Consultant's Dubious Philly Arena Forecast Relies on NY-Area Venue Fictions

Dishonest and deceptive, CSL ignores competing arenas, MSG renovation, new-venue bump, and post-pandemic surge.

Philadelphia, don’t get played.

Recently, I wrote that Conventions, Sports & Leisure International (CSL), the go-to consultant for those seeking sunny forecasts for new venues, in 2009 wrongly predicted that the new Barclays Center in Brooklyn would reap huge profits.

Because the city of Philadelphia had hired CSL to assess the Philadelphia 76ers’ proposed downtown arena—dubbed, for now, 76Place, and said to be privately funded (except for tax breaks)—that would compete with the Wells Fargo Center, I said CSL’s report would deserve skepticism.

(The team paid for this and three other studies from what the city called “independent consultants.” The other studies are, as far as I can tell, more substantive.)

CSL unsurprisingly concludes—to praise from 76Place backers—that Philly could support two financially viable arenas, thus generating more spending, jobs, and tax revenue. Wells Fargo would retain the NHL’s Philadelphia Flyers as anchor tenant.

Alternatively, as a Sportico expert previously suggested, the new downtown arena would “siphon off” revenue, becoming the dominant venue and boosting the 76ers’ value.

Meanwhile, academics Geoffrey Propheter and J.C. Bradbury told the Philadelphia Inquirer CSL’s report was “completely useless” and a “concocted PR document,” citing such studies’ track record.

Indeed, CSL’s claim that Philadelphia could support 53 additional annual events, including 35 concerts, rests on questionable comparisons, notably a portrayal of a steadily growing New York market that ignored two now-closed arenas.

New York as template?

The Inquirer echoed CSL’s fictional finding that new arenas around New York led to more concerts, without “cutting into business at existing arenas.”

Really? As Neil deMause wrote in his Aug. 27 Field of Schemes takedown of the “clown study,” the New York City market isn’t comparable; CSL, he said, should’ve analyzed the event schedule when Philadelphia had two arenas.

More importantly, the arena count is distorted.

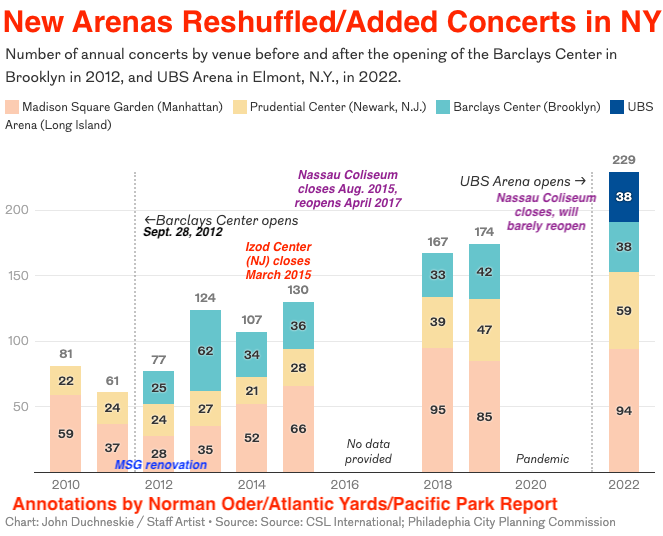

An Inquirer chart (above) combining two CSL charts (further below), it looks like the New York market, with just two arenas, gained more concerts after the opening of the Barclays Center in Brooklyn and the UBS Arena in Nassau County.

Except New York didn’t go from two to four arenas. It already had four arenas—including the Izod Center in New Jersey and the Nassau Coliseum on Long Island—before Barclays opened, bringing the total to five.

Then Izod closed. After UBS Arena opened, returning the total to five, the Coliseum essentially closed, cutting the number to four, as shown in my annotation below.

Looking more closely

That shoddy and dishonest New York analysis taints CSL’s report.

As my annotation shows, CSL didn’t just omit two competing arenas, it ignored the renovation that limited events at Manhattan’s Madison Square Garden and the post-pandemic concert bump.

Yes, the Barclays Center added events in an underserved market, given Brooklyn’s population and the arena’s adjacent transit hub.

