Did EB-5 Funds Help Build the Barclays Center?

Despite promoters' hype and even a governmental report on investor visas, the answer is no--and the reality more troubling.

The EB-5 investor visa program allows immigrant investors who put $500,000—more recently raised to $800,000—into a purportedly job-creating enterprise to get green cards for themselves and their families.

It’s attracted some shady operators, so a 2023 Government Accountability Office report to Congress was titled Immigrant Investor Program: Opportunities Exist to Improve Fraud and National Security Risk Monitoring.

It contained this background passage:

Under the EB-5 Regional Center Program, first enacted as a pilot in 1992, immigrant investors may pool investments with one or more other qualified immigrants in Regional Centers. Use of the Regional Center Program grew substantially in the late 2000s as the program increased in popularity as a viable source of low-interest funding for major real estate development projects. Such projects included the Barclays Center—a multipurpose indoor arena in Brooklyn, New York—and the Marriott Convention Center Hotel in Washington, D.C.

(Emphases added)

That’s not true, so it’s disturbing such information, without attribution, made it into a sober government report. Then again, there’s been so much propaganda and sloppy journalism that it’s not surprising the mistake has spread.

Consider the image below, part of a brochure circulated in 2010 to potential investors in China. Sure looks like a project involving the Barclays Center and the NBA, right?

That was produced in association with the New York City Regional Center (NYCRC), in the first ($228 million) of three rounds of investor visa funding for Atlantic Yards, on behalf of original developer Forest City Ratner.

It continued

The next two rounds, via the U.S. Immigration Fund, known as “Atlantic Yards II” ($249 million) and “Atlantic Yards III” ($100 million) are the investments triggering a foreclosure auction April 30, as all but some $63 million has not been paid back.

The promoters and their allies muddied the water by promoting the already constructed arena, as shown in the image below, a web ad for an October 2014 "Atlantic Yards III" investment seminar in Shanghai.

Beyond the Barclays Center claim, the initial EB-5 transaction contained other layers of hype and misdirection, which I’ll discuss below. But let’s first focus on the arena.

Arena hype

Reports that investor visas funded the Barclays Center are not uncommon.

Consider, as I wrote in January 2013, an overview of EB-5 from NPR’s All Things Considered headlined Investing In Citizenship: For The Rich, A Road To The U.S., which pictured the arena.

“If you want to see the kind of places where the money goes, you can turn on your TV set when the Brooklyn Nets are playing hoops,” host Robert Smith stated. “The team just moved to Brooklyn, and they needed a place to play; and the developer had a plan. Take a crummy neighborhood with abandoned railroad tracks; put in housing, offices, and that glorious new stadium for the Nets, Barclays Center.”

Um, it was a gentrifying neighborhood, not a crummy one. The tracks were part of a working railroad—and the arena only needed one of three blocks, which underlies only about half of the arena parcel.

(The other two non-abandoned railyard tracks await a deck, to support six residential towers.)

“Bloomberg News reports that more than $200 million of the loans to build the project came from foreigners who were using the investment to get into the United States,” NPR’s Smith continued. “The business plan predicts that in the end, it will create more than 5,000 jobs. That's how it's supposed to work.”

Actually, Bloomberg News, reporting more carefully, did not say that money would build an arena itself, as I’ll discuss below. And the business plan was pretty dubious.

Reasons for skepticism

Any EB-5 business plan deserves deep skepticism, since it involves two extremely generous provisions regarding job calculations.

First, jobs are calculated based on spending for the overall “project,” which includes not merely the EB-5 investment, but other components, without requiring that the investor visa funds actually leveraged the additional funding.

Only by lumping that $228 million (initially $249 million) with existing funding could a "project" be conjured up that would deliver 7696 jobs based on the $1.448 billion invested.

"The project itself involves three components," a representative of the NYCRC said on a webcast. "The Brooklyn arena; the related infrastructure to the lands; and the redevelopment and expansion and upgrading of the [city's] third largest transportation hub, in Brooklyn, called the Atlantic Terminal."

Of course, that's hogwash, because the EB-5 loan was hardly seed money for, say, the tax-exempt bonds used to build the arena, which was secured earlier.

Also, the job calculation does not rely on a head count of workers.

Rather, under EB-5 job-creation math, a multiplier is applied to the overall spending, which then calculates jobs, including indirect jobs and induced jobs, created by worker spending. (I discussed multiplier math here.)

Strategic ambiguity

Despite the NYCRC rep’s statement in China, a July 2011 company press release, NYCRC TO PROVIDE FUNDING FOR THE REDEVELOPMENT OF ATLANTIC YARDS, was more careful:

The loan will assist with the construction of specific components of the overall development, examples of which include: the Barclays Center Arena; a new subway station entrance within 100 feet of the arena; an outdoor public plaza outside the arena; the demolition and reconstruction of the Carlton Avenue Bridge; an on-grade parking facility; and the excavation, removal, rerouting, and upgrading of water and sewer lines.

