Who Really Controls the Six Railyard Sites? Maybe Fortress is in the Driver's Seat.

The private investment firm (owned mainly by Abu Dhabi!) may now control the EB-5 collateral. Can Empire State Development clarify this at meeting tomorrow?

Atlantic Yards/Pacific Park faces a foreclosure auction, oft postponed, initiated by the manager of the entities that lent $349 million to the project, with money raised from immigrant investors under the EB-5 investor visa program. But maybe the role of the manager has obscured another important financial player.

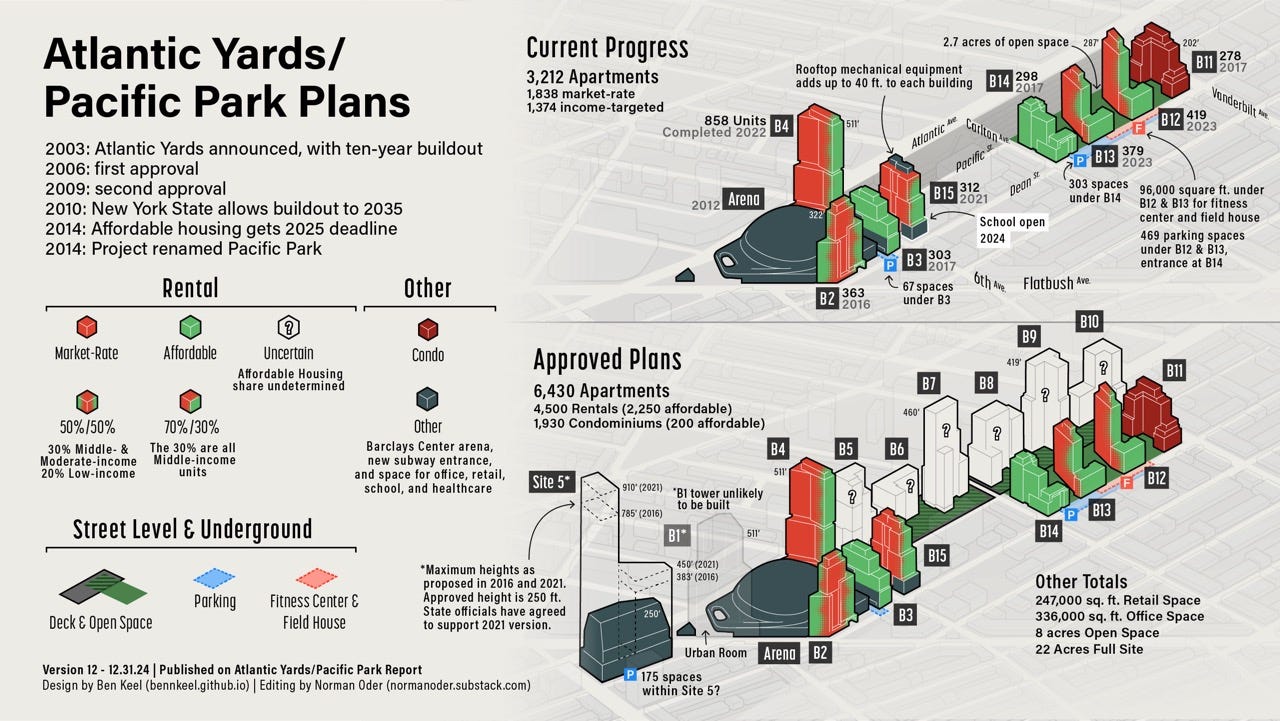

That foreclosure ultimately regards transfer of the collateral from developer Greenland USA: six development parcels (B5-B10) over the Metropolitan Transportation Authority’s Vanderbilt Yard, which require an expensive deck to activate. That’s most of the remaining project.

Yes, that's convoluted. And it's even more complicated.

Consider: while 698 investors from China each put up $500,000 (plus fees) in pursuit of green cards for themselves and their families, they may no longer own a controlling stake in AYB Funding 100 and AYB Funding 200. Those are the investment pools that in 2014-15 loaned $249 million and $100 million, respectively, to the Atlantic Yards/Pacific Park, at below-market interest rates.

That now may be owned by the firm Fortress Investment Group, which in 2020 was on the way to gaining control of the Atlantic Yards debt, as the Chinese investors moved some funds into a since-troubled Fortress project.

My assessment is based on a document, described further below, indicating such a stake was expected, not that it was consummated.

I didn’t query Fortress, which has previously ignored my questions. Fortress is now owned mainly by Mubadala Investment, an Abu Dhabi-owned sovereign wealth fund.

Opaque process

Fortress's role has never been fully explained. It has regularly partnered with the grandiosely named U.S. Immigration Fund (USIF), a "regional center" or private firm that recruits EB-5 investors and manages the loans. No representative of either firm has ever spoken at a public meeting about the project.

The roles of these opaque entities, the USIF and Fortress, should be understood by Empire State Development (ESD), the state authority that oversees/shepherds the project. Perhaps ESD can be queried at tomorrow’s meeting of the advisory Atlantic Yards Community Development Corporation.

EB-5 incentives

Let's back up.

