Atlantic Yards in 2026: The Future Looms, But Remains Murky (& Selectively Portrayed)

Many questions for the next workshop. Also: what subsidies are sought? Can't we get more honest images? What's next from BSE Global's Brooklyn "ecosystem"? What's the surprise?

As I wrote in my 2025 retrospective, last year was a busy year for Atlantic Yards. This year the momentum continues.

It’s possible the project’s contours—scale, timing, subsidies—will be essentially decided, mostly behind closed doors, by the end of March, even if formal approval would take at least a year, likely longer, before construction could resume.

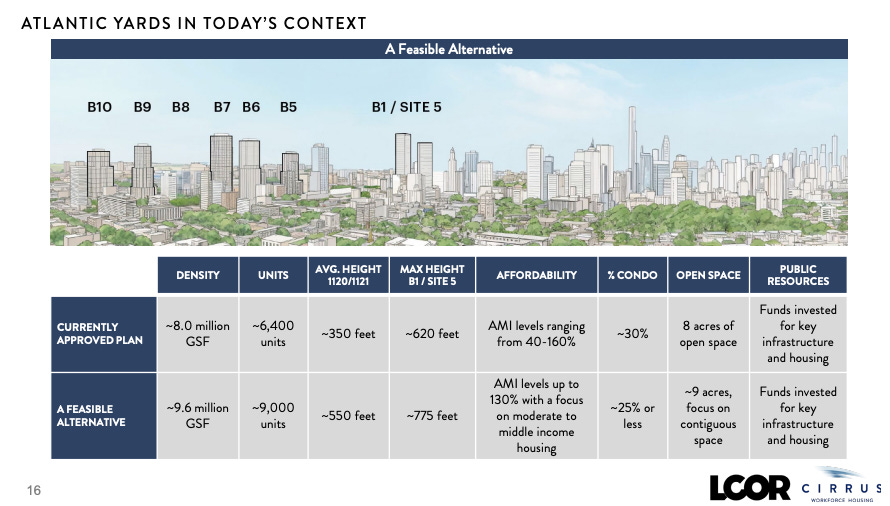

The new development team, a joint venture led by the funder Cirrus Workforce Housing and the developer LCOR, needs New York State to support a version of their “feasible alternative.”

For now, they’re requesting 1.6 million additional square feet of valuable bulk, leading to a total of some 9,000 apartments over 22 acres, though it’s not uncommon for developers to ask for more than they need to leave room for “compromise.”

That “ask” should come with a proposed new timetable to deliver the remaining project and the associated affordable housing.

The developers surely seek public assistance—direct subsidies, tax breaks?—for the costly platform needed for construction over the Metropolitan Transportation Authority’s two-block Vanderbilt Yard.

So far a lot’s been proposed, but devil, as always, is in the details (which is one of my mantras).

A key trade-off

With below-market affordable housing a key unmet promise, and with the baseline to calculate affordability rising steadily, expect pressure from advocacy groups and public officials for the project to deliver lower rents, as well as family-sized units. Both require more public support—or less revenue/profit for the developers.

That comes with a trade-off articulated more than 18 years ago by affordable housing analyst David A. Smith, when I asked him to analyze the megaproject.

“The question isn’t, ‘Could the developer make a lot of money?’ nor even ‘What is the public getting and what is the public paying?’” he stated, “but rather, ‘As things change in the future, who decides how the gains and losses are shared between developer profit and housing affordability?’”

All those questions remain worthy, I think, because it’s important to understand what the public might be paying for such public benefits.

But Smith’s “who decides” question remains crucial, because, in the history of the project, those negotiations have mostly left the developers with the upper hand.

Thus such negotiations deserve sunlight, just as the public deserves an independent entity vetting both the financial feasibility of the proposals as well as the public costs. That could be a job for the New York City Independent Budget Office.

Workshops first, then MOU

Empire State Development (ESD), the state authority that oversees/shepherds the project, has said it hopes to complete a Memorandum of Understanding (MOU) with the developer regarding project contours by the end of March, though that could be extended through the end of July.