That clever verbiage could mean that the arena was merely an example of the overall development, for which other components were funded,

A January 2020 press release, New York City Regional Center Announces Full Repayment of $228 Million to EB-5 Investors in Atlantic Yards Development Offering, was similarly ambiguous:

A NYCRC-managed fund provided a $228 million loan to assist with the construction of specific components of the Atlantic Yards development, examples of which included: the Barclays Center Arena, the first new sports and entertainment arena to be built in New York City in over 40 years; a new subway station entrance within 100 feet of the arena to serve as the main entrance to the arena from the Atlantic Terminal transportation complex; a 30,000 square foot outdoor public plaza outside the arena; the demolition and reconstruction of the Carlton Avenue Bridge; an on-grade parking facility; and the excavation, removal, rerouting, and upgrading of water and sewer lines. The project provided a state-of-the-art, multi-purpose sports arena needed to bring a professional sports team back to Brooklyn and also provided critical surrounding infrastructure work.

That doesn’t mean that the money actually funded the arena.

More ambiguity

The latter press release announced “the full repayment of $228 million to EB-5 investors in its Brooklyn Arena and Transportation Infrastructure Project offering (Atlantic Yards).”

What the heck is the “Brooklyn Arena and Transportation Infrastructure Project”?

Or the “Brooklyn Arena Infrastructure and Transportation Improvement Fund,” which provided funds to the developer?

Could the first four words of the former name, or the first two words of the latter, merely serve as modifiers for an “Infrastructure Project” associated with the arena?

Where the money went

Yes, representatives of the NYCRC told potential investors at public events and on webcasts in China that the money would go to an arena. It’s on video.

Developer Forest City was more cautious.

In March 2012, Forest City told BusinessWeek a $1.4 billion infrastructure and arena fund would pay for a new subway entrance, parking facilities, municipal water and sewer line upgrades and other work in the vicinity of the arena.

Again, there’s no evidence that purported fund—including arena bonds—existed as an aggregate, other than to submit to federal officials for EB-5 purposes.

In 2014, Forest City executive MaryAnne Gilmartin, in a video marketing the next round of EB-5 investment, stated, “Several years back we utilized EB-5 funds to execute other infrastructure improvements in and around the Barclays Center.”

More ambiguity

But was it really for infrastructure?

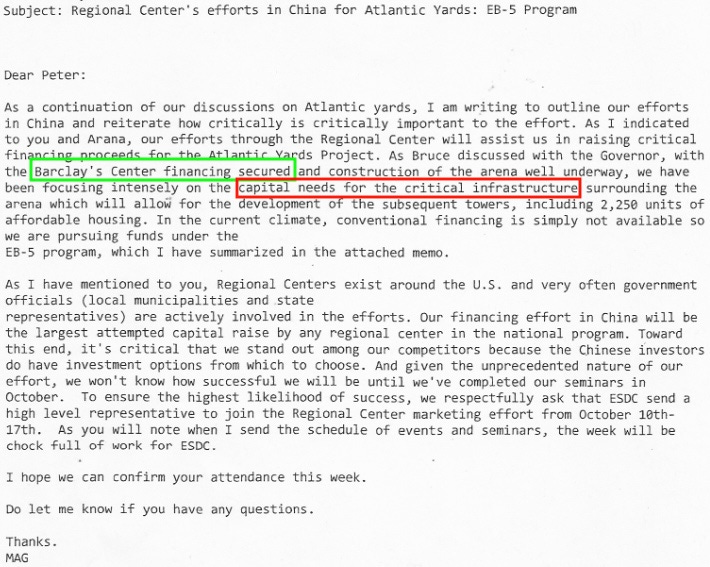

According to a September 2010 email (below) from Gilmartin to Peter Davidson of the Empire State Development Corporation (ESDC, the state agency overseeing the project), the EB-5 funds would go to infrastructure, since the arena was already funded. (I reported on this in January 2014.)

Two weeks later, the Wall Street Journal reported that Forest City had another goal unmentioned in Gilmartin’s email:

Gilmartin said she expects much of the money raised through the program would go toward financing the construction of a new rail yard for the Long Island Rail Road to replace the one that occupied a large portion of the site. Some may also be used to help pay off land loans on the project, she said.

In March 2011, Gilmartin told the New York Times that the money, in the paper’s paraphrase, “would be used to pay down a land loan for the project and additional work on the railyard.”

After all, Forest City had loans from Gramercy Capital, which specializes in high-interest financing, while EB-5 funds come with low interest, because the immigrant investors care more about green cards than return.

The switcheroo?

A year later, BusinessWeek reported:

Forest City first asked for EB-5 money to pay off loans to the company from a unit of New York-based Gramercy Capital Corp., a real estate investment trust. When USCIS ruled against that, the plan was revised, Olsen said.

How so? BusinessWeek quoted Forest City as saying it used a line of credit to pay off one Gramercy loan, but then got a loan from the regional center, secured by the same four lots.

That, of course, didn’t bring any new capital “to stimulate job creation,” as EB-5 watchdog Michael Gibson commented.

As I reported, for four of the five mortgages within the $228 million, city records indicate that an existing mortgage from Gramercy was "satisfied" around the time a new mortgage was signed with the "Brooklyn Arena Infrastructure and Transportation Improvement Fund," representing the EB-5 investors.

If that’s not paying off the Gramercy loan, it looks pretty close.

The bottom line

You’d hope the Government Accountability Office would work harder to get it right.

No, the EB-5 money didn’t fund the arena.

It’s questionable how much infrastructure it actually funded.

It’s even more questionable whether any spending fulfilled the spirit, if not the letter, of the law.