Weekly Digest #9: Evidence Shows Developer Ignored State Restrictions on EB-5 Spending

A foreclosure auction of EB-5 collateral was postponed until tomorrow. Will it happen?

This weekly digest offers a way for people to keep up with my Atlantic Yards/Pacific Park Report blog, as well as my other coverage in this newsletter.

This week, I published an investigation—the evidence was glaring—that showed that Empire State Development (ESD), the state authority that oversees/shepherds the project, had not monitored the spending in the first EB-5 loan from immigrant investors.

That means that, while New York State wanted the spending to advance the project, much of it did not.

That $250 million loan and a successor $100 million loan from immigrant investors under the EB-5 program have not been repaid (except for a fraction).

So the collateral for those loans—the rights to build six towers over the Vanderbilt Yard—was supposed to be sold in a foreclosure auction in January, which was postponed until tomorrow, Feb. 12.

What’s next?

Will that auction happen? Unclear, as I wrote.

After all, it’s unclear whether ESD would somehow waive the liquidated damages—$2000/month for each affordable housing unit not delivered by May 2025, which means $1.75 million a month for the 876 (or 877) units that won’t be ready on time.

Nor is it clear whether any real estate company would bid on the collateral without knowing that potential $21 million annual affordable housing obligation, on top of the cost to build a platform to construct those towers and to complete purchase of the development rights from the Metropolitan Transportation Authority.

If that sale is postponed, again, it wouldn’t be surprising if ESD is considering some kind of grand bargain that involves new public subsidies/support, as well as a relaxation of obligations on the part of whatever developer emerges.

But any such negotiation deserves transparency, and any greater public concessions deserve reciprocal public benefits.

From: Learning from Atlantic Yards/Pacific Park (Substack)

Feb. 5: Developer Certified that EB-5 Spending was Compliant, but Evidence Shows Otherwise. New York State limited use of investor visa funds, targeting railyard tower sites. But the money was reported as supporting two other towers.

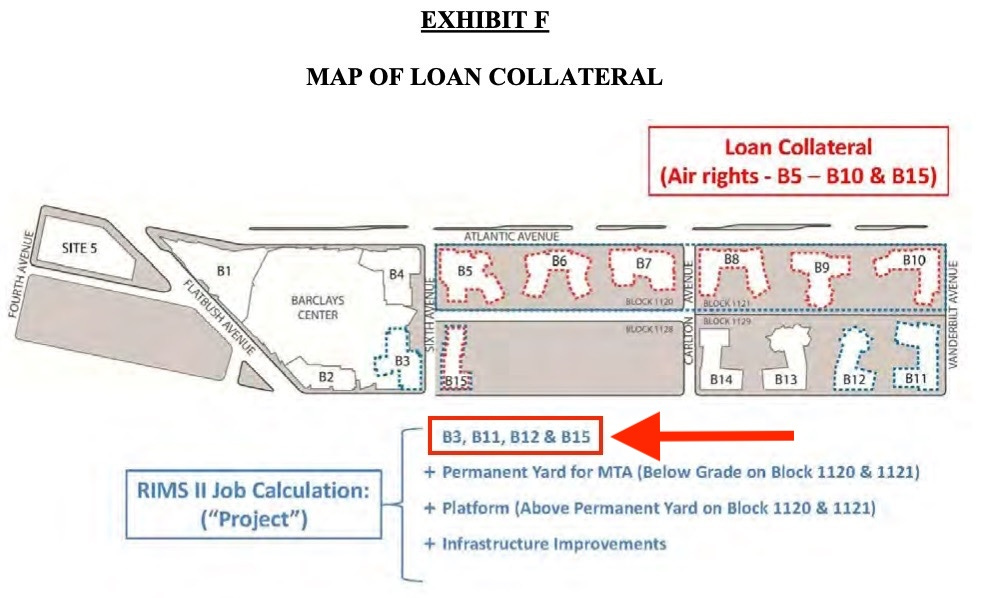

Consider the image below, which I published mainly to point to the seven parcels (B5-B10, plus B15) that served as collateral for the $249 million loan. It offered crucial clues about the spending.

As shown in the text highlighted by the arrow, the project elements used to calculate job-creation included four towers, three of which were not considered Permitted Uses. That was prospective; later, only two of the towers, B3 and B11, were cited.

From: Atlantic Yards/Pacific Park Report

Feb. 6: The latest Construction Update (nothing happening) and a small footnote re Empire State Development.

Feb. 7: Council Member Hudson, maintaining stance that proposed 962 Pacific spot rezoning should wait for neighborhood rezoning, votes it down. Can she deliver with AAMUP?

Feb. 8: The Real Deal "source": Hudson asked 962 Pacific owner to build "100% affordable" housing elsewhere & give $5-$10M? Hard to trust that account, though.

Feb. 9: With the surging Knicks (ranked #7) and floundering Nets (#23), the narrative finally flips.

Feb. 10: Will there be a foreclosure auction of the rights to six Atlantic Yards parcels Monday? Unclear.