So too has the coalition BrooklynSpeaks, the only active organization advocating on Atlantic Yards/Pacific Park.

Empire State Development has leverage here, but has not yet exercised it.

BSE Global’s boost

While the Tsai-owned New York Liberty won the WNBA championship, prompting a ticker-tape parade and reifying mascot Ellie the Elephant, BSE Global’s big boost came from a 15% investment by the family of Julia Koch, whose billions come from Koch Industries, run by the notorious right-wing funder and climate-change denier (the late) David Koch.

That valued BSE Global at $5.8 billion to $6 billion, depending on the source, representing a huge payday for the Tsai family, which put $3.3 billion (or maybe closer to $3 billion) into the Nets and arena company, bought the Liberty for a song, and have made various investments and absorbed some losses.

That makes the Nets the NBA’s fourth most valuable franchise, according to Sportico. So that bolsters the argument that Tsai should pay. As I wrote in July, Would Joe Tsai's Slickest Move Be Poaching Ticketmaster Plaza?

Note: while some rightly point out that the Koch family is #sportswashing its politics in a liberal state (and investing in a project that relies on very un-libertarian eminent domain and monopoly), it’s hard to think the Nets would be much more tainted than they already are.

The dubious records of owners Bruce Ratner, Mikhail Prokhorov, and Tsai himself prompted relatively little pushback. Nor has the role of sponsor Barclays, an admitted felon which should have, as I’ve argued, caused the company to lose the naming rights contract.

BSE Global’s big plans

In July, I reported that BSE Global had quietly absorbed once-indie Brooklyn Magazine, part of a larger media enterprise to champion and amplify Brooklyn culture.

More recently, we learned that the media effort will rely on the influence of the youth culture brand Complex.

Meanwhile, BSE Global has made plans to expand its Brooklyn Basketball youth program to the shuttered Modell’s store (and, perhaps, to another nearby location after the Site 5 project starts) and has purchased the commercial condo at the base of the historic Williamsburgh Savings Bank (aka One Hanson Plaza) for future retail and/or event space.

BSE also has purchased a slice of the Brooklyn Paramount, run by Live Nation, and has plans for other performances (where?) and an “ecosystem" of assets, including a hotel, conference center, and the new media venture.

Going forward

This all will make for an interesting 2025. Once I have my full 2024 retrospective completed, I’ll work on my 2025 predictions.