However, the growth at the Prudential Center in Newark relied significantly on the closure, unmentioned by CSL, of the nearby Izod Center in the Meadowlands.

Similarly, the near-closure of the nearby Nassau Coliseum, unmentioned by CSL, allowed UBS Arena to rule the Long Island market after it opened in late 2021. (The Coliseum, after a renovation that downsized it, had reopened in 2017.)

Missing context: benchmark year

Moreover, CSL fails to provide important context, validating deMause’s criticism that the consultant aims to “flood the zone with fancy charts in hopes that no one will look too hard at whether any of it makes any damn sense.”

In the slide below, CSL suggests that the New York market averaged just 71 concerts a year before Barclays opened, while it averaged 110 concerts during the Brooklyn arena’s first four years.

Thus, by 2019, the 174 concerts at the three arenas are said to represent a 185% increase over the 2011 benchmark of 61.

That’s vastly misleading. Why choose 2011, rather than a two-year or three-year average, which surely would’ve delivered a larger benchmark?

The concert schedule at Madison Square Garden (MSG), typically an industry leader, was vastly constricted by a renovation that started in 2011 and ended in 2013. Hence the drop from 59 concerts in 2010 to 37 in 2011.

Yes, Barclays added incrementally to the market. However, the 25 concerts in 2012, in barely three months of operation, plus 62 in 2013, represent a new-building bump, in part reliant on MSG’s constrained schedule, that wasn’t sustainable.

“In the four years that followed the opening of Barclays Center,” CSL claims, “the market grew to 110 average annual concerts (55 percent increase).” No, it didn’t. That ignores Izod and the Nassau Coliseum, as well as MSG’s post-renovation rebound.

Missing context: MSG’s recovery

Fast forward to 2019. “Not only did Barclays Center host 42 additional annual concerts in 2019,” CSL concludes, “but it did not cannibalize concerts from the existing Madison Square Garden and Prudential Center, which saw 129 and 95 percent increases in 2019 over 2011, respectively.”

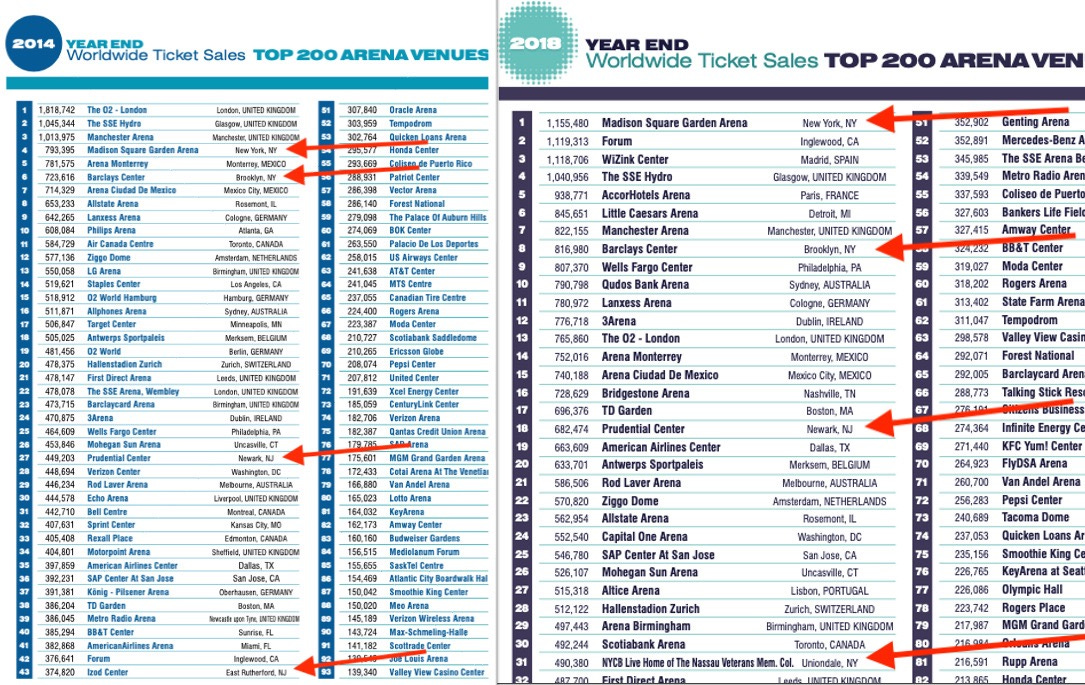

Well, duh. Madison Square Garden, post-renovation, could host more events. During the renovation, MSG sold 453,894 tickets in 2012, ranking 16 on Pollstar’s list, and sold 475,380 in 2013, ranking 23. (I don’t have the 2011 rankings.)

