Weekly Digest #16: Waiting for a 421-a Successor

The state Legislature has yet to resolve the budget, including tax breaks for new rental buildings. It likely won't enable as much middle-income "affordable housing."

This digest offers a way for people to keep up with my Atlantic Yards/Pacific Park Report blog, as well as my other coverage in this newsletter.

It’s been a relatively quiet week. Likely the most important piece of news involves the yet-unresolved contours of the state Legislature’s successor to the 421-a tax break, which the real estate industry insists—at least without property tax reform—is necessary to spur construction.

The absence of that tax break is part of why developer Greenland USA has failed to proceed with the platform necessary to support construction over the MTA’s Vanderbilt Yard, and why those sites now face a foreclosure auction.

One thing is likely: any 421-a successor will not be as generous as the previous version, which provided the tax break while offering developers the option to deliver “affordable” units at 130% of Area Median Income (AMI), which are aimed at middle-income households earning six figures.

The last four Atlantic Yards/Pacific Park buildings have below-market units only for that cohort. That is hardly where the need is greatest.

Consider: as an analysis from NYU’s Furman Center shows, only 7.7% of renter households earning above 100% of AMI are rent-burdened, paying more than 30% of household income in rent. Surely the percentage is even lower for those earning 130% of AMI.

From: Learning from Atlantic Yards/Pacific Park (Substack)

April 2: The Failure to Do Due Diligence on the Second EB-5 Loan Looms

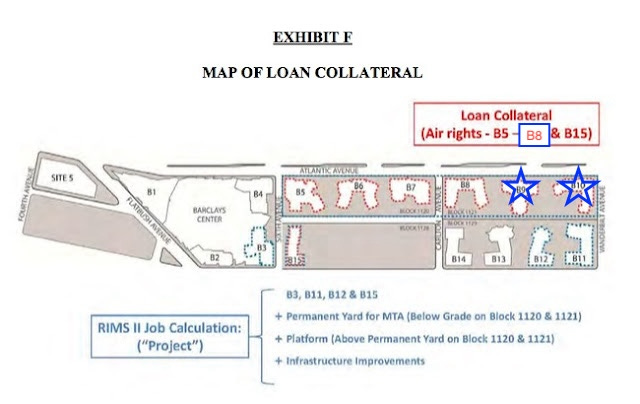

Why are six development parcels at the railyard in foreclosure, after Greenland has failed to pay back some $286 million of $349 million in loans: $249 million and $100 million from immigrant investors via the EB-5 program?

Well, one likely contributing reason is that Empire State Development (ESD), the state authority that oversees/shepherds the project, didn’t properly vet the viability of the second EB-5 loan, the $100 million in “Atlantic Yards III.”

The paper trail is murky, but there’s no evidence yet that ESD, when allowing Greenland to dilute the collateral—separating two railyard parcels from the collateral previously offered to investors in the $249 million “Atlantic Yards II”—assessed that the loan was less than 80% of the collateral’s value.

From: Atlantic Yards/Pacific Park Report

April 1: Barclays Center releases April 2024 calendar: twelve ticketed events (WWE tonight), plus open dates for (very unlikely) Brooklyn Nets playoff games. Nope, the playoffs won’t happen.

April 3: Looming: the May 12, 2025 deadline to start the platform over the railyard. But there's an "Unavoidable Delays" escape hatch and a penalty that might not be painful.

April 5: A return for the 421-a tax break? If so, likely no more towers with "affordable" units only at 130% of Area Median Income, aimed at six-figure earners.

April 6: In "50 Ideas for a Stronger and More Equitable Brooklyn," proposals include permit parking; Atlantic Ave. upgrade; housing lottery pre-qualification.