No Surprise: "Atlantic Yards III" Also Involved Construction of Ineligible Tower(s)

Evidence shows job-creation credit was claimed for 535 Carlton and maybe even its unbuilt neighbor.

Last week, I wrote about the glaring evidence that most of the money in “Atlantic Yards II,” the $249 million in EB-5 investor visa funding raised in 2014, was spent on towers that New York State did not consider Permitted Uses.

Here I can report similarly about “Atlantic Yards III,” the $100 million in EB-5 funding raised in 2015.

Today, collateral for both investments—six tower sites over the Metropolitan Transportation Authority’s Vanderbilt Yard—is subject to a foreclosure auction, since developer Greenland USA has not paid back the immigrant investors who lent the money and accepted low/no interest in exchange for green cards (and the expectation of repayment).

That auction, announced for Jan. 11 and rescheduled for yesterday, has again been postponed, until April 30.

Any bidder, as I’ve written, likely seeks to negotiate with Empire State Development (ESD), the state authority that oversees/shepherds Atlantic Yards/Pacific Park.

Failure to monitor

ESD was supposed to keep watch both on the soundness of the loan(s) and the appropriateness of the spending.

Evidence suggests it has done neither. At two junctures--one in 2015 and another in 2019--ESD whiffed on the requirement to support the fiscal soundness of proposed transactions. The first was the $100 million “Atlantic Yards III,” which diluted the collateral, as I wrote.

I also noted that developer Greenland Forest City Partners—now, essentially Greenland USA— failed to deliver required annual reports on how the loan funds were spent on Permitted Uses,

Last week, I followed up with evidence that much spending in “Atlantic Yards II” was not for Permitted Uses.

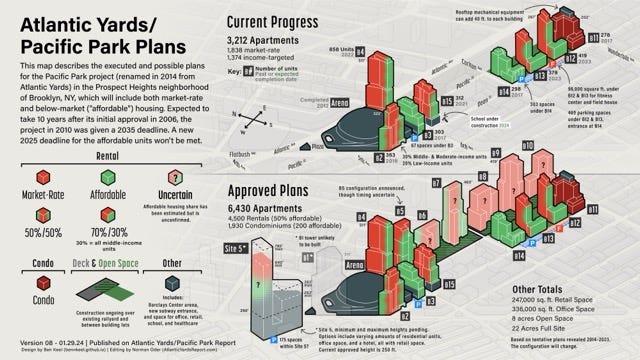

ESD apparently wanted to ensure that the only towers the money supported would be future construction, at six parcels (B5-B10) over the Metropolitan Transportation Authority’s Vanderbilt Yard, plus the B15 site across from the arena.

That didn’t happen.

The U.S. Immigration Fund (USIF)—the “regional center” that served as middleman to recruit investors—proudly promoted spending on the already in-process B3 and B11 towers, which were ineligible. (The spending also included the revamped railyard, which was a Permitted Use.)

Still, developer Greenland USA certified to ESD—more than four years late—that all the spending was for Permitted Uses.

“Atlantic Yards III”

Given that pattern, it shouldn’t be surprising that evidence suggests “Atlantic Yards III” similarly flouted the rules, despite Greenland’s certification.

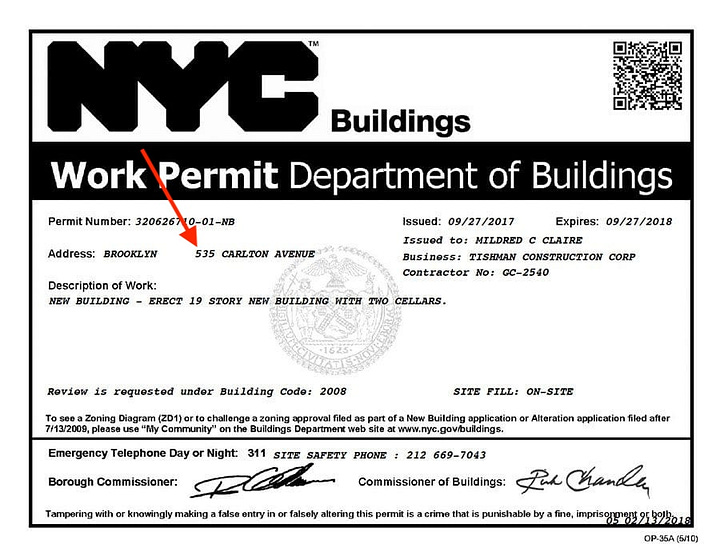

Even today, the USIF’s website for the “Atlantic Yards III” cites a work permit for 535 Carlton Avenue (B14), not a Permitted Use.