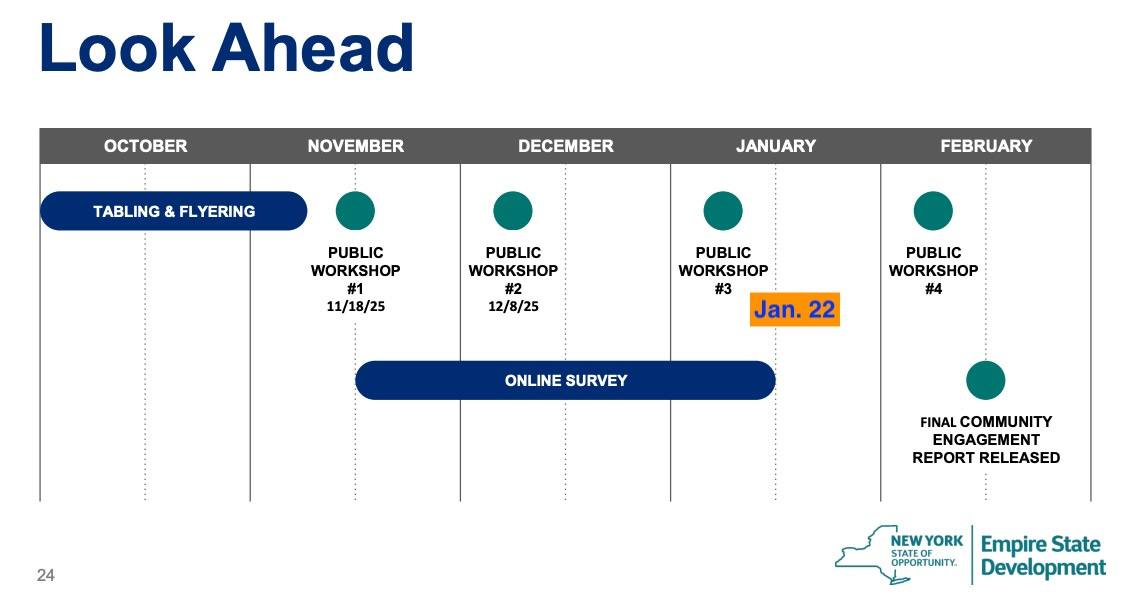

Before, ESD will host two more public workshops to gain feedback on the project. The first two were in person. The next two will be virtual.

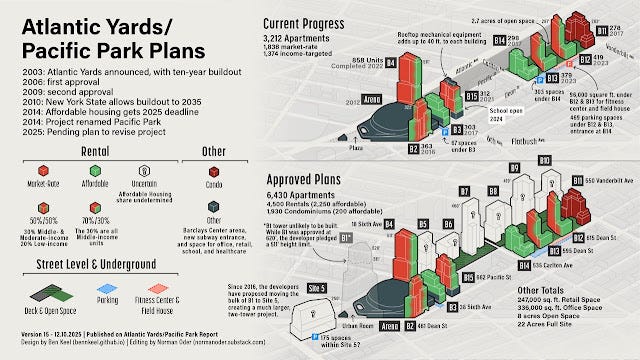

See my coverage of the Nov. 18 workshop, where the development team revealed a "feasible alternative," proposing 1.6 million additional square feet of bulk, and was cagey about affordability (and expected subsidies), and the Dec. 8 workshop, which promised more open space but offered little sense of the project's proposed scale.

The third workshop (sign up here) will be Jan. 22 at 6 pm, on Zoom, covering issues from the earlier workshops that deserve follow-up and addressing submitted questions. (Also, a public survey is open until Jan. 16.)

The fourth workshop, originally scheduled for early February, might—I’d bet—be pushed back somewhat, given the slight delay in the third workshop. That final session should preview the Community Engagement Report being prepared by consultant Karp Strategies, but perhaps could cover more.

As shown in the image above, that report was supposed to be released in mid-February. I wouldn’t be surprised if it’s also nudged back somewhat.

Two big questions: density and fairness

Attendees can pre-submit up to two questions for the Jan. 22 workshop. Here were my two big-picture questions:

What other large real estate projects in NYC have a density comparable to what’s proposed, an estimated 409 apartments/acre and 875 people/acre?

Since not building the B1 tower and preserving the plaza—creating a giant, two-tower project at Site 5, across Flatbush Avenue catercorner to the arena—helps arena operator BSE Global, can/will ESD seek any payment from BSE?

