Weekly Digest: How Might Gov. Hochul "Nudge Forward" Atlantic Yards?

Also: will the New York Liberty become a billion-dollar asset before the IRS cracks down on sports team owner tax write-offs?

This digest (#23) offers a way for people to keep up with my Atlantic Yards/Pacific Park Report blog, as well as my other coverage in this newsletter and elsewhere.

The New York Daily News does not (partly) set the local agenda as much as its better-funded tabloid competitor, the New York Post. But unlike the Post or the New York Times, the Daily News a week ago wrote an editorial about Atlantic Yards/Pacific Park: Nudge forward Atlantic Yards: Brooklyn housing plan must be completed,

What exactly that means, as I wrote, is unclear.

Does the project just need a nudge (such as a delay in the May 2025 affordable housing deadline) or a much bigger concession (such as a waiver of those $2,000/month fines for 876 below-market units, or a delivery of new subsidies)?

Or does it need a complete re-think?

Paying for the platform?

One of the few local people of influence on the project, Gib Veconi of the Prospect Heights Neighborhood Development Council/BrooklynSpeaks and a member of the Atlantic Yards Community Development Corporation (AY CDC), suggested on Twitter that New York State should pay for the platform to allow for deeply affordable housing.

That implies waiving or delaying the pending fines, as well as additional subsidies. (Note that Veconi, as a leader of the BrooklynSpeaks coalition, in 2014 helped negotiate the 2025 affordable housing deadline, which also set the fines. BrooklynSpeaks has the ear of key local elected officials.)

My take: any potential public contribution--the platform, as of 2019, was estimated to cost $240+ million and probably now more than $300 million--must involve reciprocal public benefit, and should be discussed before the developer makes a deal.

Would the belatedly-delivered affordable housing—even an increased amount, given the use of Site 5 for housing, which wasn’t previously predicted—and open space be a sufficient reciprocal benefit?

I think that if the public puts more money into the project, the private-public balance must again be reconfigured. What kind of safeguards can be inserted to ensure that the public gets a potential cut of private gains?

There’s a slight precedent for this, which deserves further discussion.

As I reported in 2019, New York City negotiated potential payments for the provision of city property, but limited those payments to exclude the arena and towers with more than 20 percent affordable housing. Those qualifying buildings would then have to meet a profit threshold.

From this Substack: nothing new

Yes, I know I owe you loyal readers another big-picture article. I have several in process, but I’ve been busy.

Rest assured, there are some interesting things coming.

From Atlantic Yards/Pacific Park Report

May 20: Daily News editorializes, vaguely, "Nudge forward Atlantic Yards: Brooklyn housing plan must be completed." Renegotiate fines? Pay for platform?

May 21: Owners hope for billion-dollar New York Liberty valuation. That bolsters the case, I argue, for "additional rent" paid to the public sector for using the (tax-exempt) Barclays Center.

May 22: Was Mikhail Prokhorov's profit when selling the Brooklyn Nets and arena company "only" $600 million? Even so, he's still the big Atlantic Yards winner. Joe and Clara Wu Tsai, who own the Nets and Liberty, are likely the next ones—even if the Liberty ambitions don’t pan out as quickly.

May 23: The amortization bonus: as major-league team values increase, owners deduct more. The ethereal concept also helps the Barclays Center bottom line.

May 24: Might the tax-loss gravy train for sports team owners be stymied by new IRS compliance effort?

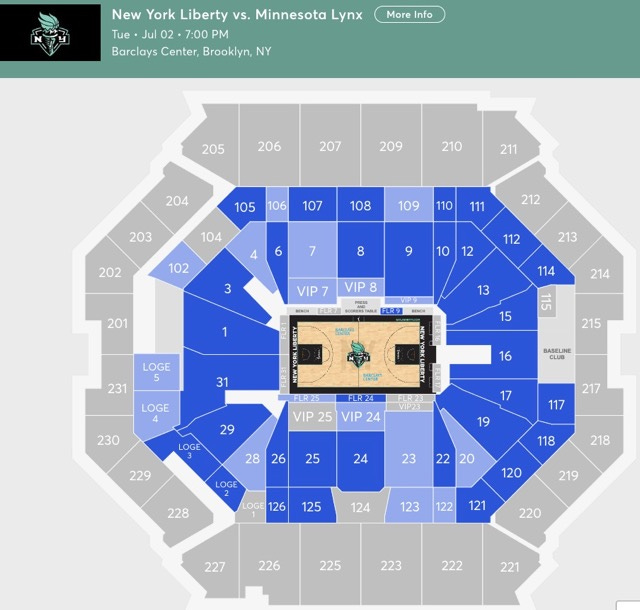

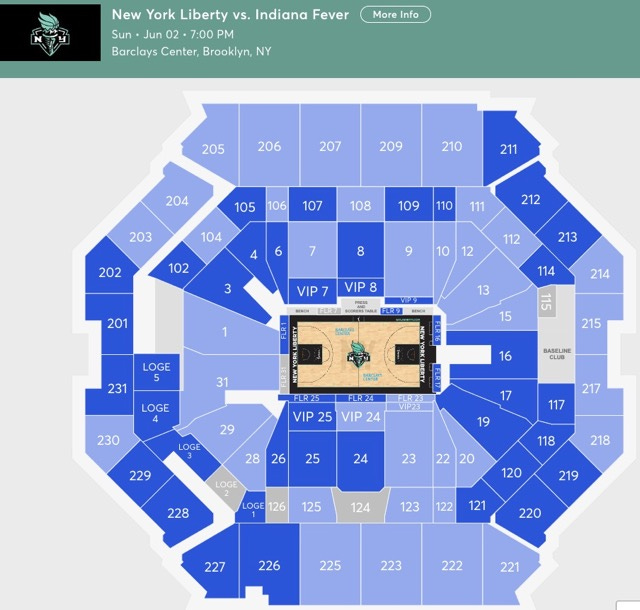

May 25: After filling the Barclays Center against star rookie Caitlin Clark and the Indiana Fever, the New York Liberty will try again. But other home games are selling none—or just part—of the Upper Deck.