An archived version of the “Atlantic Yards III” web site goes even further, as shown in the gallery below. It includes three images of 535 Carlton, plus a rendering of the arena block, though the largest of the three associated towers hadn’t been built.

An investor update

An update shared with investors in Q3 2018 compounds the evidence.

Thanks to (imperfect) machine translation from the Chinese, the focus on non-Permitted Uses is clear.

The slide below states that sites B9 and B10 are collateral for the project—remember, the collateral was diluted with this second loan—while B13 and B14 would supply job creation.

The document provides the 535 Carlton address for B14, which had been built, but no address for B13, because, well, no construction had proceeded. EB-5 projects are supposed to create at least ten jobs per $500,000 investor.

Fantasy funding?

In the graphic below, the funding structure claims that the $100 million in EB-5 funds would make up a modest 18% of the total $557.8 million “Atlantic Yards III” project, an amorphous subset aggregated for marketing purposes and/or job-creation calculations.

Within that total; 35%, or $196.2 million, would be Developer Equity, and 44%, or $245.59, million would be a Senior Loan, while government tax credits would add $15.99 million.

Putting aside the fact that the spending wouldn’t have been for Permitted Uses, there’s no evidence that those numbers, presumably calculated for both B13 and B14, would apply. After all, B13 wasn’t built.

B14, or 535 Carlton, cost $168.2 million, according to a 2018 SEC filing by Forest City Realty Trust, which at that point was contributing a 30% share to the then-joint venture.

That 535 Carlton tower, according to Dec. 3, 2014 minutes from the New York City Housing Development Corporation, was already largely funded before the EB-5 loan was finalized. It involved $75 million in bonds, $55 million in the borrower’s equity, and $16.75 million in Low-Income Housing Tax Credits.

Celebrating the ineligible

The screenshot below says that 274 tenants had moved into 535 Carlton so far, while the text stamped in red, apparently aiming to reassure investors, translates as “Completed.”

The slide below offers boilerplate—convincing perhaps to the underinformed?—from ESD’s bi-weekly Construction Updates.

The text in the asterisk at bottom states, “Construction activity on rail yards and platforms supports AY3's loan collateral.”

Well, it might provide indirect support, but the platform wasn’t built, just some precursor work.

Focus on 535 Carlton

Several slides focus on 535 Carlton (B14), with no mention of work at the purportedly job-creating B13.

The slide above, for example, offers updates on residential rentals, as well as mention that some but not all of the retail space was available for lease.

What’s missing?

Unlike with “Atlantic Yards II,” I haven’t seen a memo from the regional center’s economist regarding job-creation claims.

With 200 investors, this “project” was supposed to create at least ten jobs per investor, or 2,000 jobs. Thanks to generous EB-5 math, no head count is required; spending translates, thanks to a “multiplier,” into jobs.

Keep in mind that, if “Atlantic Yards III” follows its predecessor, the money spent on the “project” might be far less than what was claimed to shareholders.

As I wrote last week, EB-5 investors were told that “Atlantic Yards II” was to total $1.235 billion, with EB-5 funds representing 20% of the total. But the $249 million raised ultimately made up 48.7% of the claimed $511.5 million total.

Transposing such percentages to “Atlantic Yards III,” the $100 million would be 48.7% of a $205.3 million total.

For federal job-creation calculation, how could that—or a larger figure—have all been attributed to B14, which cost a lesser sum? Did it include spending on the railyard as well?

We don’t know, but if ESD ever does due diligence, it should make such information public.