My first question goes to the limits of an ever-expanding project. Sure, more units can deliver more revenue, and trickle down more affordability. But at some point an ever-expanding project becomes a less pleasant place to live and a difficult neighbor.

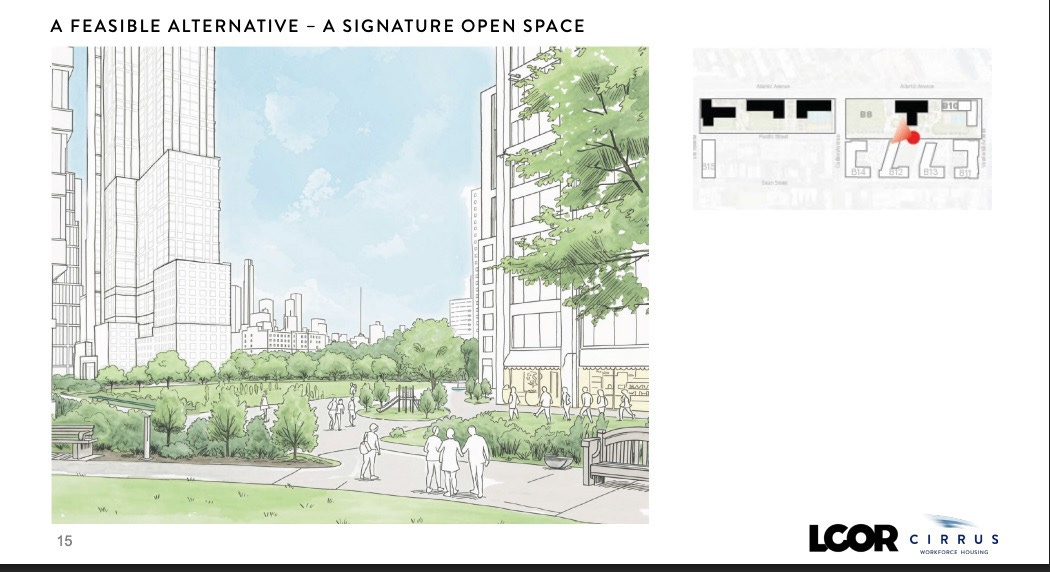

Maybe that’s why the images presented, as shown above, avoided sharing the proposed scale of the project, especially from street level. See below for some other misleading images.

My second question addresses who has benefited from this public-private partnership.

While the challenges building the infrastructure and residential towers have undermined the first two master developers, Forest City Ratner and Greenland USA, the project’s big winners have been the second and third owners of the Brooklyn Nets and the arena operating company, Mikhail Prokhorov’s Onexim and Joe Tsai’s BSE Global. (Moreover, Tsai has only partially cashed out.)

Those profits owe significantly to a government enabled arena—a scarce commodity—in the nation’s most important city, including eminent domain, tax-exempt land, tax-exempt financing, the ability to monetize naming rights, and more.

Ticketmaster Plaza is crucial to Barclays Center operations, and enables advertising and promotion. So New York State has leverage it hasn’t yet used to revise its agreement with the arena operator while agreeing to move the bulk of B1 to Site 5.

Would Joe Tsai's Slickest Move Be Poaching Ticketmaster Plaza?

In my June 25 essay in Common Edge regarding the new Koch family investment in BSE Global, parent company of the Brooklyn Nets, Barclays Center operating company, and New York Liberty, I suggested that those benefiting from the huge increase in the value of the teams and arena, the families of Joe Tsai and (secondarily) Julia Koch, owed the public.

Should not BSE Global, in exchange for the plaza, fund a quality-of-life enforcement unit, as BrooklynSpeaks has suggested? (Sure, but our new city administration would have ensure that it actually enforces.) I think they could be asked for far more.

Other worthy questions, including those listed below from the Prospect Heights Neighborhood Development Council (PHNDC), also deserve answers.

PHNDC’s questions

The Prospect Heights Neighborhood Development Council, a key component of the BrooklynSpeaks coalition, circulated the following questions. The links are theirs; the commentary in italics is mine:

If the State chose not to collect damages from the developer for missing the May 2025 affordable housing deadline, why isn’t the State guaranteeing the payments so the City can create much-needed affordable apartments now? The state has agreed on a compromise figure, a minimal $12 million. Perhaps it could require a bond that guaranteed payment if the project doesn’t proceed, but ESD is typically gentle with business.

