Weekly Digest: Modular Catch-Up, and Foreclosure Considerations

No, 461 Dean didn't save 20% on construction. A modular successor raises doubts. Will foreclosure finally proceed for railyard sites? Has EB-5 middleman stepped back?

This digest offers a way to keep up with my Atlantic Yards/Pacific Park Report blog, as well as my other coverage in this newsletter and elsewhere.

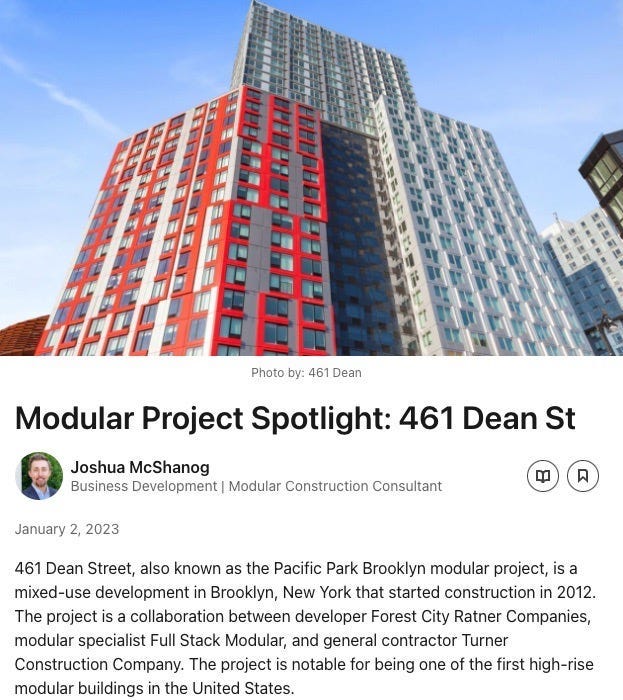

What are the lessons of 461 Dean, once claimed to be the tallest modular tower in the world? One is to build not as tall and with less complexity. Another, not yet learned, is to avoid hype.

In the course of updating an article I published in 2017, now headlined Did 461 Dean, the "World’s Tallest Modular Building,” Save 20% on Construction? No., I discovered that many modular industry players are still praising the project, as in the LinkedIn post excerpted above.

Then again, one industry observer pushed back, called it "a hard-won lesson in tolerance accumulation."

I also discovered that the company that took over the modular construction factory--once planned to build all the Atlantic Yards/Pacific Park towers—makes some claims it can’t back up.

Foreclosure returns?

For more than a year, we’ve expected a foreclosure to proceed regarding the six development sites located at the MTA’s Vanderbilt Yard, given developer Greenland USA’s failure to pay back some $286 million in loans from immigrant investors under the EB-5 investor visa program.

Now, another foreclosure auction is scheduled for tomorrow. Will it go forward? Only, I suspect, if other negotiations over the fate of the project, involving New York State, proceed.

There are still questions about Nicholas Mastroianni II, founder of the U.S. Immigration Fund (USIF), the “regional center” that recruited the EB-5 investors. Heck, there are still questions about why, and how, the USIF promotes its Atlantic Yards fundraising.

From this newsletter

Jan. 22: Did 461 Dean, the "World’s Tallest Modular Building,” Save 20% on Construction? No.

From Atlantic Yards/Pacific Park Report

Jan. 21: Catching up on FullStack Modular: a move to Connecticut, an expansion to California (and a hotel), and some dubious claims.

Jan. 23: Is oft-postponed Atlantic Yards foreclosure auction really on for Jan. 27? The pattern has been delay.

Jan. 24: EB-5 loan packager Mastroianni has stepped back. (Would that help Related joint venture avoid "Prohibited Person" status?) U.S. Immigration Fund still (misleadingly) hypes Atlantic Yards.