In 2014, upon reopening, it sold 793,395 tickets, ranking 4. It exceeded 1 million in 2015, again ranking 4, and grew to rank second worldwide in 2016 and 2017, and first in 2018 and 2019.

Missing context: NJ reshuffle

As to Prudential’s seeming boom, well, in early 2015, Izod shut down, shifting shows to the Newark venue. No wonder Prudential’s 2019 total of 47 events nearly doubled its 2011 and 2012 tallies.

For example, in 2012, Prudential sold 402,312 tickets, ranking 23 on Pollstar’s list, while Izod sold 270,289, ranking 56. In 2014, Prudential sold 449,203 tickets, ranking 27, while Izod sold 374,820, ranking 43.

In 2019, with no nearby rival, Prudential sold 635,941 tickets, ranking 26. Was that serious growth? It doesn’t even match the two-arena 2014 total: 824,023 tickets.

Missing context: 2022 bump

Only by ignoring competing venues could CSL state, in the screenshot below, “The 38 concerts hosted at UBS Arena in 2022 did not seem to demonstrate cannibalization from the other arenas.” It cited increases of 4% for MSG, 37% for Prudential, and 1% for Barclays.

Wait a sec. First, the arenas all benefited from a post-COVID bounce, which demonstrated an appetite for live events, once artists resumed their tours. Second, UBS benefited from the new-arena bump, as well as an alliance with Ticketmaster/Live Nation, as had Barclays nearly a decade earlier.

Third, UBS and the other arenas do not necessarily compete. Yes, Barclays lost some shows to UBS, less than 20 miles away by vehicle (and also accessible by the Long Island Rail Road), because of the new-building bump and/or the Ticketmaster alliance.

But Prudential is more than 70 minutes away from UBS by vehicle, and more than two hours by public transit.

Missing context: two Nassau arenas

More importantly, the 38 concerts at UBS in 2022 clearly cannibalized the nearby Nassau Coliseum, which in 2018 sold 490,380 tickets, ranking 31 on Pollstar’s list; and in 2019 sold 358,325, ranking 59.

I haven’t seen Pollstar’s 2022 figures, when UBS Arena presumably had a boom year, but in 2023, UBS sold 496,475 tickets, ranking 46. That’s barely more than the Coliseum’s 2018 total.

The Coliseum, as of 2020 branded NYCB Live, home of the Nassau Veterans Memorial Coliseum, closed briefly with the pandemic, with owner Mikhail Prokhorov giving up the keys to the EB-5 lender, controlled by the U.S. Immigration Fund, a broker for investor visas.

The Coliseum, after losing its sponsor, did reopen for sporadic events, and remains “the proud home of the Long Island Nets,” an NBA G-League team. But it has ceded the concert business to UBS and is limping toward oblivion.

CSL’s disclaimer

A disclaimer appears in the consultant’s cover letter to its client, the Philadelphia Industrial Development Corporation, stating, “The information contained in this report is based on estimates, assumptions, and other information developed from research of the market, knowledge of the sports and entertainment industries and other factors, including certain information provided by others.”

However aimed to protect CSL from liability, that doesn’t pass the smell test.

If the consultant had simply republished, in an appendix, Pollstar’s annual charts, as excerpted above, the competing New York-area arenas would have been glaringly obvious.

CSL ignored them. In his January 2020 evisceration of the consultant, deMause wrote that it provides “cover for team owners and elected officials who want a 400-page rationale for what they were hoping to do in the first place.”

That seems to be the case in Philadelphia, as well. So the city’s response to criticism—“To ensure that the public has full access to the research, the administration has placed the consultants’ findings online”—is inadequate. You can’t trust the findings.

I’ll write separately about other aspects of CSL’s study and a rival study sponsored by Wells Fargo Center landlord Comcast Spectator.