Will the new development team be required to provide over 1,000 low- and very low-income apartments promised under the original plan but not delivered? To truly make up for this deficit, the apartments would have to be very low-income, given that the baseline for “low-income” has risen significantly.

Why has the new development team set the income targets for additional affordable housing at the project from 80-130% of Area Median Income ($116,640- $189,540 for a family of three)? That’s the developers’ focus, but not necessarily an exclusive one. I would’t be surprise if they promise deeper affordability, contingent on subsidies.

Who will design and manage the project’s open space, and how will they be accountable to the public? The Pacific Park Conservancy, funded by building owners, is the manager, but it’s opaque, with no website or public meetings.

What will be done to provide the indoor public gathering place promised under the original plan? BrooklynSpeaks has advocated for such a new space in the Site 5 project, catercorner to the arena. The original plan for B1 was to include an enclosed atrium, or Urban Room. The state has refused to enforce the penalties for not building the Urban Room. Arguably, the plaza works better for the arena, and in some ways for the public, but a semi-public plaza is not indoor space managed by a nonprofit entity.

How will the public and its elected representatives be involved in approving the new plan? A new structure is needed.

What does ESD plan to do differently to improve accountability and transparency so mistakes of the past that have led to delays in public benefits aren’t repeated again? A new structure is needed. Oversight hearings were needed, and still are.

The Governor and the Mayor

“Empire State Development is focused on the successful buildout and completion of this project,” we were told more than two years ago. As I’ve written, Gov. Kathy Hochul is running for re-election this year and surely wants a “win,” a path forward with new housing.

New Mayor Zohran Mamdani, a democratic socialist, is a bit of a wild card here. For the city, he seeks more housing, more affordability, and faster permitting. But does this project, compared to others, deserve a larger share of subsidies? How can he get the bang for the city’s buck?

If Mamdani’s taking aim at billionaires, well, Joe Tsai and other team owners might be a big target. (The fact that Tsai made his biggest haul by selling a slice of BSE Global to the notorious Koch family adds a frisson to the class warfare.)

Also note changing zeitgeist, with the YIMBY (Yes In My Back Yard) trend bolstered by the mantras of “abundance.” If that brings support for the astounding efforts to supersize the project, well, more context and candor are needed.