The USIF is the most prolific regional center recruiting immigrant investors. It's led by Nicholas Mastronianni II, subject of a tough 2014 profile in Fortune magazine describing his tangled past of legal problems, debt, and broken deals.

While the USIF is often described as the “lender,” that’s bad shorthand, as I’ve written. The USIF didn’t put the money up. According to initial project documentation, the manager (a USIF entity) controlled the Atlantic Yards EB-5 investment pools. That may no longer be the case, even if ESD interacts with the USIF.

The immigrant investors accept below-market interest rates because their goal is green cards for themselves and their families, but they do expect their money back. Most of the interest goes not to the investors but to the intermediary USIF.

The borrowers, often real estate developers, appreciate a lower cost of capital. No wonder EB-5 was once dubbed “legalized crack cocaine” by a finance broker after speaking with Mastroianni. The public policy behind EB-5 is purportedly job creation, but there are many reasons to be skeptical.

First money move

In 2019, about $63 million from the USIF’s first Atlantic Yards EB-5 loan1 was repaid by Greenland after it sold the B15 parcel, later to become the 662 Pacific Street tower, to the Brodsky Organization. (So about $286 million in debt remains unpaid.)

However, most of the immigrant investors could not simply pocket that money. Under EB-5 rules, if the capital was no longer at risk because of an early payback, investors seemingly had to redeploy their funds into another at-risk investment.

The USIF offered four options, including TSX Broadway (1568 Broadway) in Times Square, a hotel/retail/theater/LED signage project for which the EB-5 mezzanine loan was said to be "extremely well collateralized."

Deal changes, Fortress role

Less than a year into the pandemic, in late 2020, the USIF encouraged shareholders in the second Atlantic Yards EB-5 loan to move up to half their money--$50 million--to TSX Broadway, according to a Chinese-language document I recently re-examined.

Claiming to have assessed the state of Atlantic Yards, the local commercial real estate market, and general economic conditions, USIF said it had determined that, “based on the risks involved,” selling up to $50 million “is in the best interest of the Company,” i.e., the EB-5 fund.

The USIF as "Manager negotiated a sale at par [face value] to an affiliate of Fortress,” according to a machine translation of the document.

While the manager, known as AYB Funding 200 GP, sought shareholder consent to move the money and acknowledged risks in the TSX project, it also warned investors that sticking with the Atlantic Yards fund posed risks, as Fortress would gain control:

Upon purchase and sale of a portion of an EB-5 loan, Fortress Capital and the Company will enter into a co-lender agreement. Under the agreement, Fortress Capital will be the majority owner of the EB-5 loans for the Project and will therefore control all major decisions affecting the EB-5 loans for the Project and the collateral supporting the EB-5 loans. Fortress Capital may make certain decisions in the future that could have a material adverse effect on the portion of the loans owned by the Company. This means that investors who choose to retain their investment in an EB-5 project loan may be subject to certain risks, including, but not limited to, losing some or all of their investment in a default, restructuring or foreclosure.

(Emphases added. Note machine translation.)

That language implies that 1) no matter the amount of the sale, Fortress would become majority owner and 2) that both EB-5 loans were involved.

If so, that was part of a trend. The USIF in 2020 also encouraged investors in the Nassau Coliseum EB-5 loan to transfer funds the same project, also called 1568 Broadway.

A permitted developer?

Neither Fortress nor the USIF, whatever their stake, can develop the railyard sites on their own. New York State requires a “permitted developer,” a firm or construction manager with at least ten years of experience in large project.

If the USIF no longer controls the EB-5 stake , that could douse questions about whether a pending joint venture would be disqualified as a “prohibited person” because it included someone with a felony record. Mastroianni was arrested on felony drug charges and pleaded no contest, according to Fortune, but it’s not clear if he pleaded to a felony.

Last November, when Related Companies was expected to lead a joint venture, ESD was asked about the issue, "We're still looking at it,” ESD lawyer Matthew Acocella said. “But based on the information we've gotten and based on the structure of the [joint venture], we don't see any bar to proceeding with this joint venture as the permitted developer with Related [Companies] and USIF.”

Fortress was omitted, but its role may be crucial. (Related bowed out, and a new permitted developer is needed.)

Incentives for Fortress?

When I assumed that the USIF as manager controlled the EB-5 loans, thanks to advantageous contract language, I observed that, because the firm didn't put any money up, delays in resolving the foreclosure didn't harm its interests.

(Meanwhile, a May 31 deadline to deliver 876 more affordable housing units looms, with $2,000/month penalties. It’s unclear whether ESD will enforce that obligation, and on whom.)

Would delays bother Fortress, which pursues “opportunistic strategies” on behalf of institutional investors? Maybe, maybe not, especially if it could control the EB-5 investments at a fraction of the value.

Also, if Fortress was able to move some assets out of the TSX Broadway deal, that would’ve been fortunate. TSX developers L&L Holding and Fortress in 2023 failed to repay some $543 million in EB-5 mezzanine debt, including (presumably) to the Atlantic Yards EB-5 investors; according to the Real Deal, the USIF said it was working on an extension.

Last August, TSX’s owners lost the property to Goldman Sachs and other lenders after they defaulted on their senior debt, which takes priority over mezzanine loans.