Weekly Digest: Is Related Companies the Future of Atlantic Yards/Pacific Park?

If new firm wins control of six railyard sites, what concessions would they want? Would they want Site 5, too?

This digest offers a way for people to keep up with my Atlantic Yards/Pacific Park Report blog, as well as my other coverage in this newsletter and elsewhere.

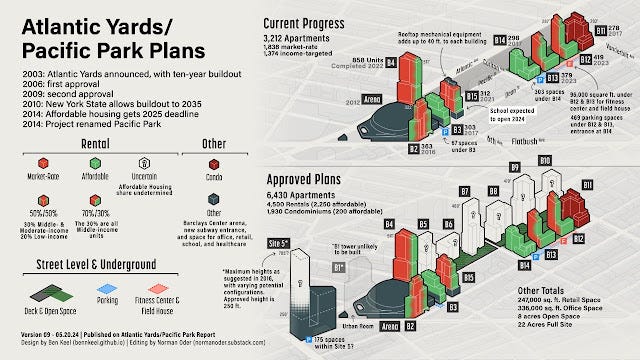

More than a week ago, we learned that a new developer might surface for the six tower sites (B5-B10) at the Metropolitan Transportation Authority’s Vanderbilt Yard, the rights to which are in foreclosure, due to master developer Greenland USA’s inability to pay off a loan from immigrant investors under the EB-5 visa program.

This week we learned, thanks to The Real Deal, that the prime candidate seems to be Related Companies, the very large, privately-owned developer behind Hudson Yards, which, of course, has experience building a platform over a railyard and then towers above it.

The big question, however, remains pending: what kind of concessions would a new developer seek, and would Empire State Development (ESD), the gubernatorially controlled state authority that oversees/shepherds the project, grant them?

Such concessions could include extended deadlines, renegotiation of the $2,000/month fines for each affordable housing unit (876 pending) not built by May 2025, and, who knows, changes in project configurations.

Stay tuned.

What about Site 5?

Another question: if Related were to buy the development rights in foreclosure and negotiate with ESD, would they also want to control development at Site 5, the parcel catercorner to the arena, already approved for a substantial tower but pending a plan for a giant, two-tower project?

After all, Related probably would prefer to time the release of new “product”—apartments that might compete with each other on the market.

Currently, Greenland USA holds the rights, and surely wants to monetize them, but Greenland hasn’t built anything outside of a joint venture with a more locally grounded firm.

So even if Greenland were successful in moving the bulk from the unbuilt flagship tower (B1, aka “Miss Brooklyn”) across Flatbush Avenue to Site 5, it’s unlikely it would build on its own.

From this newsletter

No, I didn’t publish a big-picture article in this newsletter or elsewhere, but rest assured, more is coming. Some other big issues are brewing.

From Atlantic Yards/Pacific Park Report

July 1: Another Chick-fil-A coming near Atlantic Yards/Pacific Park, this time to the northeast corner of Atlantic and Vanderbilt avenues, at The Axel. That should take some of the pressure off the uber-busy first Brooklyn Chick-fil-A on Flatbush Avenue across from the Barclays Center.

July 2: While the B5 tower, planned just east of Sixth Avenue and the first over the Vanderbilt Yard, could qualify for the extended 421-a tax break, the exclusively middle-income "affordable" option, with units at 130% of Area Median Income (AMI) is off the table. (That option was used with the last four towers to rise.)

But Option B still looks pretty good, compared to the successor 485-x, since it allows 20% of the units at 130% of AMI and 10% at 70% of AMI, a “low-income” category with ever-rising incomes.

July 3: TRD: Related Companies, which built Hudson Yards, said to be the developer interested in Atlantic Yards/Pacific Park railyard sites.

July 5: Did the new 485-x tax break make railyard development sites more viable? Site 5, too? At the least, it provides a more consistent way to assess them. More sunlight needed on transactions.

July 6: “New York street fighter”: Former Forest City CEO Gilmartin gets the Real Deal hagiography. Not so much "due diligence" on her Atlantic Yards record.