Candor required: project scale

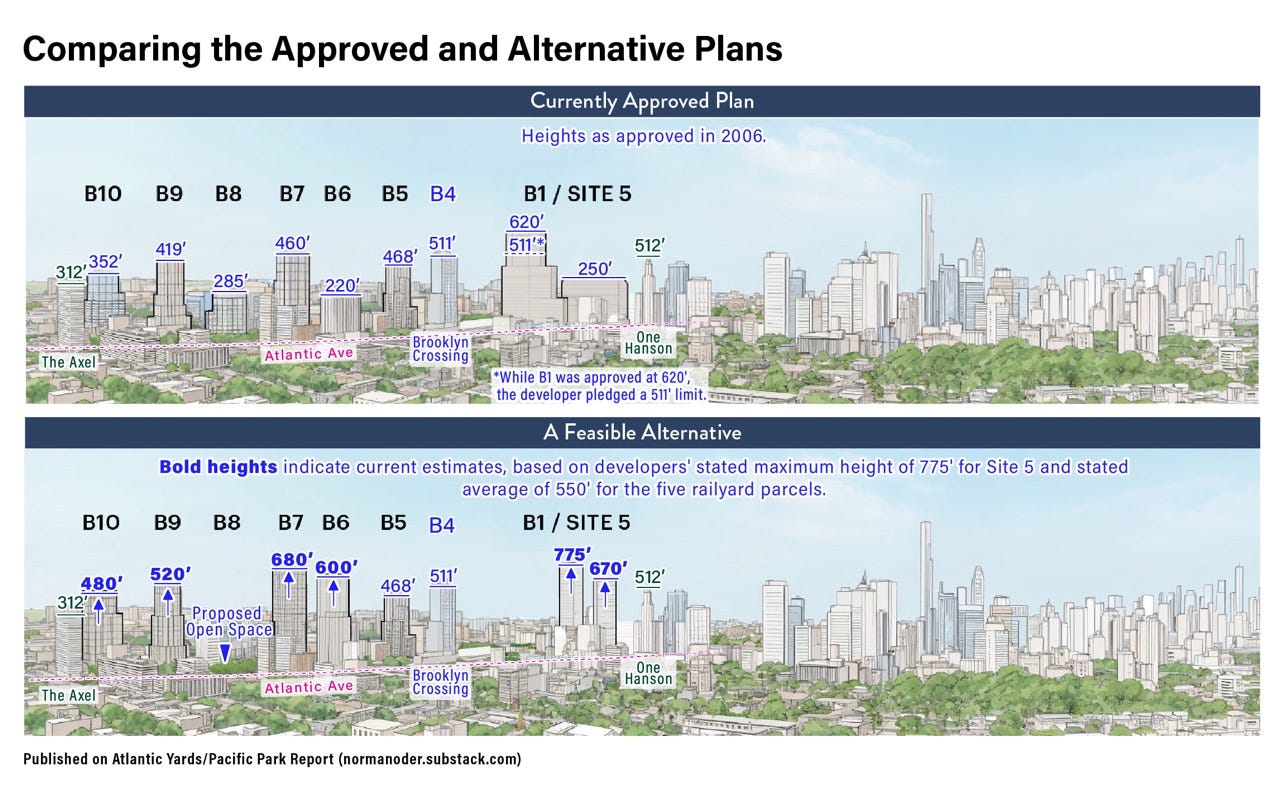

Consider the annotated image below.

Well, we shouldn’t have to consider it in the first place. The image is utterly ridiculous, because it’s a wide-angle helicopter view that no one nearby would experience.

But if we do consider it, the added labels, heights, and text suggest that the developers have exaggerated the scale of the buildings already approved and downplayed the ones proposed, which suggests the proposed changes might be merely incremental.

We deserve more candor. But that’s not the only problem. The perspective chosen is misleading, too.

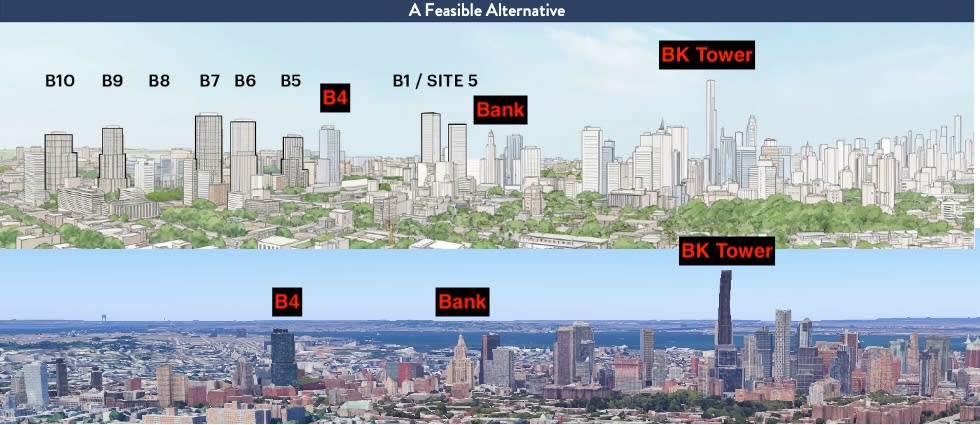

I extracted the “Feasible Alternative” and compared it, in the mash-up below, with an image from Google Earth that’s roughly comparable (though matching it is difficult).

Note how in the “Feasible Alternative” the tapered clock tower building, the Williamsburgh Savings Bank, appears just to the right (west) of the towers planned at Site 5 and relatively close to the supertall Brooklyn Tower.

However, the Google Earth photo suggests that the bank building is somewhat farther away from the supertall.

(The “Feasible Alternative” not only downplays the scale of the Brooklyn Tower, it also and both downplays the shapes of the towers nearby while, oddly, seemingly extending the view into distant Lower Manhattan. (However, a look at Google Earth shows such towers would be off the horizon.)

Overall, the framing suggests that the Atlantic Yards skyline, less than four blocks long when complete, might be comparable to—and close to—that in Downtown Brooklyn, a broader area.

Rather, the Atlantic Yards skyline would constitute an extension of its own.

Open space oversight

Significant questions remain—as I wrote last year—about the makeup and accountability of the Pacific Park Conservancy, which now is, presumably, the responsibility of the new development team.

Will a representative come to a public meeting? Will Community Boards 6 and 8, as well as the New York City Parks Department, supply a representative?

Most importantly, will they allot some of their budget to physical improvements--trees? barrier?--that might tamp down the noise from the dog run?

Or: will New York State require a more public entity to oversee it all.

The Brooklyn "ecosystem"

Expect BSE Global to move forward with its Brooklyn "ecosystem," programming events--retail sales? performances?--at the retail condo in the base of the Williamsburgh Bank tower.

Will the Planet Brooklyn street/performance festival be back? I’d bet yes, with more cross-promotion at the Brooklyn Paramount, of which BSE owns a stake.

The Nets and the Liberty

The Brooklyn Nets a few months ago were floundering, but now look better, as Coach Jordi Fernandez deploys five new rookies. Even if the Nets don’t “tank,” they’d surely they’d like to acquire a transformative star in the 2026 draft or thanks to free agency.

The New York Liberty are two seasons away from a 2024 WNBA championship and have a reasonable chance to contend, and to keep building an audience, despite ever-rising ticket prices. They’ll be promoting their new coach and, perhaps, launching construction of the training center.

Accountability and advocacy

The project's limited accountability was variable in 2025, with more meetings of the (purportedly) advisory Atlantic Yards Community Development Corporation (AY CDC) but carefully structured workshops to gain public input on emerging plans while limiting true scrutiny.

As I wrote last year, BrooklynSpeaks, led by a handful of people, has the ear of local elected officials, and should continue to advocate for more deeply affordable housing and for payment of the penalties for missing affordable housing.

One question looms: would they give the developer a pass on scale, for example endorsing the plan for Site 5 as long as there's more affordability? So far, they haven’t made scale an issue.

Note that an architect of the original affordable housing plan, Ismene Speliotis, now at the Mutual Housing Association of New York (MHANY), re-entered the fray, making a public comment at the Dec. 2 meeting of the AY CDC, focusing on how the affordable housing has fallen short—while also warning that the Downtown Brooklyn along Flatbush Avenue was not a worthy template for high-rise living.

Yet again I’ll note that interest in the project may not be galvanized until the daily newspapers cover the issue--hey, New York Times?--and/or more elected officials take notice.

Beyond the footprint

The Atlantic Avenue Mixed-Use Project (AAMUP), the plan to rezone the area just east of Vanderbilt Avenue, the eastern end of the Atlantic Yards footprint, last year passed in the wake of a series of spot rezonings. Various building projects are likely in motion.

Two large buildings on Atlantic Avenue, the product of those private rezonings, have risen and one, 1034-1042 Atlantic, is now open, marketed as Prosper Brooklyn (and claiming a Prospect Heights location, though it’s Crown Heights).

Another project, 840 Atlantic, remains stalled in court, which means the McDonald’s at the southeast corner of Vanderbilt and Atlantic avenues will persist, at least for a while.

What's the 2026 surprise?

There's always a surprise with this project.

Could new Mayor Mamdani, in his push for affordability, agree to devote new resources to deeper affordability? Would it be the best bang for the buck?

Could Mamdani and his advisors recognize that tax-exempt sports facilities are low-hanging fruit to raise revenue, and take on not just Madison Square Garden but also the Barclays Center and the baseball stadiums?

The 2026 surprise--well, it’s expected, in concept--would be the contours of that new Memorandum of Understanding, delineating obligations of the new developers and promised public resources from the city and state.

BSE Global’s sale of a stake to the Koch family, and the new investment into the Brooklyn "ecosystem," was a 2024 surprise, while BSE Global’s sale of a stake in the Liberty, as well as the announcement of a new training facility, was a 2025 surprise.

Do they have one more in them? Maybe. Could BSE Global form an alliance with Cirrus/LCOR, partnering on a hotel at Site 5? I wouldn’t rule that out.

Then again, the surprise might be something completely different.

Behind closed doors

As I’ve written, key project changes should not get decided behind closed doors. And that accountability structures get set up with only facial transparency.

However, that's been the pattern. Let’s see if it changes.

Excellent analysis!